PART 9904 - COST ACCOUNTING STANDARDS

9904.401 Cost accounting standard - consistency in estimating, accumulating and reporting costs.

9904.401-40 Fundamental requirement.

9904.401-50 Techniques for application.

9904.402 Cost accounting standard - consistency in allocating costs incurred for the same purpose.

9904.402-40 Fundamental requirement.

9904.402-50 Techniques for application.

9904.403 Allocation of home office expenses to segments.

9904.403-40 Fundamental requirement.

9904.403-50 Techniques for application.

9904.403-62 Exemption. [Reserved]

9904.404 Capitalization of tangible assets.

9904.404-40 Fundamental requirement.

9904.404-50 Techniques for application.

9904.404-61 Interpretation. [Reserved]

Part_9904_T48_7010265.html#Section_9904_404_63_T48_70102650141

9904.405 Accounting for unallowable costs.

9904.405-40 Fundamental requirement.

9904.405-50 Techniques for application.

9904.405-61 Interpretation. [Reserved]

9904.406 Cost accounting standard - cost accounting period.

9904.406-40 Fundamental requirement.

9904.406-50 Techniques for application.

9904.407 Use of standard costs for direct material and direct labor.

9904.407-40 Fundamental requirement.

9904.407-50 Techniques for application.

9904.407-61 Interpretation. [Reserved]

9904.408 Accounting for costs of compensated personal absence.

9904.408-40 Fundamental requirement.

9904.408-50 Techniques for application.

9904.408-61 Interpretation. [Reserved]

9904.409 Cost accounting standard - depreciation of tangible capital assets.

9904.409-40 Fundamental requirement.

9904.409-50 Techniques for application.

9904.409-61 Interpretation. [Reserved]

9904.410 Allocation of business unit general and administrative expenses to final cost objectives.

9904.410-40 Fundamental requirement.

9904.410-50 Techniques for application.

9904.410-61 Interpretation. [Reserved]

9904.411 Cost accounting standard - accounting for acquisition costs of material.

9904.411-40 Fundamental requirement.

9904.411-50 Techniques for application.

9904.411-61 Interpretation. [Reserved]

9904.412 Cost accounting standard for composition and measurement of pension cost.

9904.412-40 Fundamental requirement.

9904.412-50 Techniques for application.

9904.412-60.1 Illustrations - CAS Pension Harmonization Rule.

9904.412-61 Interpretation. [Reserved]

9904.412-64 Transition method.

9904.412-64.1 Transition Method for the CAS Pension Harmonization Rule.

9904.413 Adjustment and allocation of pension cost.

9904.413-40 Fundamental requirement.

9904.413-50 Techniques for application.

9904.413-61 Interpretation. [Reserved]

9904.413-64 Transition method.

9904.413-64.1 Transition Method for the CAS Pension Harmonization Rule.

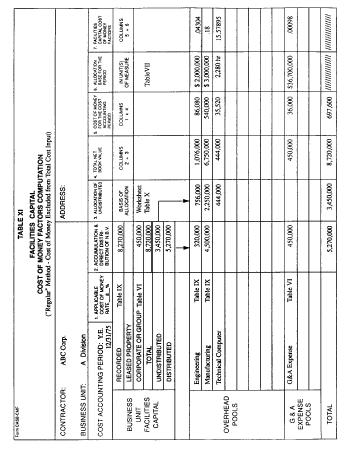

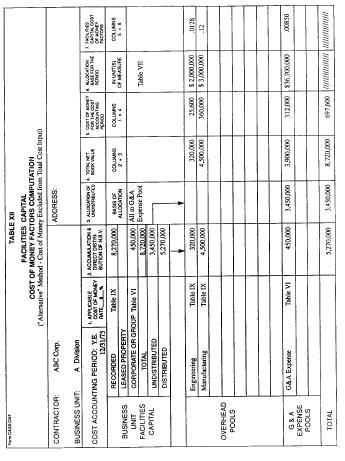

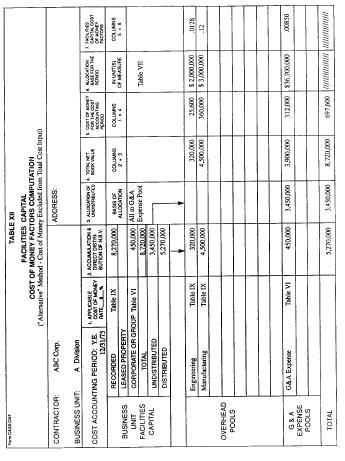

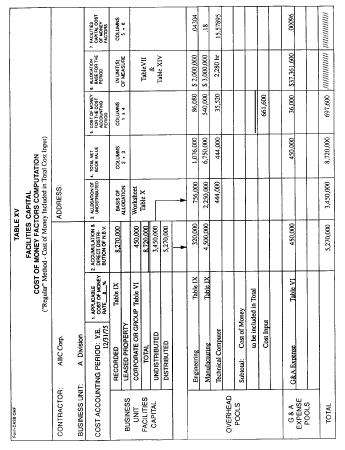

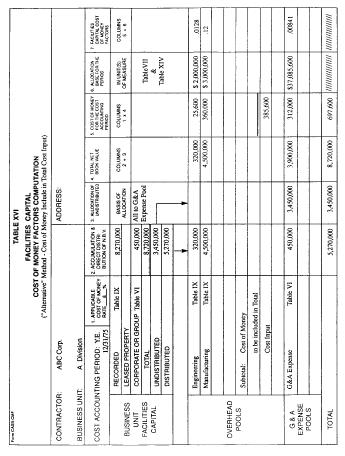

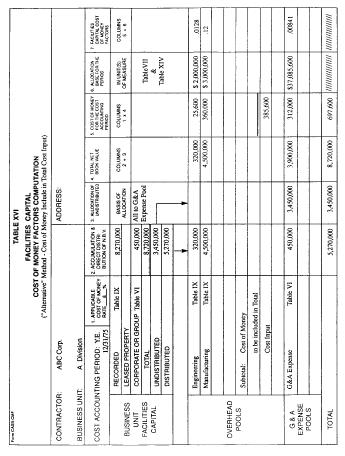

9904.414 Cost accounting standard - cost of money as an element of the cost of facilities capital.

9904.414-40 Fundamental requirement.

9904.414-50 Techniques for application.

9904.414-61 Interpretation. [Reserved]

9904.415 Accounting for the cost of deferred compensation.

9904.415-40 Fundamental requirement.

9904.415-50 Techniques for application.

9904.415-61 Interpretation. [Reserved]

9904.416 Accounting for insurance costs.

9904.416-40 Fundamental requirement.

9904.416-50 Techniques for application.

9904.416-61 Interpretation. [Reserved]

9904.417 Cost of money as an element of the cost of capital assets under construction.

9904.417-40 Fundamental requirement.

9904.417-50 Techniques for application.

9904.417-61 Interpretation. [Reserved]

9904.418 Allocation of direct and indirect costs.

9904.418-40 Fundamental requirements.

9904.418-50 Techniques for application.

9904.418-61 Interpretation. [Reserved]

9904.420 Accounting for independent research and development costs and bid and proposal costs.

9904.420-40 Fundamental requirement.

9904.420-50 Techniques for application.

9904.400 [Reserved]

9904.401 Cost accounting standard - consistency in estimating, accumulating and reporting costs.

9904.401-10 [Reserved]

9904.401-20 Purpose.

The purpose of this Cost Accounting Standard is to ensure that each contractor's practices used in estimating costs for a proposal are consistent with cost accounting practices used by him in accumulating and reporting costs. Consistency in the application of cost accounting practices is necessary to enhance the likelihood that comparable transactions are treated alike. With respect to individual contracts, the consistent application of cost accounting practices will facilitate the preparation of reliable cost estimates used in pricing a proposal and their comparison with the costs of performance of the resulting contract. Such comparisons provide one important basis for financial control over costs during contract performance and aid in establishing accountability for cost in the manner agreed to by both parties at the time of contracting. The comparisons also provide an improved basis for evaluating estimating capabilities.

