APPENDIX - AA ARMY SOURCE SELECTION SUPPLEMENT

(Revised 01 October 2024)

(Appendix G revised 14 October 2018)

CHAPTER 1: PURPOSE, ROLES, AND RESPONSIBILITIES

1.4 Source Selection Team Roles & Responsibilities

CHAPTER 2: PRESOLICITATION ACTIVITIES

2.1 Conduct Acquisition Planning

2.2 Develop a Source Selection Plan

2.3 Develop the Request for Proposals

2.4 Release the Request for Proposals - No Army Text

CHAPTER 3: EVALUATION AND DECISION PROCESS

3.2 Documentation of Initial Evaluation Results

3.4 Competitive Range Decision Document - No Army Text

3.6 Final Proposal Revisions - No Army Text

3.7 Documentation of Final Evaluation Results

3.8 Conduct and Document the Comparative Analysis

3.9 Best-Value Decision - No Army Text

3.10 Source Selection Decision Document - No Army Text

3.11 Debriefings - See Appendix A

3.12 Integrating Proposal into the Contract

CHAPTER 4: DOCUMENTATION REQUIREMENTS

4.1 Minimum Requirements - No Army Text

4.2 Electronic Source Selection

Oral Presentations and Proposals

CHAPTER 1: PURPOSE, ROLES, AND RESPONSIBILITIES

1.1 Purpose

The Army Source Selection Supplement (AS3) implements and supplements the mandatory Department of Defense (DoD) Source Selection Procedures to establish consistent policies and procedures for Army source selections. The Federal Acquisition Regulation (FAR) and its supplements (Defense FAR Supplement (DFARS) and Army FAR Supplement (AFARS)) prescribe the general policies governing these acquisitions.

1.2 Applicability and Waivers

The AS3 applies to best value, negotiated, competitive source selections with an estimated value greater than $10 million. It may also be used as guidance in all other acquisitions. See DoD Source Selection Procedures, Paragraph 1.2, for applicability and exceptions.

The AS3 is not a stand-alone document, and shall be used in conjunction with FAR Part 15, DFARS Part 215 and the DoD Source Selection Procedures. Any conflicts shall be resolved through the Office of the Deputy Assistant Secretary of the Army (Procurement) (DASA(P)), Policy Directorate.

Any request for waiver of the DoD Source Selection Procedures shall be submitted by the cognizant Senior Contracting Official (SCO), through the Head of the Contracting Activity (HCA), to the DASA(P), Attn: Policy Directorate (SAAL-PP). The Office of the DASA(P) will process all waivers as follows:

For solicitations valued at $1 billion or more, waivers may only be approved with the express, written permission of the Principal Director, Defense Pricing, Contracting, and Acquisition Policy (DPCAP) (DPCAP);

For solicitations valued below $1 billion, waivers must be approved by the DASA(P).

1.3 Best Value Continuum

Subjective Tradeoff . Use of subjective tradeoff is appropriate for most Army source selections. See Appendix B for more information. (Reference DOD Source Selection Procedures 1.3.1.3)

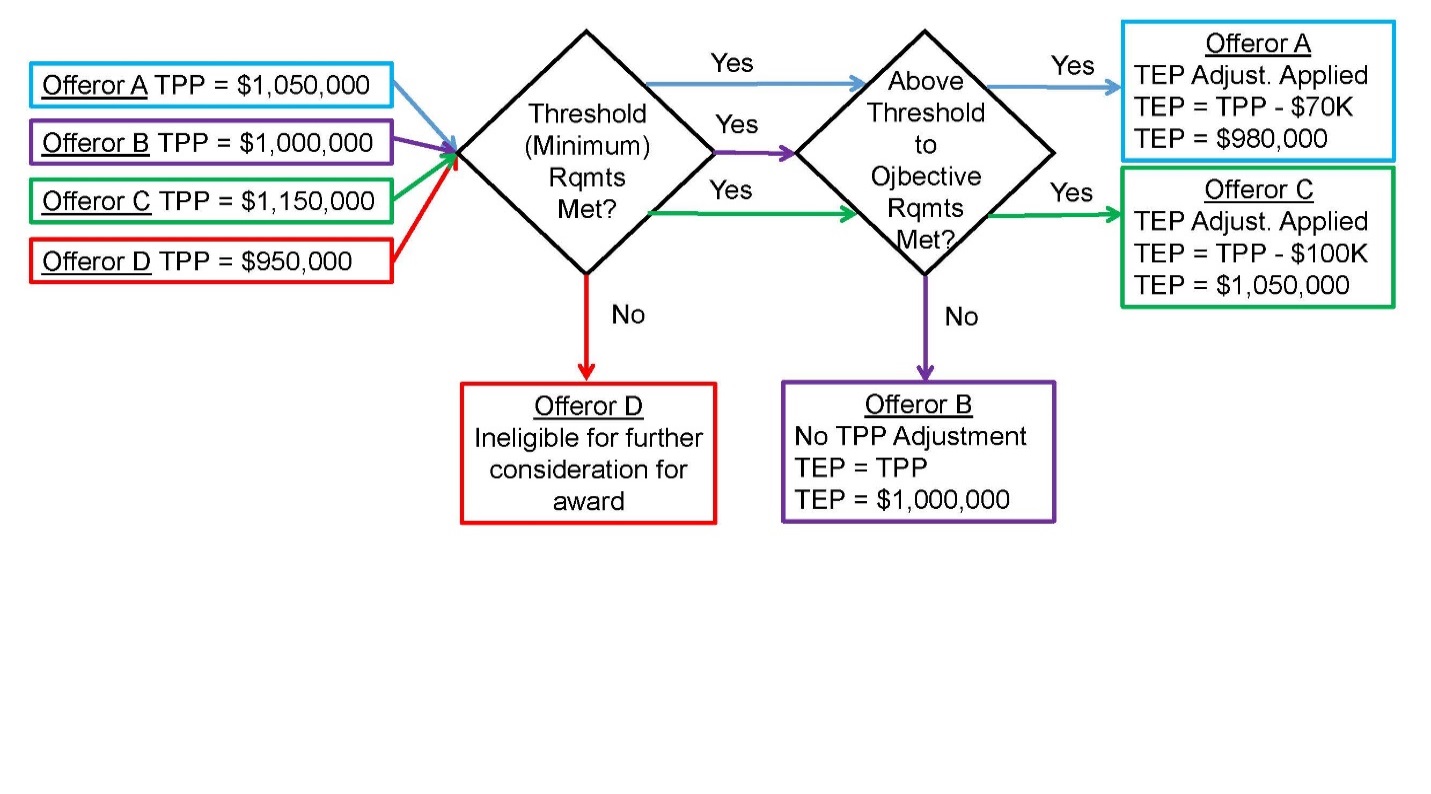

Value Adjusted Total Evaluated Price (VATEP). Use of VATEP may be most suitable for procuring developmental items when the Government can determine the value (or worth) of “better performance” and quantify it in the Request for Proposal (RFP). See Appendix B for more information. (Reference DOD Source Selection Procedures 1.3.1. 4 )

1.4 Source Selection Team Roles & Responsibilities

Source selection is a multi-disciplined team effort. The Source Selection Team (SST) should include representatives from appropriate functional areas such as contracting, small business, technical, logistics, cost/price, legal, and program management. User organizations should also be represented.

The success of any source selection is determined to a large degree by the personnel involved. Likewise, the Source Selection Authority (SSA), with assistance from the SCO, will ensure the appointment of people with the requisite skills, expertise, and experience to ensure the success of the source selection. This includes those members appointed to the Source Selection Advisory Council (SSAC).

The SCO is responsible for determining the capability of the organization to effectively resource the SST as set forth in the hierarchy of source selection expertise below (see Figure 1-1). In the event the SCO determines the required expertise is not obtainable, the HCA will be consulted. If the HCA concurs the resources are still unavailable, the DASA(P) will be notified and will assist in providing resources from other contracting activities, or assign the procurement to another contracting activity for execution.

| Look within own organization for expertise. Identify and appoint Government personnel outside own organization with the requisite expertise. Identify junior personnel to grow expertise and experience in source selection by allowing them to participate on non-technical factors. If expertise does not exist, then move acquisition elsewhere. Consider establishing and/or hiring, on an ad hoc basis, qualified retired annuitants to supplement source selection teams. Establish an advance pool of experts to supplement on an ad hoc and rotational basis. In accordance with FAR Subparts 7.5 and 9.5, hire contractor experts to augment the Source Selection Evaluation Board (SSEB) ensuring there is no organizational conflict of interest or inclusion of inherently governmental functions. |

Figure 1-1: Hierarchy of Source Selection Expertise

The size and composition of the SST will vary depending upon the requirements of each acquisition. For example, major hardware acquisitions frequently involve requirements organizations from across the Army (or from other services on joint-service programs). In such cases, and when forming the SST, SSEB Factor/Subfactor teams should include evaluator representation from each major requirements organization. These evaluators should be assigned to the evaluation criteria associated with their specific area of requirements interest. Inclusion of technical evaluators who are subject matter experts on the requirement(s) being evaluated is essential to a successful evaluation process and fair/accurate assessment of the proposals, and absolutely critical where joint-service and/or multiple functional requirements are involved.