9904.401-30 Definitions.

(a) The following are definitions of terms which are prominent in this Standard. Other terms defined elsewhere in this part 99 shall have the meanings ascribed to them in those definitions unless paragraph (b) of this subsection, requires otherwise.

(1) Accumulating costs means the collecting of cost data in an organized manner, such as through a system of accounts.

(2) Actual cost means an amount determined on the basis of cost incurred (as distinguished from forecasted cost), including standard cost properly adjusted for applicable variance.

(3) Estimating costs means the process of forecasting a future result in terms of cost, based upon information available at the time.

(4) Indirect cost pool means a grouping of incurred costs identified with two or more objectives but not identified specifically with any final cost objective.

(5) Pricing means the process of establishing the amount or amounts to be paid in return for goods or services.

(6) Proposal means any offer or other submission used as a basis for pricing a contract, contract modification or termination settlement or for securing payments thereunder.

(7) Reporting costs means provision of cost information to others.

(b) The following modifications of terms defined elsewhere in this chapter 99 are applicable to this Standard: None.

9904.401-40 Fundamental requirement.

(a) A contractor's practices used in estimating costs in pricing a proposal shall be consistent with his cost accounting practices used in accumulating and reporting costs.

(b) A contractor's cost accounting practices used in accumulating and reporting actual costs for a contract shall be consistent with his practices used in estimating costs in pricing the related proposal.

(c) The grouping of homogeneous costs in estimates prepared for proposal purposes shall not per se be deemed an inconsistent application of cost accounting practices under paragraphs (a) and (b) of this section when such costs are accumulated and reported in greater detail on an actual cost basis during contract performance.

9904.401-50 Techniques for application.

(a) The standard allows grouping of homogeneous costs in order to cover those cases where it is not practicable to estimate contract costs by individual cost element or function. However, costs estimated for proposal purposes shall be presented in such a manner and in such detail that any significant cost can be compared with the actual cost accumulated and reported therefor. In any event the cost accounting practices used in estimating costs in pricing a proposal and in accumulating and reporting costs on the resulting contract shall be consistent with respect to:

(1) The classification of elements or functions of cost as direct or indirect;

(2) The indirect cost pools to which each element or function of cost is charged or proposed to be charged; and

(3) The methods of allocating indirect costs to the contract.

(b) Adherence to the requirement of 9904.401-40(a) of this standard shall be determined as of the date of award of the contract, unless the contractor has submitted cost or pricing data pursuant to 10 U.S.C. 2306a or 41 U.S.C. 254(d) (Pub. L. 87-653), in which case adherence to the requirement of 9904.401-40(a) shall be determined as of the date of final agreement on price, as shown on the signed certificate of current cost or pricing data. Notwithstanding 9904.401-40(b), changes in established cost accounting practices during contract performance may be made in accordance with part 99.

9904.401-60 Illustrations.

(a) The following examples are illustrative of applications of cost accounting practices which are deemed to be consistent.

| Practices used in estimating costs for proposals | Practices used in accumulating and reporting costs of contract performance |

|---|---|

| 1. Contractor estimates an average direct labor rate for manufacturing direct labor by labor category or function | 1. Contractor records manufacturing direct labor based on actual cost for each individual and collects such costs by labor category or function. |

| 2. Contract estimates an average cost for minor standard hardware items, including nuts, bolts, washers, etc | 2. Contractor records actual cost for minor standard hardware items based upon invoices or material transfer slips. |

| 3. Contractor uses an estimated rate for manufacturing overhead to be applied to an estimated direct labor base. He identifies the items included in his estimate of manufacturing overhead and provides supporting data for the estimated direct labor base | 3. Contractor accounts for manufacturing overhead by individual items of cost which are accumulated in a cost pool allocated to final cost objectives on a direct labor base. |

(b) The following examples are illustrative of application of cost accounting practices which are deemed not to be consistent.

| Practices used for estimating costs for proposals | Practices used in accumulating and reporting costs of contract performance |

|---|---|

| 4. Contractor estimates a total dollar amount for engineering labor which includes disparate and significant elements or functions of engineering labor. Contractor does not provide supporting data reconciling this amount to the estimates for the same engineering labor cost functions for which he will separately account in contract performance | 4. Contractor accounts for engineering labor by cost function, i.e. drafting, designing, production, engineering, etc. |

| 5. Contractor estimates engineering labor by cost function, i.e. drafting, production engineering, etc | 5. Contractor accumulates total engineering labor in one undifferentiated account. |

| 6. Contractor estimates a single dollar amount for machining cost to cover labor, material and overhead | 6. Contractor records separately the actual costs of machining labor and material as direct costs, and factory overhead as indirect costs. |

9904.401-61 Interpretation.

(a) 9904.401, Cost Accounting Standard - Consistency in Estimating, Accumulating and Reporting Costs, requires in 9904.401-40 that a contractor's “practices used in estimating costs in pricing a proposal shall be consistent with his cost accounting practices used in accumulating and reporting costs.”

(b) In estimating the cost of direct material requirements for a contract, it is a common practice to first estimate the cost of the actual quantities to be incorporated in end items. Provisions are then made for additional direct material costs to cover expected material losses such as those which occur, for example, when items are scrapped, fail to meet specifications, are lost, consumed in the manufacturing process, or destroyed in testing and qualification processes. The cost of some or all of such additional direct material requirements is often estimated by the application of one or more percentage factors to the total cost of basic direct material requirements or to some other base.

(c) Questions have arisen as to whether the accumulation of direct material costs in an undifferentiated account where a contractor estimates a significant part of such costs by means of percentage factors is in compliance with 9904.401. The most serious questions pertain to such percentage factors which are not supported by the contractor with accounting, statistical, or other relevant data from past experience, nor by a program to accumulate actual costs for comparison with such percentage estimates. The accumulation of direct costs in an undifferentiated account in this circumstance is a cost accounting practice which is not consistent with the practice of estimating a significant part of costs by means of percentage factors. This situation is virtually identical with that described in Illustration 9904.401-60(b)(5), which deals with labor.

(d) 9904.401 does not, however, prescribe the amount of detail required in accumulating and reporting costs. The amount of detail required may vary considerably depending on the percentage factors used, the data presented in justification or lack thereof, and the significance of each situation. Accordingly, it is neither appropriate nor practical to prescribe a single set of accounting practices which would be consistent in all situations with the practices of estimating direct material costs by percentage factors. Therefore, the amount of accounting and statistical detail to be required and maintained in accounting for this portion of direct material costs has been and continues to be a matter to be decided by Government procurement authorities on the basis of the individual facts and circumstances.

9904.401-62 Exemption.

None for this Standard.

9904.401-63 Effective date.

This Standard is effective as of April 17, 1992.

9904.402 Cost accounting standard - consistency in allocating costs incurred for the same purpose.

9904.402-10 [Reserved]

9904.402-20 Purpose.

The purpose of this standard is to require that each type of cost is allocated only once and on only one basis to any contract or other cost objective. The criteria for determining the allocation of costs to a product, contract, or other cost objective should be the same for all similar objectives. Adherence to these cost accounting concepts is necessary to guard against the overcharging of some cost objectives and to prevent double counting. Double counting occurs most commonly when cost items are allocated directly to a cost objective without eliminating like cost items from indirect cost pools which are allocated to that cost objective.

9904.402-30 Definitions.

(a) The following are definitions of terms which are prominent in this standard. Other terms defined elsewhere in this part 99 shall have the meanings ascribed to them in those definitions unless paragraph (b) of this section requires otherwise.