Whether the team is large or small, it should be structured to ensure teamwork, unity of purpose, and appropriate open communication among the team members throughout the process. This will facilitate a comprehensive evaluation and selection of the best value proposal.

Key Components of the SST

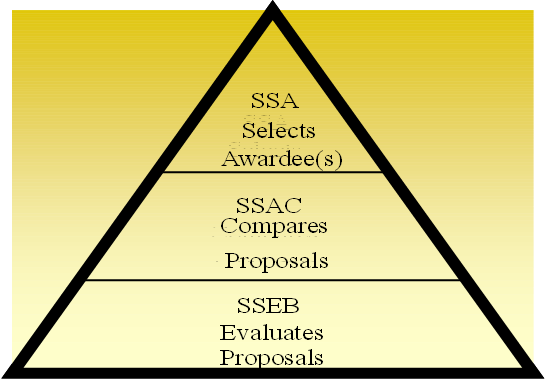

For source selections with a total estimated value of $100M or more, the SST shall consist of the SSA, a SSAC, and an SSEB. Each of these SST entities has distinct and separate functions (See Figure 1-2).

Figure 1-2: SST Responsibilities

The SSEB is usually comprised of multiple groups of evaluators who are responsible for evaluating specific areas of the proposal against the RFP requirements. Additionally, legal counsel, small business advisors, cost/price, and technical experts may also serve as SST advisors. The precise structure of the SSEB is a matter within the SSA’s discretion.

The information below supplements the Roles and Responsibilities found in the DoD Source Selection Procedures (see paragraph 1.4).

The SSA.

Appointment. The AFARS 5115.303 provides the policy on SSA appointments.

All appointed SSAs are considered procurement officials and are subject to the associated statutory / regulatory rules.

Once appointed, the SSA cannot further delegate their SSA authorities.

Note: The identity of the SSA shall be considered procurement sensitive and shall not be disclosed to anyone who has not signed a non-disclosure agreement for that RFP / acquisition.

Ensure the Source Selection Plan (SSP) and evaluation criteria are consistent with the requirements of the solicitation and applicable regulations.

The Procuring Contracting officer (PCO).

No Army text.

The SSAC.

The SSAC will consist of senior Government personnel, and may include representation from the cognizant contracting office and legal office.

For Acquisition Category I/II Source Selections involving requirements organizations from across the Army (or from other services on joint-service programs), the SSAC must include representation from all significant requirements organizations. The SSAC representatives must be at an organization / grade level commensurate with the other members of the SSAC, usually military 0-6/GS-15 or higher.

The SSEB.

The SSEB Chairperson.

Ensure the SSEB members understand the evaluation criteria and establish a uniform approach to the evaluation and rating effort. Seek to build consensus among the SSEB members.

Isolate policy issues and major questions requiring decision by the SSA.

Relieve and replace SSEB members from assignment only in the event of a demonstrated emergency or other appropriate cause.

Arrange for the SSEB members to work compensatory time, when necessary, authorized, and approved.

Arrange for the needed administrative staff at the evaluation work site.

The SSEB Members.

Prepare the evaluation notices (ENs).

Brief the SSAC/SSA (as requested), and respond to comments / instructions from the SSAC/SSA.

Legal Counsel.

No Army text.

Other Advisors.

No Army text.

Program Manager (PM) / Requiring Activity (RA).

No Army text.

Administrative Support.

Each acquisition will vary in terms of the administrative support requirements. Figure 1-3 contains a checklist of some important requirements common to many acquisitions.

| Adequate facilities (to include space for the evaluators and related meetings and for discussions with Offerors): Consider whether the facilities are of an adequate size, capable of segregation of committees, comfortable, properly furnished, secure, accessible to disabled persons, and close to support services such as copiers, restrooms, and eating facilities. Appropriate security controls, such as identification badges and access control. Adequate secure storage space for proposals and source selection materials. Appropriate computer hardware and software and related support. Adequate telephones, facsimile machines, copiers and/or printing services located in secure areas and secure audio/video teleconferencing capabilities. Adequate office supplies. Adequate lodging and transportation for personnel on temporary duty (TDY). |

Figure 1-3: Administrative Support Considerations

CHAPTER 2: PRESOLICITATION ACTIVITIES

2.1 Conduct Acquisition Planning

Acquisition Planning. Acquisition planning should start when an agency identifies a need for supplies, construction and/or services. When practical, utilize an Integrated Product Team (IPT) approach to develop the acquisition strategy. This early teaming effort may reduce false starts and resultant delays that frequently accompany the preparation of a complex procurement. (Reference DOD Source Selection Procedures 2.1.1 )

Best Practice: Some of the decisions/determinations made during the planning phase are key and will impact the entire acquisition from source selection through contract administration. Including key stakeholders, such as contract administrators, Contracting officer’s Representatives (CORs), Quality Assurance (QA) and Property Administrator, will help to ensure consideration of issues that may impact the requirements, performance, and acquisition strategy as a whole.

Risk Assessment. Risk analysis is a critical component of acquisition planning, and the market research results should be a primary consideration as part of this analysis. Early identification, formation, and direct involvement of the acquisition team (and key stakeholders) will help to ensure a comprehensive understanding of the requirements and any marketplace influences on risk and risk mitigation. (Reference DOD Source Selection Procedures 2.1.1.2 )

Peer Reviews. See AFARS 5101.170 for Preaward peer reviews. Planning, and including realistic time allowances, for all requisite reviews when establishing milestone schedules is essential to the success of your acquisition.

Market Research. Market research is a continuous process and directly influences how the acquisition strategy and source selection process is shaped. (Reference DOD Source Selection Procedures 2.1.2 and AFARS 5110.002).

Some techniques you may use in conducting market research include:

Use general sources of information available from the marketplace, other DOD/ government agencies, and the internet;

Contact knowledgeable individuals regarding market capabilities and business practices (include the Small Business Advisor);

Review the results of recent market research;

Query government and/or commercial databases;

2.2 Develop a Source Selection Plan

Selection of Evaluation Factors . Selecting the correct evaluation factors is the most important decision in the evaluation process. Structure the evaluation factors and their relative importance to clearly reflect the needs of your acquisition.

Mandatory Evaluation Considerations . In every source selection, you must evaluate cost/price, and the technical quality of the proposed product or service through one or more non-cost evaluation factors (e.g. technical excellence, management capability, and key personnel qualifications).

Additionally, you must evaluate past performance on all negotiated competitive acquisitions expected to exceed the thresholds identified in FAR 15.304 and DFARS 215.304, unless the PCO documents why it would not be appropriate. There may be other required evaluation factors, such as small business participation, based upon regulatory and/or statutory requirements (see FAR 15.304 and its supplements).

From this point, the acquisition team must apply prudent business judgement to add other evaluation factors, subfactors, and elements that are important to selecting the most advantageous proposal(s). The number of factors and subfactors should be kept to the absolute minimum required to effectively assess the proposals. The use of more factors than needed to conduct the evaluation can complicate and extend the process while providing no additional value, and dilute the meaningful discriminators. Limiting factors also serves to reduce the evaluation oversight span-of-control responsibilities of the SSEB leadership, SSA/SSAC, PCO and legal counsel, thereby permitting more focused oversight on the remaining (and most important) factors/subfactors and reducing the likelihood of evaluation errors.