(1) Allocate means to assign an item of cost, or a group of items of cost, to one or more cost objectives. This term includes both direct assignment of cost and the reassignment of a share from an indirect cost pool.

(2) Cost objective means a function, organizational subdivision, contract, or other work unit for which cost data are desired and for which provision is made to accumulate and measure the cost to processes, products, jobs, capitalized projects, etc.

(3) Direct cost means any cost which is identified specifically with a particular final cost objective. Direct costs are not limited to items which are incorporated in the end product as material or labor. Costs identified specifically with a contract are direct costs of that contract. All costs identified specifically with other final cost objectives of the contractor are direct costs of those cost objectives.

(4) Final cost objective means a cost objective which has allocated to it both direct and indirect costs, and in the contractor's accumulation system, is one of the final accumulation points.

(5) Indirect cost means any cost not directly identified with a single final cost objective, but identified with two or more final cost objectives or with at least one intermediate cost objective.

(6) Indirect cost pool means a grouping of incurred costs identified with two or more cost objectives but not specifically identified with any final cost objective.

(b) The following modifications of terms defined elsewhere in this chapter 99 are applicable to this Standard: None.

9904.402-40 Fundamental requirement.

All costs incurred for the same purpose, in like circumstances, are either direct costs only or indirect costs only with respect to final cost objectives. No final cost objective shall have allocated to it as an indirect cost any cost, if other costs incurred for the same purpose, in like circumstances, have been included as a direct cost of that or any other final cost objective. Further, no final cost objective shall have allocated to it as a direct cost any cost, if other costs incurred for the same purpose, in like circumstances, have been included in any indirect cost pool to be allocated to that or any other final cost objective.

9904.402-50 Techniques for application.

(a) The Fundamental Requirement is stated in terms of cost incurred and is equally applicable to estimates of costs to be incurred as used in contract proposals.

(b) The Disclosure Statement to be submitted by the contractor will require that he set forth his cost accounting practices with regard to the distinction between direct and indirect costs. In addition, for those types of cost which are sometimes accounted for as direct and sometimes accounted for as indirect, the contractor will set forth in his Disclosure Statement the specific criteria and circumstances for making such distinctions. In essence, the Disclosure Statement submitted by the contractor, by distinguishing between direct and indirect costs, and by describing the criteria and circumstances for allocating those items which are sometimes direct and sometimes indirect, will be determinative as to whether or not costs are incurred for the same purpose. Disclosure Statement as used herein refers to the statement required to be submitted by contractors as a condition of contracting as set forth in subpart 9903.2.

(c) In the event that a contractor has not submitted a Disclosure Statement, the determination of whether specific costs are directly allocable to contracts shall be based upon the contractor's cost accounting practices used at the time of contract proposal.

(d) Whenever costs which serve the same purpose cannot equitably be indirectly allocated to one or more final cost objectives in accordance with the contractor's disclosed accounting practices, the contractor may either:

(1) Use a method for reassigning all such costs which would provide an equitable distribution to all final cost objectives, or

(2) Directly assign all such costs to final cost objectives with which they are specifically identified.

In the event the contractor decides to make a change for either purpose, the Disclosure Statement shall be amended to reflect the revised accounting practices involved.

(e) Any direct cost of minor dollar amount may be treated as an indirect cost for reasons of practicality where the accounting treatment for such cost is consistently applied to all final cost objectives, provided that such treatment produces results which are substantially the same as the results which would have been obtained if such cost had been treated as a direct cost.

9904.402-60 Illustrations.

(a) Illustrations of costs which are incurred for the same purpose:

(1) Contractor normally allocates all travel as an indirect cost and previously disclosed this accounting practice to the Government. For purposes of a new proposal, contractor intends to allocate the travel costs of personnel whose time is accounted for as direct labor directly to the contract. Since travel costs of personnel whose time is accounted for as direct labor working on other contracts are costs which are incurred for the same purpose, these costs may no longer be included within indirect cost pools for purposes of allocation to any covered Government contract. Contractor's Disclosure Statement must be amended for the proposed changes in accounting practices.

(2) Contractor normally allocates planning costs indirectly and allocates this cost to all contracts on the basis of direct labor. A proposal for a new contract requires a disproportionate amount of planning costs. The contractor prefers to continue to allocate planning costs indirectly. In order to equitably allocate the total planning costs, the contractor may use a method for allocating all such costs which would provide an equitable distribution to all final cost objectives. For example, he may use the number of planning documents processed rather than his former allocation base of direct labor. Contractor's Disclosure Statement must be amended for the proposed changes in accounting practices.

(b) Illustrations of costs which are not incurred for the same purpose:

(1) Contractor normally allocates special tooling costs directly to contracts. The costs of general purpose tooling are normally included in the indirect cost pool which is allocated to contracts. Both of these accounting practices were previously disclosed to the Government. Since both types of costs involved were not incurred for the same purpose in accordance with the criteria set forth in the Contractor's Disclosure Statement, the allocation of general purpose tooling costs from the indirect cost pool to the contract, in addition to the directly allocated special tooling costs, is not considered a violation of the standard.

(2) Contractor proposes to perform a contract which will require three firemen on 24-hour duty at a fixed-post to provide protection against damage to highly inflammable materials used on the contract. Contractor presently has a firefighting force of 10 employees for general protection of the plant. Contractor's costs for these latter firemen are treated as indirect costs and allocated to all contracts; however, he wants to allocate the three fixed-post firemen directly to the particular contract requiring them and also allocate a portion of the cost of the general firefighting force to the same contract. He may do so but only on condition that his disclosed practices indicate that the costs of the separate classes of firemen serve different purposes and that it is his practice to allocate the general firefighting force indirectly and to allocate fixed-post firemen directly.

9904.402-61 Interpretation.

(a) 9904.402, Cost Accounting Standard - Consistency in Allocating Costs Incurred for the Same Purpose, provides, in 9904.402-40, that “ * * * no final cost objective shall have allocated to it as a direct cost any cost, if other costs incurred for the same purpose, in like circumstances, have been included in any indirect cost pool to be allocated to that or any other final cost objective.”

(b) This interpretation deals with the way 9904.402 applies to the treatment of costs incurred in preparing, submitting, and supporting proposals. In essence, it is addressed to whether or not, under the Standard, all such costs are incurred for the same purpose, in like circumstances.

(c) Under 9904.402, costs incurred in preparing, submitting, and supporting proposals pursuant to a specific requirement of an existing contract are considered to have been incurred in different circumstances from the circumstances under which costs are incurred in preparing proposals which do not result from such specific requirement. The circumstances are different because the costs of preparing proposals specifically required by the provisions of an existing contract relate only to that contract while other proposal costs relate to all work of the contractor.

(d) This interpretation does not preclude the allocation, as indirect costs, of costs incurred in preparing all proposals. The cost accounting practices used by the contractor, however, must be followed consistently and the method used to reallocate such costs, of course, must provide an equitable distribution to all final cost objectives.

9904.402-62 Exemption.

None for this Standard.

9904.402-63 Effective date.

This Standard is effective as of April 17, 1992.

9904.403 Allocation of home office expenses to segments.

9904.403-10 [Reserved]

9904.403-20 Purpose.

(a) The purpose of this Cost Accounting Standard is to establish criteria for allocation of the expenses of a home office to the segments of the organization based on the beneficial or causal relationship between such expenses and the receiving segments. It provides for:

(1) Identification of expenses for direct allocation to segments to the maximum extent practical;

(2) Accumulation of significant nondirectly allocated expenses into logical and relatively homogeneous pools to be allocated on bases reflecting the relationship of the expenses to the segments concerned; and

(3) Allocation of any remaining or residual home office expenses to all segments.