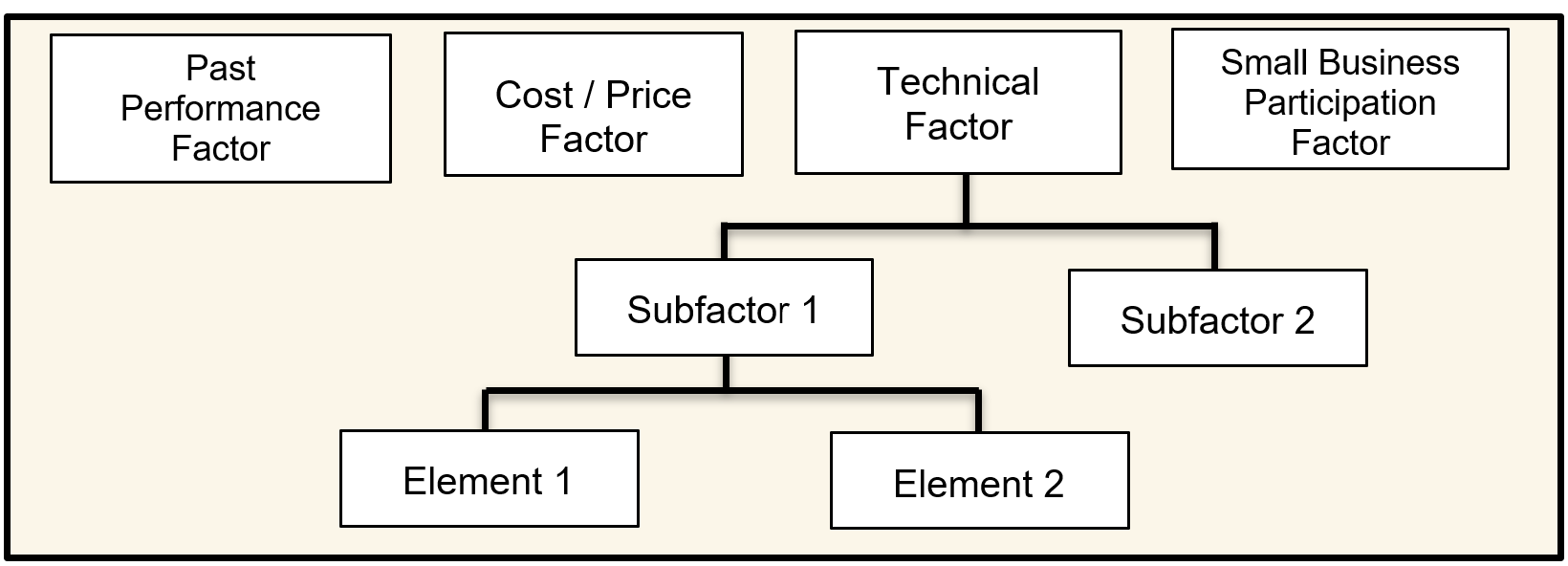

Common evaluation factors are cost/price, technical, past performance, and small business participation. Additionally, as appropriate, you may have other evaluation factors and/or may use one or more levels of subfactors. The standard Army naming convention for the various levels is: Evaluation Factor, Subfactor, and Element.

Figure 2-1: Sample Evaluation Factor Structure

Establishing Evaluation Factors and Subfactors . The acquisition team develops the evaluation factors, and any appropriate subfactors and elements. The team should select the factors based on user requirements, acquisition objectives, thorough market research and risk analysis. Figure 2-2 illustrates the steps involved in developing the factors and subfactors.

Once the RFP is issued, the factors and subfactors give the offerors insight into the significant considerations the Government will use in selecting the best value proposal and help them to understand the source selection process. Carefully consider whether minimum “go/no go” or “pass/fail” entry-gates, can be included. When used properly, this use of entry-gate criteria can streamline the evaluation process significantly.

| Conduct market research as a starting point for development of criteria in order to maximize competition Conduct risk analysis in accordance with FAR 7.105 as necessary to support the acquisition. Brainstorm critical factors and subfactors. Identify key discriminators. Define the discriminators as evaluation factors and subfactors, and their relative order of importance. Obtain SSA approval of the list of factors and subfactors. When a draft RFP is used, clearly inform offerors in the draft RFP of the proposed factors and subfactors, and their relative order of importance. Assess feedback during presolicitation exchanges. Get SSA approval as necessary to change the factors and subfactors before issuing the RFP. Clearly inform offerors of the factors and subfactors, and their relative importance, in the formal RFP. Do not change the factors and subfactors after receipt of proposals except in extreme circumstances, and only then after obtaining SSA?s approval and amending the RFP and SSP. |

Figure 2-2 : Steps Involved in Formulating Evaluation Factors and Subfactors

Nongovernment Advisors . Nongovernment advisors may assist in, and provide input, regarding the evaluation, but they shall not determine ratings or rankings of the offeror’s proposals. Nongovernment sources can include academia, nonprofit institutions, and industry.

Reminder: When using nongovernment advisors, you must advise potential offerors of the nongovernment advisors’ participation in the source selection, and obtain the offerors consent to provide access of its proprietary information to the nongovernment advisor, or the company which employs the nongovernment advisor. Figure 2-3 identifies suggested RFP language relative to the use of commercial firms to support the source selection process. (Reference DOD Source Selection Procedures 2.2.8)

| (1) Offerors are advised that employees of the firms identified below may serve as non-government advisors in the source selection process. These individuals will be authorized access only to those portions of the proposal data and discussions that are necessary to enable them to perform their respective duties. Such firms are expressly prohibited from competing on the subject acquisition. INSERT NAMES, ADDRESSES, AND TELEPHONE NUMBERS OF FIRMS (2) In accomplishing their duties related to the source selection process, the aforementioned firms may require access to proprietary information contained in the offerors' proposals. Therefore, pursuant to FAR 9.505?4, these firms must execute an agreement with each offeror that states that they will (1) protect the offerors? information from unauthorized use or disclosure for as long as it remains proprietary and (2) refrain from using the information for any purpose other than that for which it was furnished. To expedite the evaluation process, each offeror must contact the above companies to effect execution of such an agreement prior to the submission of proposals. Each offeror shall submit copies of the agreement with their proposal. NOTE: This requirement shall flow down to all Subcontractors. |

Figure 2-3: Suggested RFP Language for the use of Nongovernment Advisors

Source Selection for Services . The source selection process for services, including development of the SSP, is often very complex. Organizations must ensure that the SST is comprised of qualified personnel with specific knowledge of the types of services to be acquired.

The use of Sample Tasks is an effective tool in the evaluation of services. Sample Tasks can provide insight as to the offeror’s level of understanding of the work to be performed, as well as how the technical approach relates to the cost/price proposed for that Sample Task. See Appendix G for a sample of a Sample Task.

To the maximum extent practicable, sample tasks should set forth requirements that are contemplated for award to establish the expectation that offerors will be held accountable for the resources and costs they propose.

The use of generic or hypothetical sample tasks may unintentionally create an environment encouraging offerors to understate resources and costs in recognition of the fact that the sample tasks will not be awarded. Consequently, care must be taken to draft the sample tasks as closely as possible to the types and scope of services expected to be acquired from the Performance Work Statement (PWS). If possible, consider the use of a “live” task, which would be awarded at time of contract award.

Evaluation criteria should be limited to essential areas of performance that are measurable during the proposal evaluation process. This will permit a more focused evaluation of the offeror's proposed solution to the sample task.

If utilizing a sample task, ensure this is accounted for and aligned with Sections L and M.

2.3 Develop the Request for Proposals

The success of an acquisition is directly linked to the quality of the RFP. A well-written RFP will:

Facilitate fair competition;

Convey a clear understanding of the government’s requirements;

Clearly identify the evaluation and award criteria;

Clearly detail information required by the offerors;

Limit criteria to discriminators that add value and reduce risk;

Preserve the offeror’s flexibility to propose innovative solutions when appropriate;

Specify areas where the offerors can make technical and cost tradeoffs in their proposals;

Ensure that Sections L and M relate back to each other and the SSP.

Ways to Improve the RFP Process

Ensure Consistency in the RFP and Related Documents. RFP inconsistencies can create ambiguity and result in less advantageous offers, require RFP amendments, cause delays in the acquisition, and result in litigation. Inconsistencies between the descriptions of the Government’s requirements, instructions on how to prepare a proposal, and information related to the evaluation factors and subfactors are particularly troublesome (may be caused by different groups of people developing the different RFP sections without proper coordination and review). Additionally, when one document is revised, those revisions must also be made to corresponding documents.