Appropriate implementation of this Standard will limit the amount of home office expenses classified as residual to the expenses of managing the organization as a whole.

(b) This Standard does not cover the reallocation of a segment's share of home office expenses to contracts and other cost objectives.

9904.403-30 Definitions.

(a) The following are definitions of terms which are prominent in this Standard. Other terms defined elsewhere in this part 99 shall have the meanings ascribed to them in those definitions unless paragraph (b) of this subsection, requires otherwise.

(1) Allocate means to assign an item of cost, or a group of items of cost, to one or more cost objectives. This term includes both direct assignments of cost and the reassignment of a share from an indirect cost pool.

(2) Home office means an office responsible for directing or managing two or more, but not necessarily all, segments of an organization. It typically establishes policy for, and provides guidance to the segments in their operations. It usually performs management, supervisory, or administrative functions, and may also perform service functions in support of the operations of the various segments. An organization which has intermediate levels, such as groups, may have several home offices which report to a common home office. An intermediate organization may be both a segment and a home office.

(3) Operating revenue means amounts accrued or charge to customers, clients, and tenants, for the sale of products manufactured or purchased for resale, for services, and for rentals of property held primarily for leasing to others. It includes both reimbursable costs and fees under cost-type contracts and percentage-of-completion sales accruals except that it includes only the fee for management contracts under which the contractor acts essentially as an agent of the Government in the erection or operation of Government-owned facilities. It excludes incidental interest, dividends, royalty, and rental income, and proceeds from the sale of assets used in the business.

(4) Segment means one of two or more divisions, product departments, plants, or other subdivisions of an organization reporting directly to a home office, usually identified with responsibility for profit and/or producing a product or service. The term includes Government-owned contractor-operated (GOCO) facilities, and joint ventures and subsidiaries (domestic and foreign) in which the organization has a majority ownership. The term also includes those joint ventures and subsidiaries (domestic and foreign) in which the organization has less than a majority of ownership, but over which it exercises control.

(5) Tangible capital asset means an asset that has physical substance, more than minimal value, and is expected to be held by an enterprise for continued use or possession beyond the current accounting period for the services it yields.

(b) The following modifications of terms defined elsewhere in this Chapter 99 are applicable to this Standard: None.

9904.403-40 Fundamental requirement.

(a)

(1) Home office expenses shall be allocated on the basis of the beneficial or causal relationship between supporting and receiving activities. Such expenses shall be allocated directly to segments to the maximum extent practical. Expenses not directly allocated, if significant in amount and in relation to total home office expenses, shall be grouped in logical and homogeneous expense pools and allocated pursuant to paragraph (b) of this subsection. Such allocations shall minimize to the extent practical the amount of expenses which may be categorized as residual (those of managing the organization as a whole). These residual expenses shall be allocated pursuant to paragraph (c) of this subsection.

(2) No segment shall have allocated to it as an indirect cost, either through a homogeneous expense pool, or the residual expense pool, any cost, if other costs incurred for the same purpose have been allocated directly to that or any other segment.

(b) The following subparagraphs provide criteria for allocation of groups of home office expenses.

(1) Centralized service functions. Expenses of centralized service functions performed by a home office for its segments shall be allocated to segments on the basis of the service furnished to or received by each segment. Centralized service functions performed by a home office for its segments are considered to consist of specific functions which, but for the existence of a home office, would be performed or acquired by some or all of the segments individually. Examples include centrally performed personnel administration and centralized data processing.

(2) Staff management of certain specific activities of segments. The expenses incurred by a home office for staff management or policy guidance functions which are significant in amount and in relation to total home office expenses shall be allocated to segments receiving more than a minimal benefit over a base, or bases, representative of the total specific activity being managed. Staff management or policy guidance to segments is commonly provided in the overall direction or support of the performance of discrete segment activities such as manufacturing, accounting, and engineering (but see paragraph (b)(6) of this subsection).

(3) Line management of particular segments or groups of segments. The expense of line management shall be allocated only to the particular segment or group of segments which are being managed or supervised. If more than one segment is managed or supervised, the expense shall be allocated using a base or bases representative of the total activity of such segments. Line management is considered to consist of management or supervision of a segment or group of segments as a whole.

(4) Central payments or accruals. Central payments or accruals which are made by a home office on behalf of its segments shall be allocated directly to segments to the extent that all such payments or accruals of a given type or class can be identified specifically with individual segments. Central payments or accruals are those which but for the existence of a number of segments would be accrued or paid by the individual segments. Common examples include centrally paid or accrued pension costs, group insurance costs, State and local income taxes and franchise taxes, and payrolls paid by a home office on behalf of its segments. Any such types of payments or accruals which cannot be identified specifically with individual segments shall be allocated to benefitted segments using an allocation base representative of the factors on which the total payment is based.

(5) Independent research and development costs and bid and proposal costs. Independent research and development costs and bid and proposal costs of a home office shall be allocated in accordance with 9904.420.

(6) Staff management not identifiable with any certain specific activities of segments. The expenses incurred by a home office for staff management, supervisory, or policy functions, which are not identifiable to specific activities of segments shall be allocated in accordance with paragraph (c) of this subsection as residual expenses.

(c) Residual expenses.

(1) All home office expenses which are not allocable in accordance with paragraph (a) of this subsection and paragraphs (b)

(1) through (b)(5) of this subsection shall be deemed residual expenses. Typical residual expenses are those for the chief executive, the chief financial officer, and any staff which are not identifiable with specific activities of segments. Residual expenses shall be allocated to all segments under a home office by means of a base representative of the total activity of such segments, except where paragraph (c) (2) or (3) of this subsection applies.

(2) Residual expenses shall be allocated pursuant to 9904.403-50(c)(1) if the total amount of such expenses for the contractor's previous fiscal year (excluding any unallowable costs and before eliminating any amounts to be allocated in accordance with paragraph (c)(3) of this subsection) exceeds the amount obtained by applying the following percentage(s) to the aggregate operating revenue of all segments for such previous year: 3.35 percent of the first $100 million; 0.95 percent of the next $200 million; 0.30 percent of the next $2.7 billion; 0.20 percent of all amounts over $3 billion. The determination required by this paragraph for the 1st year the contractor is subject to this Standard shall be based on the pro forma application of this Standard to the home office expenses and aggregate operating revenue for the contractor's previous fiscal year.

(3) Where a particular segment receives significantly more or less benefit from residual expenses than would be reflected by the allocation of such expenses pursuant to paragraph (c) (1) or (2) of this subsection (see 9904.403-50(d)), the Government and the contractor may agree to a special allocation of residual expenses to such segment commensurate with the benefits received. The amount of a special allocation to any segment made pursuant to such an agreement shall be excluded from the pool of residual expenses to be allocated pursuant to paragraph (c) (1) or (2) of this subsection, and such segment's data shall be excluded from the base used to allocate this pool.

9904.403-50 Techniques for application.

(a)

(1) Separate expense groupings will ordinarily be required to implement 9904.403-40. The number of groupings will depend primarily on the variety and significance of service and management functions performed by a particular home office. Ordinarily, each service or management function will have to be separately identified for allocation by means of an appropriate allocation technique. However, it is not necessary to identify and allocate different functions separately, if allocation in accordance with the relevant requirements of 9904.403-40(b) can be made using a common allocation base. For example, if the personnel department of a home office provides personnel services for some or all of the segments (a centralized service function) and also established personnel policies for the same segments (a staff management function), the expenses of both functions could be allocated over the same base, such as the number of personnel, and the separate functions do not have to be identified.

(2) Where the expense of a given function is to be allocated by means of a particular allocation base, all segments shall be included in the base unless:

(i) Any excluded segment did not receive significant benefits from, or contribute significantly to the cause of the expense to be allocated and,

(ii) Any included segment did receive significant benefits from or contribute significantly to the cause of the expense in question.

(b)

(1) Section 9904.403-60 illustrates various expense pools which may be used together with appropriate allocation bases. The allocation of centralized service functions shall be governed by a hierarchy of preferable allocation techniques which represent beneficial or causal relationships. The preferred representation of such relationships is a measure of the activity of the organization performing the function. Supporting functions are usually labor-oriented, machine-oriented, or space-oriented. Measures of the activities of such functions ordinarily can be expressed in terms of labor hours, machine hours, or square footage. Accordingly, costs of these functions shall be allocated by use of a rate, such as a rate per labor hour, rate per machine hour or cost per square foot, unless such measures are unavailable or impractical to ascertain. In these latter cases the basis for allocation shall be a measurement of the output of the supporting function. Output is measured in terms of units of end product produced by the supporting function, as for example, number of printed pages for a print shop, number of purchase orders processed by a purchasing department, number of hires by an employment office.

(2) Where neither activity nor output of the supporting function can be practically measured, a surrogate for the beneficial, or causal relationship must be selected. Surrogates used to represent the relationship are generally measures of the activity of the segments receiving the service; for example, for personnel services reasonable surrogates would be number of personnel, labor hours, or labor dollars of the segments receiving the service. Any surrogate used should be a reasonable measure of the services received and, logically, should vary in proportion to the services received.

(c)

(1) Where residual expenses are required to be allocated pursuant to 9904.403-40(c)(2), the three factor formula described below must be used. This formula is considered to result in appropriate allocations of the residual expenses of home offices. It takes into account three broad areas of management concern: The employees of the organization, the business volume, and the capital invested in the organization. The percentage of the residual expenses to be allocated to any segment pursuant to the three factor formula is the arithmetical average of the following three percentages for the same period.

(i) The percentage of the segment's payroll dollars to the total payroll dollars of all segments.

(ii) The percentage of the segment's operating revenue to the total operating revenue of all segments. For this purpose, the operating revenue of any segment shall include amounts charged to other segments and shall be reduced by amounts charged by other segments for purchases.

(iii) The percentage of the average net book value of the sum of the segment's tangible capital assets plus inventories to the total average net book value of such assets of all segments. Property held primarily for leasing to others shall be excluded from the computation. The average net book value shall be the average of the net book value at the beginning of the organization's fiscal year and the net book value at the end of the year.

(d) The following paragraphs provide guidance for implementing the requirements of 9904.403-40(c)(3).

(1) An indication that a segment received significantly less benefit in relation to other segments can arise if a segment, unlike all or most other segments, performs on its own many of the functions included in the residual expense. Another indication may be that, in relation to its size, comparatively little or no costs are allocable to a segment pursuant to 9904.403-40(b) (1) through (5). Evidence of comparatively little communication or interpersonal relations between a home office and a segment, in relation to its size, may also indicate that the segment receives significantly less benefit from residual expenses. Conversely, if the opposite conditions prevail at any segment, a greater allocation than would result from the application of 9904.403-40(c) (1) or (2) may be indicated. This may be the case, for example, if a segment relies heavily on the home office for certain residual functions normally performed by other segments on their own.

(2) Segments which may require special allocations of residual expenses pursuant to 9904.403-40(c)(3) include, but are not limited to foreign subsidiaries, GOCO's, domestic subsidiaries with less than a majority ownership, and joint ventures.

(3) The portion of residual expenses to be allocated to a segment pursuant to 9904.403-40(c)(3) shall be the cost of estimated or recorded efforts devoted to the segments.

(e) Home office functions may be performed by an organization which for some purposes may not be a part of the legal entity with which the Government has contracted. This situation may arise, for example, in instances where the Government contracts directly with a corporation which is wholly or partly owned by another corporation. In this case, the latter corporation serves as a “home office,” and the corporation with which the contract is made is a “segment” as those terms are defined and used in this Standard. For purposes of contracts subject to this Standard, the contracting corporation may only accept allocations from the other corporation to the extent that such allocations meet the requirements set forth in this Standard for allocation of home office expenses to segments.

9904.403-60 Illustrations.

(a) The following table lists some typical pools, together with illustrative allocation bases, which could be used in appropriate circumstances:

| Home office expense or function | Illustrative allocation bases |

|---|---|

| Centralized service functions: | |

| 1. Personnel administration | 1. Number of personnel, labor hours, payroll, number of hires. |

| 2. Data processing services | 2. Machine time, number of reports. |

| 3. Centralized purchasing and subcontracting | 3. Number of purchase orders, value of purchases, number of items. |

| 4. Centralized warehousing | 4. Square footage, value of material, volume. |

| 5. Company aircraft service | 5. Actual or standard rate per hour, mile, passenger mile, or similar unit. |

| 6. Central telephone service | 6. Usage costs, number of instruments. |

(b) The selection of a base for allocating centralized service functions shall be governed by the criteria established in 9904.403-50(b).

(c) The listed allocation bases in this section are illustrative. Other bases for allocation of home office expenses to segments may be used if they are substantially in accordance with the beneficial or casual relationships outlined in 9904.403-40.

| Home office expenses or function | Illustrative allocation bases |

|---|---|

| Staff management or specific activities: | |

| 1. Personnel management | 1. Number of personnel, labor hours, payroll, number of hires. |

| 2. Manufacturing policies, (quality control, industrial engineering, production, scheduling, tooling, inspection and testing, etc | 2. Manufacturing cost input, manufacturing direct labor. |

| 3. Engineering policies | 3. Total engineering costs, engineering direct labor, number of drawings. |

| 4. Material/purchasing policies | 4. Number of purchase orders, value of purchases. |

| 5. Marketing policies | 5. Sales, segment marketing costs. |

| Central payments or accruals: | |

| 1. Pension expenses | 1. Payroll or other factor on which total payment is based. |

| 2. Group insurance expenses | 2. Payroll or other factor on which total payment is based. |

| 3. State and local income taxes and franchise taxes | 3. Any base or method which results in an allocation that equals or approximates a segment's proportionate share of the tax imposed by the jurisdiction in which the segment does business, as measured by the same factors used to determine taxable income for that jurisdiction. |

9904.403-61 Interpretation.

(a) Questions have arisen as to the requirements of 9904.403, Cost Accounting Standard, Allocation of Home Office Expenses to Segments, for the purpose of allocating State and local income taxes and franchise taxes based on income (hereinafter collectively referred to as income taxes) from a home office of an organization to its segments.

(b) By means of an illustrative allocation base in 9904.403-60, the Standard provides that income taxes are to be allocated by “any base or method which results in an allocation that equals or approximates a segment's proportionate share of the tax imposed by the jurisdiction in which the segment does business, as measured by the same factors used to determine taxable income for that jurisdiction.” This provision contains two essential criteria for the allocation of income taxes from a home office to segments. First, the taxes of any particular jurisdiction are to be allocated only to those segments that do business in the taxing jurisdiction. Second, where there is more than one segment in a taxing jurisdiction, the taxes are to be allocated among those segments on the basis of “the same factors used to determine the taxable income for that jurisdiction.” The questions that have arisen relate primarily to whether segment book income or loss is a “factor” for this purpose.

(c) Most States tax a fraction of total organization income, rather than the book income of segments that do business within the State. The fraction is calculated pursuant to a formula prescribed by State statute. In these situations the book income or loss of individual segments is not a factor used to determine taxable income for that jurisdiction. Accordingly, in States that tax a fraction of total organization income, rather than the book income of segments within the State, such book income is irrelevant for tax allocation purposes. Therefore, segment book income is to be used as a factor in allocating income tax expense from a home office to segments only where this amount is expressly used by the taxing jurisdiction in computing the income tax.

9904.403-62 Exemption. [Reserved]

9904.403-63 Effective date.