You may find it beneficial to develop a matrix that correlates the RFP sections and content to ensure consistency. Figure 2-4 illustrates how the key documents and evaluation standards map to one another and shows the recommended sequencing for document preparation. Provide industry with a copy of the matrix (make it part of the solicitation) as a reference tool to aid in proposal preparation. You may also consider including a column for offerors to complete in the tracking matrix (as shown in Figure 2-4), denoting where in their proposal the requirement is addressed. This approach promotes understanding of the linkage within the solicitation, explains how all parts of the proposal will be used in the evaluation process, and enables a crosswalk for both the government and offerors to ensure all requirements have been addressed.

| SPECIFICATION AND PWS | EVALUATION FACTORS, SUBFACTORS EVALUATION AND SUBMISSION INFORMATION | PROPOSAL REFERENCE | ||

| SPECIFICATION | PWS | PROPOSAL EVALUATION INFORMATION RFP Section M Factor - Technical Subfactor - Software Modification Approach | PROPOSAL SUBMISSION INFORMATION RFP Section L | OFFEROR TO COMPLETE Provide Page and Paragraph Number Where Addressed |

| Software code shall meet the computer software design and coding requirements as defined in International Standards Organization (ISO) 9000-3. | 3.1.1. The contractor shall modify, integrate and test software as specified in the system Specification. 3.1.1.3 The contractor shall prepare a software modification plan. | The offeror's software modification approach will be evaluated relative to the modified software’s ability to accommodate open architecture, tracking accuracy, and reliability. | The offeror will describe its approach to software modification and explain how the software will accommodate open architecture, conforms to ISO-9000-3, tracks accurately, and maintains reliability. | |

Figure 2-4 Requirements to RFP to Proposal Tracking Matrix

Avoid Requesting Too Much Information from the Offerors. Instructions for preparing and submitting proposals are critical to the acquisition. Always keep in mind:

There must be a direct linkage between solicitation requirements and objectives, each evaluation factor and subfactor, and the proposal preparation instructions.

Request only the essential information needed to evaluate proposals against the evaluation factors and subfactors.

Never ask for information that will not be evaluated. Instructions that require voluminous information can unintentionally limit or reduce competition by causing potential offerors to forego responding to the solicitation in favor of a less costly business opportunity.

Excessively large proposals may increase the time and costs associated with performing the evaluation. Proposal page limitations or page recommendations are encouraged but need to be clearly defined and tailored to the needs of the acquisition.

Focus exclusively on true discriminators (discriminators linked to critical requirements based on market research and the assessment of risk and that enable the evaluation to discern between the values of the offeror’s proposal). Failure to do so dilutes the evaluation and compromises the SSA’s ability to identify the best value proposal.

Use Performance-Based Requirements. Use of detailed design requirements or overly prescriptive performance work statements severely limits the offerors’ flexibility to propose their best solutions. Instead, use functional or performance-based requirements to the maximum extent practicable. While it may be more difficult to develop evaluation criteria and conduct the evaluation process using this approach, the benefits warrant it. These benefits include increased competition, access to the best commercial technology, better technical solutions, and fewer situations for protests.

Drafting Instructions to Offerors (Section L or Equivalent)

Provide specific guidance to offerors regarding the structure of their proposals . The proposal should be divided into distinct volumes or files. These volumes/files should correlate to each of the evaluation teams (e.g. technical, cost/price, past performance, etc.). You should also prescribe how each volume/file is to be structured. These practices will facilitate distributing the proposal material to the various teams and will make it easier for evaluators to locate specific information in the proposals.

Note: Clearly advise offerors to keep technical and pricing information separate, and not intermixed between proposal volumes.

Past Performance Information . Tailor the proposal submission requirements to reflect the complexity of the procurement and the relative importance assigned to past performance. Request only the information necessary for the evaluation, and consider the following when developing proposal submission requirements:

Contract references. Request offerors to submit a list of Government and non-Government contract references (including contract number, type, and dollar value; place of performance; date of award; whether performance is on-going or complete; extent of subcontracting; and the names, phone numbers, and e-mail addresses of at least two points of contacts for each contract);

Require the list to include all relevant on-going contracts, or contracts completed during a specified period. This approach will provide an ‘unfiltered’ view of the offeror’s contract efforts, not just the ‘select’ contract efforts. If you anticipate the number of contracts will be excessive, limit the submission to a specified number of the most recent, relevant contracts. In such cases, require the contracts to have been active for a specified period of time, since newly awarded contracts will probably not provide sufficient information.

Limit the specified period to contracts performed within the last three years (six years for construction) from the RFP release date. A shorter period may be appropriate for acquisitions where there are numerous actions and/or many vendors providing the required items.

When offerors are likely to be large, multi-function firms, limit the contract references to those performed by the segment of the firm (e.g. division, group, and unit), that is submitting a proposal.

Past Performance Information of a Prospective Subcontractor. When you intend to evaluate subcontractors’ past performance, explain how you will handle any related adverse past performance information. In some acquisitions, an offeror’s prospective subcontractor may be the offeror’s competitor on other acquisitions. In such cases, the prospective subcontractor may be hesitant to have any adverse information related to its past performance released to the offeror. You should tailor your acquisition accordingly and advise offerors in the RFP how you will handle disclosure of such information.

Questionnaires. You may utilize questionnaires or interviews to obtain the information from individuals having knowledge about the offeror’s past performance, such as contract points of contact. Consider the following when using questionnaires:

Keep the questionnaire short. Typically, is should be no longer than 1-2 pages; long surveys are not returned timely, if at all.

Format the questionnaire to easily facilitate electronic completion (e.g. fill-in blocks, and electronic checkboxes).

Include a copy of the questionnaire in the RFP.

Either distribute the questionnaires to the points of contact or have the offerors distribute the questionnaires. Where the government is sending out the questionnaires, and when practical, contact the respective point of contact prior to sending out the survey and emphasize the importance of their returning the completed surveys to the government promptly. Having the offerors send out the questionnaires may save time and resources.

Relevant Past Performance. Include in the RFP a definition of what constitutes relevant past performance. Factors that may be used to define relevancy include similarity size, complexity, dollar value, contract type, and degree of subcontracting/teaming. As appropriate, require the offeror to provide a description of how the contract references are relevant to the immediate acquisition. In some cases, previous contracts as a whole may be relevant to the immediate acquisition, while only portions of other contracts may be relevant.

Small Business Participation . The Army methodology for evaluating Small Business Participation in unrestricted source selections is to establish a separate factor (versus a subfactor under technical) with an assigned relative order of importance for Small Business Participation as it relates to the other source selection evaluation factors. The factor shall be designed to require all offerors (both small and large businesses) to submit proposed Small Business Participation Plans to identify the extent to which small businesses will participate in the performance of the proposed acquisition.

Proposal Submission Instructions . The submission instructions should be written clearly enough to indicate that:

Large business contractors may achieve the small business participation goals through subcontracting to small businesses.

Small business contractors may achieve small business participation goals through their own performance/participation as a prime and also through a joint venture, teaming arrangement, and subcontracting to other small businesses.

Small Business Participation Proposal . The Small Business Participation proposal format is designed to streamline and bring uniformity to responses and evaluations for Small Business Participation (FAR 15.304). The format provides clarity in that it is distinctly different that the Small Business Subcontracting Plan required for large businesses only (FAR 52.219-9). A sample Small Business Participation Proposal format is located at Appendix E, and can be provided in the Instructions to offerors, or as an attachment to the RFP.

Subcontracting Plan. Separate from the Small Business Participation Plan, other than U.S. Small Business Offerors must also submit a subcontracting plan meeting the requirements of FAR 52.219-9 and DFARS 252.219-7003 (or DFARS 252.219-7004 if the offeror has a comprehensive subcontracting plan).

Other than U.S. Small Businesses must submit acceptable subcontracting plans to be eligible for award. Subcontracting Plans shall reflect and be consistent with the commitments offered in the Small Business Participation Plan.

When an evaluation assesses the extent that small businesses are specifically identified in proposals, the small businesses considered in the evaluation shall be listed in any subcontracting plan submitted pursuant to FAR 52.219-9 to facilitate compliance with 252.219-7003(e).

Drafting Evaluation Criteria (Section M or Equivalent)

In Section M (or equivalent) of the RFP, clearly state how each factor will be evaluated, and its relative importance.

Past Performance Information . Clearly stated how past performance will be evaluated, its relative importance, and how offerors with no relevant past performance will be evaluated. Consider the following when drafting this section:

Use Past Performance to streamline the source selection process. Instead of evaluating management as a separate evaluation factor, consider assessing management effectiveness in meeting Technical and Schedule requirements as part of the past performance evaluation. Using past performance in this way may, under appropriate circumstances, eliminate the need for the offeror to submit management and quality plans.

Past Performance Considerations. At a minimum, consider the offeror’s record of complying with contractual requirements in the areas of schedule, technical quality, and cost control (for cost reimbursement contracts). You may also consider the offeror’s record of business relations. Tailor the scope of the areas considered to the immediate acquisition.

Small Business Participation . All offerors (both large and small businesses) will be evaluated on the level of proposed participation of U.S. small businesses in the performance of the contract (as small business prime offerors or small business subcontractors) relative to the objectives and goals established herein. The government may evaluate:

The extent to which such firms, as defined in FAR Part 19, are specifically identified in proposals;

The extent of commitment to use such firms (and enforceable commitments will be considered more favorably than non-enforceable ones);

Identification of the complexity and variety of the work small firms are to perform;

The realism of the proposal;

Past performance of the offerors in complying with requirements of the clauses at FAR 52.219-8, Utilization of Small Business Concerns, and 52.219-9, Small Business Subcontracting Plan; and

The extent of participation of small business prime offerors and small business subcontractors. The Army’s preferred methodology for evaluating Small Business Participation goals in source selections is in terms of the percentage of the value of the total acquisition. However, it is permissible to set goals as a percentage of ‘planned subcontracting’ dollars.

Small Business Participation goals must be based on market research for each acquisition.

The dollars should correlate directly to the percentage of subcontracted dollars in the Small Business Subcontracting Plan for large businesses. The contracting activity’s assigned subcontracting goals may be used when market research results how that goals are achievable.

Small business prime offerors shall be advised that their own participation as a prime counts towards the percentages set in this evaluation factor, and small businesses shall not be required to subcontract to other small businesses in order to achieve the small business participation goals.

Requiring offerors to provide both the percentage and total dollars to be performed by small businesses will ensure consistency in the evaluation. ( Note: Utilizing total contract dollars is more definitive in minimizing negative impacts on small businesses when services previously performed by small businesses are consolidated into an unrestricted acquisition).

Total Contract Dollars Example (Preferred) : This scenario provides clearer results for the evaluation. Scenario: Small Business Participation goal is set at 15% of total contract dollars on a procurement valued at $1,000,000:

Large Business Offeror A: 20% (20% of $1,000,000 = $200,000)

Large Business Offeror B: 25% (25% of $1,000,000 = $250,000)

Small Disadvantaged Business (SDB) Offeror C: 15% (SDB self-performs 15% of the $1,000,000 = $150,000)

Sample language: The extent to which the Offeror meets or exceeds the goals: Goals for this procurement are -- Small Business: {a%} of the total contract value; Small Disadvantaged Business (SDB): {b%} of the total contract value; Woman-Owned Small Business (WOSB): {c%} of the total contract value; Historically Underutilized Business Zone (HUBZone) Small Business: {d%} of the total contract value; Veteran Owned Small Business (VOSB): {e%} of the total contract value; Service Disabled Veteran Owned Small Business (SDVOSB): {f%} of the total contract value. (NOTE : For example, a participation plan that reflects {c%} of the contract value for WOSB would also count towards the overall Small Business Goal; and percentages for SDVOSB also count towards VOSB).

Percentage of Subcontracted Dollars Example (Least Preferred) : Since each Offeror in the scenario below is allowed to determine how much of the work is planned for subcontracting, the basis for the evaluation could be flawed since the planned subcontracting will differ for each Offeror. Scenario: Small Business Participation goal is set at 15% of the planned subcontracted dollars on a procurement valued at $1,000,000:

Large Business Offeror A: 20% (20% of $200,000 planned for subcontracting = $40,000)

Large Business Offeror B: 25% (25% of $10,000 planned for subcontracting = $2,500)

SDB Offeror C: 15% (SDB self-performs 15% of the total contract = $150,000)

Sample language: (Alternate when using planned subcontracted dollars) The extent to which the Offeror meets or exceeds the goals: Goals for this procurement are -- Small Business: { a %} of the total subcontracted dollars; SDB: {b %} of the total subcontracted dollars; WOSB: { c %} of the total subcontracted dollars; HUBZone: { d %} of the total subcontracted dollars; VOSB: { e %} of the total subcontracted dollars; SDVOSB: { f %} of the total subcontracted dollars.

Establishing Relative Importance . When using the tradeoff process, you must assign relative importance to each evaluation factor and subfactor. Tailor the relative importance to your specific requirements.

Use priority statements to express the relative importance of the evaluation factors and subfactors. Priority statements relate one evaluation factor (or subfactor) to each of the other evaluation factors (or subfactors). Figure 2-5 below contains a sample priority statement. (Reference DOD Source Selection Procedures 2.3.5)

Reminder : Numerical weighting (i.e., assigning points or percentages to the evaluation factors and subfactors), is NOT an authorized method of expressing the relative importance of evaluation factors and subfactors (see AFARS 5115.304(b)(2)(B)).

| The Technical, Past Performance and the Small Business Participation Factors, when combined, are significantly more important than cost or price. Technical is significantly more important than Past Performance and Small Business Participation, which are equal. The Past Performance and Small Business Participation Factors are more important than the Cost Factor. |

Figure 2-5 : Sample Priority Statement

2.4 Release the Request for Proposals - No Army Text

CHAPTER 3: EVALUATION AND DECISION PROCESS

3.1 Evaluation Activities

While the specific evaluation processes and tasks will vary between source selections, the basic objective remains constant – to provide the SSA with the information needed to make an informed and reasoned selection.Towards this end, the evaluators will identify strengths, weaknesses, deficiencies, risks, and uncertainties applicable to each proposal. The process of identifying these findings is crucial to the competitive range determination, the conduct of meaningful discussions and debriefings, and the tradeoff analysis described in the Source Selection Decision Document (SSDD).

Reminder: The SSEB shall not perform comparative analysis of proposals or make source selection recommendations unless requested by the SSA (Reference DOD Source Selection Procedures 1.4.4.4.3).

While the below steps are identified in a linear manner, the process is actually iterative and some of the steps may be taken concurrently. Except where noted, these steps apply to the evaluation of both the cost and non-cost factors. The groups responsible for evaluating past performance, other non-cost factors, and cost/price normally perform their evaluations in parallel. The PCO and SSEB Chairperson shall ensure that the evaluation of each proposal is performed in a fair, integrated and comprehensive manner.

Best Practice: Identify acquisition teams at the requirements development phase and provide comprehensive training on the entire process, from acquisition planning through source selection decision. Provide SSEB training covering the final RFP and SSP approximately one to two weeks prior to receipt of proposals.

Step 1: Conduct SSEB Training – Prior to receipt of proposals, each evaluator must become familiar with all pertinent documents (e.g., the RFP and SSP). Training shall be conducted by the PCO, with the assistance of Legal Counsel, and include an overview of these documents and the source selection process. Training will provide a detailed focus on how to properly document each proposal’s strengths, weaknesses, uncertainties, risks, and deficiencies. The training will be based on the contents of the DoD Source Selection Procedures and this supplement, and shall also include ethics / procurement integrity training and protection of source selection information. This training is especially crucial when evaluators do not have prior source selection evaluation experience.

Step 2: Perform Initial Screening of Proposals – Upon receipt of proposals, the PCO or designee shall conduct an initial screening to ensure offerors’ proposals comply with the RFP instructions for submission of all required information, including electronic media, in the quantities and format specified in the RFP. Figure 3-1 is an extract of a sample proposal screening checklist that may be used to accomplish this initial screening and should be tailored to match the specific proposal submission requirements of the RFP.

A key aspect of this step is to also screen proposals for any exceptions taken by offerors to the terms and conditions as set forth within the RFP.

| TAB | TECHNICAL PROPOSAL | Circle Applicable Response |

| 1: Executive Summary | Does this tab include a brief synopsis of the technical proposal? Does it identify the offeror’s proposed teaming partners and/or subcontractors and discuss the nature and extent of their proposed involvement in satisfying the Government’s requirements? Is a letter of commitment from each proposed team member and key subcontractor included at this tab? | Y / N Y / N Y / N |

| 2: Matrix | Does this tab include a matrix which cross-references the proposal and Volume 1 RFP paragraphs (at least all titled paragraphs)? | Y / N |

| 3: Exceptions | Are any exceptions identified at this tab? | Y / N |

| 4: Install/ Modify/ Terminate and Restore Service | Does this tab address paragraph 2.1 of the RFP? Is there a description of the format and content of a typical service restoration plan (as required by PWS para 2.1.5.a)? | Y / N |

| 5: Customer Coordination | Does this tab include a detailed description of the proposed customer coordination services…. | Y / N |

Figure 3-1 : Sample Proposal Screening Checklist (Extract)

Step 3: Sharing of Cost/Price Information – The SSEB Chairperson and PCO, in coordination with the SSA, shall determine whether cost information will be provided to the technical evaluators, when and what information shall be provided, and under what conditions. The SSEB Chairperson and PCO shall ensure the Small Business Participation evaluation team verifies the total proposed price (not individual cost elements), and any subcontracting information with the Cost/Price team. This will ensure the dollar amounts are consistent with what is being proposed in the Small Business Participation Plan.

Step 4: Conduct Initial Evaluation – Evaluators will independently read and evaluate the offeror’s proposal against the criteria identified in the RFP and SSP, document their initial evaluation findings (e.g., strengths, weaknesses, deficiencies, risks and uncertainties), and draft proposed ENs for each finding to be addressed.