This Standard is effective as of April 17, 1992. Contractors with prior CAS-covered contracts with full coverage shall continue this Standard's applicability upon receipt of a contract to which this Standard is applicable. For contractors with no previous contracts subject to this Standard, this Standard shall be applied beginning with the contractor's next full fiscal year beginning after the receipt of a contract to which this Standard is applicable.

9904.404 Capitalization of tangible assets.

9904.404-10 [Reserved]

9904.404.20 Purpose.

This Standard requires that, for purposes of cost measurement, contractors establish and adhere to policies with respect to capitalization of tangible assets which satisfy criteria set forth herein. Normally, cost measurements are based on the concept of enterprise continuity; this concept implies that major asset acquisitions will be capitalized, so that the cost applicable to current and future accounting periods can be allocated to cost objectives of those periods. A capitalization policy in accordance with this Standard will facilitate measurement of costs consistently over time.

9904.404-30 Definitions.

(a) The following are definitions of terms which are prominent in this standard. Other terms defined elsewhere in this part 99 shall have the meanings ascribed to them in those definitions unless paragraph (b) of this subsection, requires otherwise.

(1) Asset accountability unit means a tangible capital asset which is a component of plant and equipment that is capitalized when acquired or whose replacement is capitalized when the unit is removed, transferred, sold, abandoned, demolished, or otherwise disposed of.

(2) Original complement of low cost equipment means a group of items acquired for the initial outfitting of a tangible capital asset or an operational unit, or a new addition to either. The items in the group individually cost less than the minimum amount established by the contractor for capitalization for the classes of assets acquired but in the aggregate they represent a material investment. The group, as a complement, is expected to be held for continued service beyond the current period. Initial outfitting of the unit is completed when the unit is ready and available for normal operations.

(3) Repairs and maintenance generally means the total endeavor to obtain the expected service during the life of tangible capital assets. Maintenance is the regularly recurring activity of keeping assets in normal or expected operating condition while repair is the activity of putting them back into such condition.

(4) Tangible capital asset means an asset that has physical substance, more than minimal value, and is expected to be held by an enterprise for continued use or possession beyond the current accounting period for the service it yields.

(b) The following modifications of terms defined elsewhere in this chapter 99 are applicable to this Standard: None.

9904.404-40 Fundamental requirement.

(a) The acquisition cost of tangible capital assets shall be capitalized. Capitalization shall be based upon a written policy that is reasonable and consistently applied.

(b) The contractor's policy shall designate economic and physical characteristics for capitalization of tangible assets.

(1) The contractor's policy shall designate a minimum service life criterion, which shall not exceed 2 years, but which may be a shorter period. The policy shall also designate a minimum acquisition cost criterion which shall not exceed $5,000, but which may be a smaller amount.

(2) The contractor's policy may designate other specific characteristics which are pertinent to his capitalization policy decisions (e.g., class of asset, physical size, identifiability and controllability, the extent of integration or independence of constituent units).

(3) The contractor's policy shall provide for identification of asset accountability units to the maximum extent practical.

(4) The contractor's policy may designate higher minimum dollar limitations for original complement of low cost equipment and for betterments and improvements than the limitation established in accordance with paragraph (b)(1) of this subsection, provided such higher limitations are reasonable in the contractor's circumstances.

(c) Tangible assets shall be capitalized when both of the criteria in the contractor's policy as required in paragraph (b)

(1) of this subsection are met, except that assets described in subparagraph (b)(4) of this subsection shall be capitalized in accordance with the criteria established in accordance with that paragraph.

(d) Costs incurred subsequent to the acquisition of a tangible capital asset which result in extending the life or increasing the productivity of that asset (e.g., betterments and improvements) and which meet the contractor's established criteria for capitalization shall be capitalized with appropriate accounting for replaced asset accountability units. However, costs incurred for repairs and maintenace to a tangible capital asset which either restore the asset to, or maintain it at, its normal or expected service life or production capacity shall be treated as costs of the current period.

9904.404-50 Techniques for application.

(a) The cost to acquire a tangible capital asset includes the purchase price of the asset and costs necessary to prepare the asset for use.

(1) The purchase price of an asset shall be adjusted to the extent practical by premiums and extra charges paid or discounts and credits received which properly reflect an adjustment in the purchase price.

(i) Purchase price is the consideration given in exchange for an asset and is determined by cash paid, or to the extent payment is not made in cash, in an amount equivalent to what would be the cash price basis. Where this amount is not available, the purchase price is determined by the current value of the consideration given in exchange for the asset. For example, current value for a credit instrument is the amount immediately required to settle the obligation or the amount of money which might have been raised directly through the use of the same instrument employed in making the credit purchase. The current value of an equity security is its market value. Market value is the current or prevailing price of the security as indicated by recent market quotations. If such values are unavailable or not appropriate (thin market, volatile price movement, etc.), an acceptable alternative is the fair value of the asset acquired.

(ii) Donated assets which, at the time of receipt, meet the contractor's criteria for capitalization shall be capitalized at their fair value at that time.

(2) Costs necessary to prepare the asset for use include the cost of placing the asset in location and bringing the asset to a condition necessary for normal or expected use. Where material in amount, such costs, including initial inspection and testing, installation and similar expenses, shall be capitalized.

(b) Tangible capital assets constructed or fabricated by a contractor for its own use shall be capitalized at amounts which include all indirect costs properly allocable to such assets. This requires the capitalization of general and administrative expenses when such expenses are identifiable with the constructed asset and are material in amount (e.g., when the in-house construction effort requires planning, supervisory, or other significant effort by officers or other personnel whose salaries are regularly charged to general and administrative expenses). When the constructed assets are identical with or similar to the contractor's regular product, such assets shall be capitalized at amounts which include a full share of indirect costs.

(c) In circumstances where the acquisition by purchase or donation of previously used tangible capital assets is not an arm's length transaction, acquisition cost shall be limited to the capitalized cost of the asset to the owner who last acquired the asset through an arm's-length transaction, reduced by depreciation charges from date of that acquisition to date of gift or sale.

(d) The capitalized values of tangible capital assets acquired in a business combination, accounted for under the “purchase method” of accounting, shall be assigned to these assets as follows:

(1) All the tangible capital assets of the acquired company that during the most recent cost accounting period prior to a business combination generated either depreciation expense or cost of money charges that were allocated to Federal government contracts or subcontracts negotiated on the basis of cost, shall be capitalized by the buyer at the net book value(s) of the asset(s) as reported by the seller at the time of the transaction.

(2) All the tangible capital asset(s) of the acquired company that during the most recent cost accounting period prior to a business combination did not generate either depreciation expense or cost of money charges that were allocated to Federal government contracts or subcontracts negotiated on the basis of cost, shall be assigned a portion of the cost of the acquired company not to exceed their fair value(s) at the date of acquisition. When the fair value of identifiable acquired assets less liabilities assumed exceeds the purchase price of the acquired company in an acquisition under the “purchase method,” the value otherwise assignable to tangible capital assets shall be reduced by a proportionate part of the excess.

(e) Under the “pooling of interest method” of accounting for business combinations, the values established for tangible captial assets for financial accounting shall be the values used for determining the cost of such assets.

(f) Asset accountability units shall be identified and separately capitalized at the time the assets are acquired. However, whether or not the contractor identifies and separately capitalizes a unit initially, the contractor shall remove the unit from the asset accounts when it is disposed of and, if replaced, its replacement shall be capitalized.

9904.404-60 Illustrations.

(a) Illustrations of costs which must be capitalized.

(1) Contractor has an established policy of capitalizing tangible assets which have a service life of more than 1 year and a cost of $6,000. The contractor's policy must be modified to conform to the $5,000 policy limitation on minimum acquisition cost established by the Standard.