Step 5: Identify and Document Areas of the Proposal That May Be Resolvable

Through Clarifications or Communications – If information is required to enhance the Government’s understanding of the proposal, the PCO may request amplification and other information from the offeror by means of the clarification or communication process. The PCO should engage the legal advisor prior to conducting this process. See Figure 3-3 for a detailed discussion of the differences between clarifications, communications, and discussions.

Step 6 : Assign Ratings for Non -Cost Evaluation Factors When Using the Tradeoff Process – At this point, the evaluators may or may not individually assign ratings to each evaluation factor or subfactor for which they are responsible. At a minimum, each evaluation team (factor, subfactor) must convene to discuss the offeror’s proposal. The purpose of the discussion is to share their views on the offeror’s strengths, weaknesses, deficiencies, risks, and uncertainties related to their assigned evaluation factor(s) / subfactor(s), and to reach a team consensus on findings and rating as appropriate.

Note: Ratings must be supported by evaluation fin dings and narrative statements.

Consensus requires a meeting of the minds on the assigned rating and associated deficiencies, strengths, weaknesses, uncertainties and risks. Note : A simple averaging of the individual evaluation results does not constitute consensus.

In exceptional cases where the evaluators are unable to reach consensus without unreasonably delaying the source selection process, the evaluation report shall include the majority conclusion and the dissenting view(s), in the form of a minority opinion, with supporting rationale. The report must be briefed to the SSAC (if used) and the SSA.

Step 7: Finalize ENs – ENs will include deficiencies, significant weaknesses, weaknesses (and any uncertainties not resolved through clarifications or communications) as well as ENs for strengths, if dictated by the SSP.

Step 8: Prepare Summary Evaluation Reports for Each Factor – Each Factor Chair will prepare a summary report for their respective factor which provides a discussion of their associated findings. These reports will help form the Summary SSEB Evaluation Report, and must be prepared at each phase of the process: initial, interim, and final evaluations.

Step 9: Prepare a Summary SSEB Evaluation Report – The final step is for the SSEB Chairperson to prepare a summary report for each proposal that includes the evaluated price, the rating for each evaluation factor and subfactor, and a discussion of the associated findings (strengths, weaknesses, deficiencies, risks, and uncertainties). A Summary SSEB Evaluation Report must be prepared at each stage of the process: initial, interim, and final evaluations.

Cost or Price Evaluation

Figure 3-2 below provides a side-by-side comparison of what price analysis, cost analysis, and cost realism analysis should consist of and when they must be used. For detailed instructions and professional guidance on how to conduct these analyses, refer to FAR 15.4, and the Army Cost and Price Portal on the ODASA(P) Procurement.Army.Mil Knowledge Management Portal.

| Price Analysis | Cost Analysis | Cost Realism Analysis | |

| What is it? | The process of examining and evaluating an offeror’s proposed price to determine if it is fair and reasonable without evaluating its separate cost elements and proposed profit/fee. Price analysis always involves some type of comparison with other prices; e.g., comparing an offeror’s proposed price with the proposed prices of competing offerors or with previously proposed prices for the same or similar items. | The review and evaluation of the separate cost elements in an offeror’s proposal and the application of judgment to determine how well the proposed costs represent what the cost of the contract should be, assuming reasonable economy and efficiency. | The process of independently evaluating specific elements of each offeror’s cost estimate to determine whether the estimated cost elements are: realistic for the work to be performed; reflect a clear understanding of the requirements; and consistent with the unique methods of performance and materials described in the Offeror’s technical proposal. The probable cost estimate is a product of a cost realism analysis. |

| When must you perform it? | When cost and pricing data is not required to determine if the overall price is fair and reasonable. Price realism may be performed to determine that the price offered is consistent with the effort proposed. | When Certified Cost or Pricing Data has been submitted. When Data Other Than Certified Cost or Pricing Data is submitted if being evaluated for cost reasonableness or cost realism. May also be used when a fair and reasonable price cannot be determined through price alone. (See FAR 15.404-1(a)(4). | When cost-reimbursement contracts are anticipated. Also you may use it on fixed price (FP) incentive contracts or, in exceptional cases, on other competitive FP contracts when the Offerors may not fully understand new requirements, there are quality concerns, or past experience indicates contractors’ proposed costs have resulted in quality/ service shortfalls. However, when cost realism analysis is performed on FP contracts, proposals shall be evaluated using the criteria in the solicitation, and the offered prices shall not be adjusted as a result of the analysis. |

Figure 3-2 : Comparison of Price, Cost, and Cost Realism Analysis

The following are some general evaluation guidelines and recommendations for evaluating cost/price:

The Independent Government Cost Estimate (IGCE) may play a key role in cost/price analysis. It serves as a benchmark for price analysis and in cost realism, it may also serve as a benchmark for individual cost elements. The IGCE must contain a rationale for how it was developed, (e.g., what estimating tools were used and what assumptions were made), in order to properly evaluate cost/price.

With the approval of the SSEB Chairperson and the PCO, the cost/price evaluators should coordinate with the non-cost Factor/Functional Team Leads as necessary to ensure consistency between the proposed costs/prices and other portions of the proposal. This interchange between SSEB factor teams is part of the initial validation exercise and should be continued throughout the evaluation process to ensure that interrelationships are promptly identified and the evaluation findings reflect their recognition. For example, the technical evaluation may reveal areas where each offeror’s approach is inadequate or its resourcing unrealistic, given the proposed approach. The technical evaluators and the cost evaluators should crosswalk technical deficiencies and weaknesses and their impact on cost to ensure proper adjustments can be made to the proposed costs.

When conducting price analysis, consider not only the total price, including options, but also the prices for the individual Contract Line Items to ensure they are not unbalanced. Unbalanced pricing exists when the price of one or more contract line items is significantly over or understated as indicated by the application of cost/price analysis techniques. The PCO with concurrence of the SSA (and if permitted by the RFP) may reject the offer if they determine that this poses an unacceptable risk to the Government. For more information on unbalanced pricing, see FAR 15.404-1(g).

For fixed-price contracts, the evaluation can be as simple as consideration of adequate price competition and ensuring prices are fair and reasonable. For cost-reimbursement contracts, you must analyze the offerors’ estimated costs for both realism and reasonableness. In a competitive environment, the cost realism analysis enables you to determine each offeror’s probable cost of performance. This precludes an award decision based on an overly optimistic cost estimate.

Technical Evaluation

The Army methodology for evaluating Technical Approach and Related Risk is Methodology 2: Combined Technical/Risk Rating (Reference DOD Source Selection Procedures 3.1.2. 2). This methodology provides the most flexibility and least complexity in the rating process, in conducting of the comparative analysis, and best value subjective tradeoff analysis process.

Past Performance Evaluation

In past performance evaluations, you examine the offeror’s performance record on similar contract efforts, and use the information to predict the probability the offeror will successfully perform under your contract. It is important to understand the difference between an offeror’s experience and its past performance – experience is what (work) the offeror has done, and past performance is how well the offeror did it.

FAR Parts 9, 12, 15, 36 and 42 contain regulatory policies related to the evaluation of past performance. FAR Part 36 provides specific procedures, forms, and thresholds for evaluation of Architect & Engineering and construction acquisitions. Additionally, the Office of Federal Procurement Policy (OFPP) and DOD have published the following guides that pertain to the evaluation of past performance information:

OFPP Guide: Best Practices for Collecting and Using Current and Past Performance Information

DOD Guide: A Guide to Collection and Use of Past Performance Information

Recency. No Army Text.

Relevance. A helpful tool to consider using to assist in determining/verifying the relevancy of a contract reference is to locate and review the contract and requirements in Electronic Document Access (EDA). Note: EDA requires user registration within the Wide Area Workflow suite of tools. To ensure your ability to access contract records, complete this process well in advance of SSEB. (Reference DOD Source Selection Procedures 3.1.3.1.2)

Quality of Products or Services. No Army Text.

Sources of Past Performance Information . Where possible, use past performance information available from Government-wide and agency-wide databases. Use of such information will help to expedite and streamline the evaluation process.

If possible, contact two points of contact on each contract effort selected for in-depth review. The PCOs, CORs, Fee Determining Officials, and program management office representatives are often excellent sources of information.

If multiple points of contact are providing past performance information on contract (for example, the PCO and PM), arrange for submission of consolidated input from these sources. This may remove the need for the evaluation team to reconcile variances in past performance information submitted.

In assessing the feedback, pay particular attention to the source of that feedback and their familiarity with the requirements of the contract being assessed. For example, end users may be unfamiliar with the contract requirements or certain issues, and resolution arising from contract performance may not be apparent to them.

The agency has an obligation to consider information that has a bearing on an offeror’s past performance, if the SST is aware of (or should have been aware of) the information. For example, an agency may not ignore contract performance by an offeror involving the same agency, the same services, and/or the same PCO, simply because an agency official fails to complete the necessary assessments or documentation. Consult legal counsel on how to address this type of information.

Addressing Adverse Past Performance Information. When adverse past performance is obtained, as appropriate, contact the respective point of contact for that contract to obtain further information about the circumstances surrounding the situation. Additionally, and when practical, contact at least one other individual to get a second perspective on the offeror’s performance on the subject acquisition. Consider the context of the performance problems, any mitigating circumstances, the number and severity of the problems, the demonstrated effectiveness of corrective actions taken, and the overall work record.

If there is past performance information that adversely impacts an offeror’s proposal assessment, provide the offeror an opportunity to address any such information on which it has not had a previous opportunity to comment. This opportunity may occur during clarifications, communications, or discussions, depending upon whether discussions are anticipated.

When addressing adverse past performance information, identify the contract, but do not identify the name of the individual who provided the information. Summarize the problem(s) with sufficient detail to give the offeror a reasonable opportunity to respond.

NOTE : Past performance is considered a responsibility-type evaluation factor for purposes of SBA’s Certificate of Competency (COC) program. FAR 19.602-1(a) requires agencies to refer a finding of non-responsibility to the SBA if the determination would preclude award. Therefore, if the PCO refuses to consider a small business concern for award after evaluating the concern's past performance on a non-comparative basis (e.g., a pass/fail, go/no go, or acceptable/unacceptable), the matter must be referred to the SBA. Alternatively, when using the trade-off process, the government may use traditional responsibility factors such as past performance as technical evaluation factors where a comparative evaluation of those areas will be performed as opposed to a pass/fail basis. In this case SBA referral is not required because the evaluation of past performance is part of a comparative, best value evaluation and not a responsibility determination.

Small Business Evaluation

The Army methodology for rating the Small Business Participation Factor is to utilize the DoD Source Selection Procedures rating scheme for Small Business Participation (see DoD Source Selection Procedures 3.1.4.1.2 – Table 6). Acceptable/ Unacceptable (Pass/Fail) rating schemes are the least preferred method of evaluating small business participation in best value source selections. This rating scheme does not allow evaluators to give higher ratings to offerors that significantly exceed the stated small business goals or submit proof of binding agreements with small businesses, and therefore are discouraged.

Additionally, Small Business Past Performance should be considered, and in some cases is required (see FAR 15.304(c)(3)(ii) DOD Deviation). In looking at Small Business Past Performance, the Government evaluates how well the offeror has performed on achieving its small business goals. Remember that this should only be evaluated against large businesses in their compliance of FAR 52.219-9. For example, the Government may request e lectronic Subcontracting Reporting System ( eSRS ) information.

Note: Although DFARS PGI 215.304 provides an example that indicates evaluation of Past Performance compliance within a separate Small Business Participation Factor, it may be evaluated instead under the Past Performance Factor, but not in both factors .

Small Business offerors proposing on unrestricted requirements are not held to the requirements of FAR 52.219-14 Limitations on Subcontracting because the clause is applicable to small business set-aside procurements only. However, small business offerors should meet the small business participation factor goals through performance as a prime small business or a combination of performance and small business subcontracting.

Types of Exchanges

After receipt of proposals, there are three types of exchanges that may occur between the Government and offerors -- clarifications, communications and negotiations / discussions. They differ on when they occur, their purpose and scope, and whether offerors are allowed to revise their proposals as a result of the exchanges. All SSEB exchanges must be accomplished through the use of ENs .

| Clarifications | Communications | Negotiations/Discussions | |

| When They Occur | Limited exchanges, between the Government and offerors when award WITHOUT discussions is contemplated NOTE: Award may be made without discussions if the solicitation announces that the government intends to evaluate proposals and make award without discussions. | After receipt of proposals, leading to the establishment of the competitive range of offerors with which the government intends to conduct discussions May only be held with those offerors (other than offerors under FAR 15.306 (b)(1)(i)) whose exclusion from the competitive range is uncertain. | After establishing the competitive range NOTE: The term “negotiations” applies to both competitive and non-competitive acquisitions. In competitive acquisitions, negotiations are also called discussions. |

| Scope of the Exchanges | Most limited of the three types of exchanges. Clarifications are not required to be held with all offerors. | Limited; similar to fact finding | Most detailed and extensive. When conducting discussions with one offeror must conduct with all offerors in the competitive range. |

| Purpose | To clarify certain aspects of proposals | To enhance the Government’s understanding of the proposal by addressing issues that must be explored to allow a reasonable interpretation of the offeror’s proposal to determine whether a proposal should be placed in the competitive range | To allow the offeror an opportunity to revise its proposal so that the Government obtains the best value, based on the requirement and applicable evaluation factors |

| Examples of Topics of Exchanges | Relevance of an offeror’s past performance Adverse past performance information Resolution of minor or clerical errors | Address issues that must be explored to determine whether a proposal should be placed in the competitive range Ambiguities or other concerns (e.g., perceived deficiencies, weaknesses, errors, omissions, or mistakes) Relevance of an offeror’s past performance Adverse past performance information | Examples of potential discussion topics include the identification of all evaluated deficiencies, significant weaknesses, weaknesses, and any adverse past performance information to which the offeror has not yet had an opportunity to respond. Additionally, it is a best practice to identify strengths and significant strengths to ensure that the offeror does not remove when submitting the FPR. Finally, the PCO may inform the Offeror that its price is too low or too high with the basis of these conclusions. |

| Are Resultant Proposal Revisions Allowed? | No | No | Yes |

Figure 3-3: Comparison of Types of Exchanges (After Receipt of Proposals)

Conducting Exchanges with Offerors

The PCO controls all exchanges with Offerors. Before participating in any exchanges, the PCO shall review the ground rules with the team members. During exchanges with offerors, the Government may not:

Favor one offeror over another;

Reveal an offeror’s technical solution to another offeror;

Reveal an offeror’s price to another offeror without that offeror’s permission;

Knowingly disclose source selection information, or reveal the name of individuals providing past performance information;

Reveal source selection information in violation of statutory and regulatory requirements.

3.2 Documentation of Initial Evaluation Results

Visit the ODASA(P) Procurement.Army.Mil Knowledge Management Portal for Army Source Selection evaluation / report templates and samples.

3.3 Award Without Discussions

Reminder: Discussions should be conducted for all acquisitions with an estimated value of $100 million or more. Award without discussions on complex, large procurements is discouraged and seldom in the Government’s best interest. (Reference DFARS 215.306 and DOD Source Selection Procedures 3.2.3 )

3.4 Competitive Range Decision Document - No Army Text

3.5 Discussion Process

Competitive Range

If the competitive range is further reduced for purposes of efficiency, the basis for this reduction must be adequately documented. Considerations for further restricting competition may include expected dollar value of the award, complexity of the acquisition and solutions proposed, and extent of available resources.

Note: Predetermined cut-off ratings (e.g., setting a minimum rating) or identifying a predetermined number of offerors that will be included in the competitive range must not be established. The government may not limit a competitive range for the purposes of efficiency on the basis of technical scores alone.

The PCO, with approval of the SSA, should continually reassess the competitive range as discussions and evaluations continue to ensure neither the Government nor the offerors waste resources by keeping proposals in that are no longer contenders for award.

Discussions

The Government’s objectives shall be fully documented in the prenegotiation objective memorandum (POM) prior to entering into discussions (see FAR 15.406-1, DFARS PGI 215.406-1).

Meaningful discussions do not include advising the individual offerors on how to revise their proposal nor does it include information on how their proposal compares to other offerors’ proposals.

Additionally, discussions must not be misleading. An agency may not inadvertently mislead an offeror, through the framing of a discussion question, into responding in a manner that does not address the agency’s concerns; or that misinforms the offeror concerning its proposal weaknesses or deficiencies; or the government’s requirements.

3.6 Final Proposal Revisions - No Army Text

3.7 Documentation of Final Evaluation Results

At the request of the SSA, the SSAC and/or SSEB members may also present the evaluation results by means of one or more briefings. Figure 3-4 illustrates a sample format for the briefing. The documentation should be clear and concise and should cross-reference, rather than repeat, information in existing documents as much as possible (e.g., the SSP, evaluation team reports, etc.). In rare occasions, if the SSA identifies concerns with the evaluation findings and/or analysis, the SSA may require the SSEB and/or SSAC to conduct a re-evaluation and/or analysis to address these concerns. The evaluation results shall clearly be documented in the Price Negotiation Memorandum (PNM). (See FAR 15.406-3, DFARS PGI 215.406-3)

| OFFEROR | TECHNICAL EVALUATION | PAST PERFORMANCE CONFIDENCE | SMALL BUSINESS PARTICIPATION | TOTAL EVALUATED PRICE |

| A | Outstanding | Substantial Confidence | Good | $171,503,971 |

| B | Outstanding | Limited Confidence | Good | $134,983,305 |

| C | Good | Limited Confidence | Outstanding | $120,976,836 |

| D | Outstanding | Limited Confidence | Outstanding | $150,840,308 |

| E | Acceptable | Substantial Confidence | Acceptable | $115,751,933 |

Figure 3-4: Sample Proposal Evaluation Matrix

3.8 Conduct and Document the Comparative Analysis

When performing the comparative analysis, the SSAC will consider each offeror’s total evaluated price and the discriminators in the non-cost ratings as indicated by the SSEB’s evaluation findings for each offeror. Consider these differences in light of the relative importance(or weight)assigned to each evaluation factor .