(i) Contractor acquires a tangible capital asset with a life of 18 months at a cost of $6,500. The Standard requires that the asset be capitalized in compliance with contractor's policy as to service life.

(ii) Contractor acquires a tangible asset with a life of 18 months at a cost of $900. The asset need not be capitalized unless the contractor's revised policy establishes a minimum cost criterion below $900.

(2) Contractor has an established policy of capitalizing tangible assets which have a service life of more than 1 year and a cost of $250. Contractor acquires a tangible asset with a life of 18 months and a cost of $300. The Standard requires that, based upon contractor's policy, the asset be capitalized.

(3) Contractor establishes a major new production facility. In the process, a number of large and small items of equipment were acquired to outfit it. The contractor has an established policy of capitalizing individual items of tangible assets which have a service life of over 1 year and a cost of $500, and all items meeting these requirements were capitalized. In addition, the contractor's policy requires capitalization of an original complement which has a service life of over 1 year and a cost of $5,000. Items of durable equipment acquired for the production facility costing less than $500 each aggregated $50,000. Based upon the contractor's policy, the durable equipment items must be capitalized as the original complement of low cost equipment. (The concept of original complement applies to such items as books in a new library, impact wrenches in a new factory, work benches and racks in a new production facility, or furniture and fixtures in a new office building.)

(4) Contractor has an established policy for treating its heavy presses and their power supplies as separate asset accountability units. A power supply is replaced during the service life of the related press. The Standard requires that, based upon the contractor's policy, the new power supply be capitalized with appropriate accounting for the replaced unit.

(b) Illustrations of costs which need not be capitalized.

(1) The contractor has an established policy of capitalizing tangible assets which have a service life of 2 years and a cost of $500. The contractor acquires an asset with a useful life of 18 months and a cost of $5,000. The tangible asset should be expensed because it does not meet the 2-year criterion.

(2) The contractor establishes a new assembly line. In outfitting the line, the contractor acquires $5,000 of small tools. On similar assembly lines under similar conditions, the original complement of small tools was expensed because the complement was replaced annually as a result of loss, pilferage, breakage, and physical wear and tear. Because the unit of original complement does not meet the contractor's service life criterion for capitalization (1 year), the small tools may be expensed.

9904.404-61 Interpretation. [Reserved]

9904.404-62 Exemption.

None for this Standard.

9904.405 Accounting for unallowable costs.

9904.405-10 [Reserved]

9904.405-20 Purpose.

(a) The purpose of this Cost Accounting Standard is to facilitate the negotiation, audit, administration and settlement of contracts by establishing guidelines covering:

(1) Identification of costs specifically described as unallowable, at the time such costs first become defined or authoritatively designated as unallowable, and

(2) The cost accounting treatment to be accorded such identified unallowable costs in order to promote the consistent application of sound cost accounting principles covering all incurred costs.

The Standard is predicated on the proposition that costs incurred in carrying on the activities of an enterprise - regardless of the allowability of such costs under Government contracts - are allocable to the cost objectives with which they are identified on the basis of their beneficial or causal relationships.

(b) This Standard does not govern the allowability of costs. This is a function of the appropriate procurement or reviewing authority.

9904.405-30 Definitions.

(a) The following are definitions of terms which are prominent in this Standard. Other terms defined elsewhere in this part 99 shall have the meanings ascribed to them in those definitions unless paragraph (b) of this subsection, requires otherwise.

(1) Directly associated cost means any cost which is generated solely as a result of the incurrence of another cost, and which would not have been incurred had the other cost not been incurred.

(2) Expressly unallowable cost means a particular item or type of cost which, under the express provisions of an applicable law, regulation, or contract, is specifically named and stated to be unallowable.

(3) Indirect cost means any cost not directly identified with a single final cost objective, but identified with two or more final cost objectives or with at least one intermediate cost objective.

(4) Unallowable cost means any cost which, under the provisions of any pertinent law, regulation, or contract, cannot be included in prices, cost reimbursements, or settlements under a Government contract to which it is allocable.

(b) The following modifications of terms defined elsewhere in this chapter 99 are applicable to this Standard: None.

9904.405-40 Fundamental requirement.

(a) Costs expressly unallowable or mutually agreed to be unallowable, including costs mutually agreed to be unallowable directly associated costs, shall be identified and excluded from any billing, claim, or proposal applicable to a Government contract.

(b) Costs which specifically become designated as unallowable as a result of a written decision furnished by a contracting officer pursuant to contract disputes procedures shall be identified if included in or used in the computation of any billing, claim, or proposal applicable to a Government contract. This identification requirement applies also to any costs incurred for the same purpose under like circumstances as the costs specifically identified as unallowable under either this paragraph or paragraph (a) of this subsection.

(c) Costs which, in a contracting officer's written decision furnished pursuant to contract disputes procedures, are designated as unallowable directly associated costs of unallowable costs covered by either paragraph (a) or (b) of this subsection shall be accorded the identification required by paragraph (b) of this subsection.

(d) The costs of any work project not contractually authorized, whether or not related to performance of a proposed or existing contract, shall be accounted for, to the extent appropriate, in a manner which permits ready separation from the costs of authorized work projects.

(e) All unallowable costs covered by paragraphs (a) through (d) of this subsection shall be subject to the same cost accounting principles governing cost allocability as allowable costs. In circumstances where these unallowable costs normally would be part of a regular indirect-cost allocation base or bases, they shall remain in such base or bases. Where a directly associated cost is part of a category of costs normally included in an indirect-cost pool that will be allocated over a base containing the unallowable cost with which it is associated, such a directly associated cost shall be retained in the indirect-cost pool and be allocated through the regular allocation process.

(f) Where the total of the allocable and otherwise allowable costs exceeds a limitation-of-cost or ceiling-price provision in a contract, full direct and indirect cost allocation shall be made to the contract cost objective, in accordance with established cost accounting practices and Standards which regularly govern a given entity's allocations to Government contract cost objectives. In any determination of unallowable cost overrun, the amount thereof shall be identified in terms of the excess of allowable costs over the ceiling amount, rather than through specific identification of particular cost items or cost elements.

9904.405-50 Techniques for application.

(a) The detail and depth of records required as backup support for proposals, billings, or claims shall be that which is adequate to establish and maintain visibility of identified unallowable costs (including directly associated costs), their accounting status in terms of their allocability to contract cost objectives, and the cost accounting treatment which has been accorded such costs. Adherence to this cost accounting principle does not require that allocation of unallowable costs to final cost objectives be made in the detailed cost accounting records. It does require that unallowable costs be given appropriate consideration in any cost accounting determinations governing the content of allocation bases used for distributing indirect costs to cost objectives. Unallowable costs involved in the determination of rates used for standard costs, or for the indirect-cost bidding or billing, need be identified only at the time rates are proposed, established, revised or adjusted.

(b)

(1) The visibility requirement of paragraph (a) of this subsection, may be satisfied by any form of cost identification which is adequate for purposes of contract cost determination and verification. The Standard does not require such cost identification for purposes which are not relevant to the determination of Government contract cost. Thus, to provide visibility for incurred costs, acceptable alternative practices would include:

(i) The segregation of unallowable costs in separate accounts maintained for this purpose in the regular books of account,

(ii) The development and maintenance of separate accounting records or workpapers, or

(iii) The use of any less formal cost accounting techniques which establishes and maintains adequate cost identification to permit audit verification of the accounting recognition given unallowable costs.

(2) Contractors may satisfy the visibility requirements for estimated costs either:

(i) By designation and description (in backup data, workpapers, etc.) of the amounts and types of any unallowable costs which have specifically been identified and recognized in making the estimates, or

(ii) By description of any other estimating technique employed to provide appropriate recognition of any unallowable costs pertinent to the estimates.