3.9 Best-Value Decision - No Army Text

3.10 Source Selection Decision Document - No Army Text

3.11 Debriefings - See Appendix A

3.12 Integrating Proposal into the Contract

When planning the acquisition/source selection, coordinate closely with legal counsel to select the best method to incorporate beneficial aspects or above-threshold performance. The following methods may be considered:

Use of Attachment. Beneficial aspects can be captured in a separate document attached to the PWS which clearly defines the changes to requirements based on specific beneficial aspects but leaves the original PWS untouched. This is particularly true for those items cited to or emphasized in the SSDD and reflects the benefit(s) provided and supports a price premium paid by the Government.

Section C PWS/S tatement of Work (S OW ) , System Specifications, Section H – Special Contract Requirements, or Other. Above-threshold performance may be captured within the PWS/SOW, System Specifications, Section H - Special Contract Requirements, or otherwise captured in the contract document, depending upon what is proposed. If using this method, care must be executed not to permanently increase the Government’s requirements in future RFPs unless it is an intentional decision on the part of the organization to do so.

Best Practice: Use of the foregoing methodology which points to the above-threshold performance or significant strength vice a PWS addendum may be preferred due to the possibility of inadvertent inclusion in subsequent contracts (causing requirements creep). The intent is not to increase the Government’s minimum requirements, but to hold a particular Offeror to their proposal. (The Government may later determine that the minimum requirement should include the higher performance and include it at time of re -compete ).

Model Contract Process. The RFP should discuss the model contract process (if used) in Section L (or equivalent), to ensure that offerors know that they will be contractually-bound to their proposed above-threshold performance. Include language in the RFP describing how the Government will capture the promised above-threshold performance prior to award. Above-threshold performance and significant strengths the Government expects to capture in the contract should be addressed with the offerors during the discussions process. When used, model contracts are typically sent to offerors prior to closing discussions and submission of Final Proposal Revisions (FPRs) to include the above-threshold performance that will be captured upon contract award, thereby ensuring that all parties are aware of what is expected of the prospective awardee. Caution must be exercised that the correct proposed above-threshold performance is carefully assigned per each model contract, by offeror. Ensure final narrative is consistent with the letter to the offeror requesting the FPR.

Incorporation of Portions of Offeror’s Technical Proposal by Reference. The RFP should advise offerors that any part of their proposal can be incorporated by reference. Only incorporate those portions of an offeror’s technical proposal that provide benefit to the Government.

Awarding the Contract(s)

After the SSA has signed the source selection decision document, the PCO will execute and distribute the contract(s). Congressional notification may be required IAW FAR 5.303 and AFARS 5105.303 , Announcement of Contract Awards . For Section 8(A) Set-Asides, the SBA shall be notified IAW FAR 19.804. For Small Business Programs, the apparent unsuccessful offerors shall be provided the preaward notice required by FAR 15.503.

Notification to Unsuccessful Offerors

The PCO must notify unsuccessful offerors in writing after contract award or whenever their proposals are eliminated from the competition within the timeframe identified in Figure 3-5 below. This chart provides a side-by-side comparison of the differences between preaward and postaward notices. The type of information that must be included in the notice will depend upon whether it is sent before or after contract award.

| PREAWARD NOTICE FAR 15.503(a) | POSTAWARD NOTICE FAR 15.503(b) | |

| Who Must be Notified? | Any offeror whose proposal was excluded from the competitive range or otherwise eliminated from the competition before contract award. | Any offeror whose proposal was in the competitive range but was not selected for award or who had not received a preaward notice. |

| When Must it be Sent? | Promptly after the offeror’s proposal was eliminated from the competition. | Within three days after the date of contract award. |

| What is Included in the Notice? | A summary of the basis for the determination A statement that the Government will not consider any further proposal revisions from the offeror. NOTE: Small business offerors are entitled to additional information as well as the timelines associated with small business offerors as described at FAR Part 15.503(a)(2) and FAR Part 19.302(d). After contract award and upon request from an offeror who previously received a preaward notice, the PCO must provide the Offeror the information normally provided as part of a postaward notice. | Number of offerors solicited; Number of proposals received; Name(s) and address(s) of awardee(s) Items, quantities, and unit prices of each awardee. However, unit prices may not be freely releasable under Freedom of Information Act (FOIA).Therefore, PCOs should always consult legal counsel prior to disclosing unit prices. A summary of the reason(s) the Offeror’s proposal was not selected, unless the price information readily reveals the reason. Notice of right to request a debriefing. |

Figure 3-5: Comparison of Preaward and Postaward Notices

CHAPTER 4: DOCUMENTATION REQUIREMENTS

4.1 Minimum Requirements - No Army Text

4.2 Electronic Source Selection

In those instances when an electronic system for source selection documentation is used, the PCO should determine which system is appropriate for the effort. The system available to the Army is the Virtual Contracting Enterprise Acquisition Source Selection Interactive Support Tool (ASSIST). For more information, please reference the ASSIST user guide at https://assist1.army.mil .

CHAPTER 5: DEFINITIONS

Affordability Caps are the approved cost constraints for major systems acquisitions determined by the resources a DoD component can allocate, which provide a threshold for procurement and sustainment costs that cannot be exceeded. For other procurements, this is the approved funding allocated for a given acquisition.

Adverse past performance is defined as past performance information that supports a less than satisfactory rating on any evaluation. Adverse past performance that must be addressed with Offerors includes unfavorable comments received from sources such as those received from respondents from past performance questionnaires or interviews that have not been finalized within a formal rating system. A best practice can be to discuss adverse past performance which caused a rating to be lowered to Satisfactory Confidence.

Best Value is the expected outcome of an acquisition that, in the Government’s estimation, provides the greatest overall benefit in response to the requirement.

Clarifications are limited exchanges between the Government and Offerors that may occur when award without discussions is contemplated.

Communications are exchanges, between the Government and Offerors, after receipt of proposals, leading to establishment of the competitive range.

Competitive Range is the range of proposals that are most highly rated, unless the range is further reduced for efficiency. Discussions will be held only with Offerors in the competitive range. See FAR 15.306(c).

Deficiency is a material failure of a proposal to meet a Government requirement or a combination of significant weaknesses in a proposal that increases the risk of unsuccessful contract performance to an unacceptable level. See FAR 15.001.

Discussions are exchanges (i.e., negotiations) in a competitive environment that are undertaken with the intent of allowing the offeror to revise its proposal. Discussions take place after establishment of the competitive range. See FAR 15.306(d).

Due Diligence (Industry) – The process followed by prospective contractors to fully understand the government requirement in order to submit a complete, responsive proposal to the government which will result in a successful acquisition. Methods may include such activities as conducting site visits, attending industry days, one-on-one sessions with the acquisition teams, pre-proposal conferences and responding to draft requests for proposals.

Due Diligence (Government) – The process followed by the government acquisition team to ensure all prospective contractors are as informed of the government requirement and method of acquisition as possible in order to receive a reasonable number of competitive proposals from industry. Methods may include such activities as providing for site visits, conducting industry days, one-on-one sessions with interested vendors, pre-proposal conferences and sending draft requests for proposals to industry.

Evaluation Findings are the evaluator’s written observations/judgments regarding the individual merits of the proposal against the RFP requirements.

Evaluation Notice is the PCO’s written notification to the offeror for purposes of clarifications, communications, or discussions.

Excesses are elements of the proposal that have exceeded mandatory minimums (in ways that are not integral to the design) whose removal and corresponding price decrease may make an Offeror’s proposal more competitive. See FAR 15.306(d)(4).

Formal Source S election means the source selection process used where someone other than the PCO is the SSA, normally for high dollar value or complex acquisitions.

Large Business means businesses determined other than Small Business based upon industry size standards and/or North American Industry Classification System [NAICs]. Includes: Large businesses, State and Local Government and non-profit companies. May also include: public utilities, educational institutions, and foreign-owned firms.