(c) Specific identification of unallowable cost is not required in circumstances where, based upon considerations of materiality, the Government and the contractor reach agreement on an alternate method that satisfies the purpose of the Standard.

9904.405-60 Illustrations.

(a) An auditor recommends disallowance of certain direct labor and direct materials costs, for which a billing has been submitted under a contract, on the basis that these particular costs were not required for performance and were not authorized by the contract. The contracting officer issues a written decision which supports the auditor's position that the questioned costs are unallowable. Following receipt of the contracting officer's decision, the contractor must clearly identify the disallowed direct labor and direct material costs in his accounting records and reports covering any subsequent submission which includes such costs. Also, if the contractor's base for allocation of any indirect cost pool relevant to the subject contract consists of direct labor, direct material, total prime cost, total cost input, etc., he must include the disallowed direct labor and material costs in his allocation base for such pool. Had the contracting officer's decision been against the auditor, the contractor would not, of course, have been required to account separately for the costs questioned by the auditor.

(b) A contractor incurs, and separately identifies, as a part of his manufacturing overhead, certain costs which are expressly unallowable under the existing and currently effective regulations. If manufacturing overhead is regularly a part of the contractor's base for allocation of general and administrative (G&A) or other indirect expenses, the contractor must allocate the G&A or other indirect expenses to contracts and other final cost objectives by means of a base which includes the identified unallowable manufacturing overhead costs.

(c) An auditor recommends disallowance of the total direct indirect costs attributable to an organizational planning activity. The contractor claims that the total of these activity costs are allowable under the Federal Acquisition Regulation (FAR) as “Economic planning costs” (48 CFR 31.205-12); the auditor contends that they constitute “Organization costs” (48 CFR 31.205-27) and therefore are unallowable. The issue is referred to the contracting officer for resolution pursuant to the contract disputes clause. The contracting officer issues a written decision supporting the auditor's position that the total costs questioned are unallowable under the FAR. Following receipt of the contracting officer's decision, the contractor must identify the disallowed costs and specific other costs incurred for the same purpose in like circumstances in any subsequent estimating, cost accumulation or reporting for Government contracts, in which such costs are included. If the contracting officer's decision had supported the contractor's contention, the costs questioned by the auditor would have been allowable “Economic planning costs,” and the contractor would not have been required to provide special identification.

(d) A defense contractor was engaged in a program of expansion and diversification of corporate activities. This involved internal corporate reorganization, as well as mergers and acquisitions. All costs of this activity were charged by the contractor as corporate or segment general and administrative (G&A) expense. In the contractor's proposals for final Segment G&A rates (including corporate home office allocations) to be applied in determining allowable costs of its defense contracts subject to 48 CFR part 31, the contractor identified and excluded the expressly unallowable costs (as listed in 48 CFR 31.205-12) incurred for incorporation fees and for charges for special services of outside attorneys, accountants, promoters, and consultants. In addition, during the course of negotiation of interim bidding and billing G&A rates, the contractor agreed to classify as unallowable various in-house costs incurred for the expansion program, and various directly associated costs of the identifiable unallowable costs. On the basis of negotiations and agreements between the contractor and the contracting officers' authorized representatives, interim G&A rates were established, based on the net balance of allowable G&A costs. Application of the rates negotiated to proposals, and on an interim basis to billings, for covered contracts constitutes compliance with the Standard.

(e) An official of a company, whose salary, travel, and subsistence expenses are charged regularly as general and administrative (G&A) expenses, takes several business associates on what is clearly a business entertainment trip. The entertainment costs of such trips is expressly unallowable because it constitutes entertainment expense, and is separately identified by the contractor. The contractor does not regularly include his G&A expenses in any indirect-expense allocation base. In these circumstances, the official's travel and subsistence expenses would be directly associated costs for identification with the unallowable entertainment expense. However, unless this type of activity constituted a significant part of the official's regular duties and responsibilities on which his salary was based, no part of the official's salary would be required to be identified as a directly associated cost of the unallowable entertainment expense.

9904.405-61 Interpretation. [Reserved]

9904.405-62 Exemption.

None for this Standard.

9904.405-63 Effective date.

This Standard is effective as of April 17, 1992.

9904.406 Cost accounting standard - cost accounting period.

9904.406-10 [Reserved]

9904.406-20 Purpose.

The purpose of this Cost Accounting Standard is to provide criteria for the selection of the time periods to be used as cost accounting periods for contract cost estimating, accumulating, and reporting. This Standard will reduce the effects of variations in the flow of costs within each cost accounting period. It will also enhance objectivity, consistency, and verifiability, and promote uniformity and comparability in contract cost measurements.

9904.406-30 Definitions.

(a) The following are definitions of terms which are prominent in this Standard. Other terms defined elsewhere in this part 99 shall have the meanings ascribed to them in those definitions unless paragraph (b) of this subsection, requires otherwise.

(1) Allocate means to assign an item of cost, or a group of items of cost, to one or more cost objectives. This term includes both direct assignment of cost and the reassignment of a share from an indirect cost pool.

(2) Cost objective means a function, organizational subdivision, contract, or other work unit for which cost data are desired and for which provision is made to accumulate and measure the cost of processes, products, jobs, capitalized projects, etc.

(3) Fiscal year means the accounting period for which annual financial statements are regularly prepared, generally a period of 12 months, 52 weeks, or 53 weeks.

(4) Indirect cost pool means a grouping of incurred costs identified with two or more cost objectives but not identified specifically with any final cost objective.

(b) The following modification of terms defined elsewhere in this chapter 99 are applicable to this Standard: None.

9904.406-40 Fundamental requirement.

(a) A contractor shall use this fiscal year as his cost accounting period, except that:

(1) Costs of an indirect function which exists for only a part of a cost accounting period may be allocated to cost objectives of that same part of the period as provided in 9904.406-50(a).

(2) An annual period other than the fiscal year may, as provided in 9904.406-50(d), be used as the cost accounting period if its use is an established practice of the contractor.

(3) A transitional cost accounting period other than a year shall be used whenever a change of fiscal year occurs.

(4) Where a contractor's cost accounting period is different from the reporting period used for Federal income tax reporting purposes, the latter may be used for such reporting.

(b) A contractor shall follow consistent practices in his selection of the cost accounting period or periods in which any types of expense and any types of adjustment to expense (including prior-period adjustments) are accumulated and allocated.

(c) The same cost accounting period shall be used for accumulating costs in an indirect cost pool as for establishing its allocation base, except that the contracting parties may agree to use a different period for establishing an allocation base as provided in 9904.406-50(e).

9904.406-50 Techniques for application.

(a) The cost of an indirect function which exists for only a part of a cost accounting period may be allocated on the basis of data for that part of the cost accounting period if the cost is:

(1) Material in amount,

(2) Accumulated in a separate indirect cost pool, and

(3) Allocated on the basis of an appropriate direct measure of the activity or output of the function during that part of the period.

(b) The practices required by 9904.406-40(b) of this Standard shall include appropriate practices for deferrals, accruals, and other adjustments to be used in identifying the cost accounting periods among which any types of expense and any types of adjustment to expense are distributed. If an expense, such as taxes, insurance or employee leave, is identified with a fixed, recurring, annual period which is different from the contractor's cost accounting period, the Standard permits continued use of that different period. Such expenses shall be distributed to cost accounting periods in accordance with the contractor's established practices for accruals, deferrals, and other adjustments.

(c) Indirect cost allocation rates, based on estimates, which are used for the purpose of expediting the closing of contracts which are terminated or completed prior to the end of a cost accounting period need not be those finally determined or negotiated for that cost accounting period. They shall, however, be developed to represent a full cost accounting period, except as provided in paragraph (a) of this subsection.

(d) A contractor may, upon mutual agreement with the Government, use as his cost accounting period a fixed annual period other than his fiscal year, if the use of such a period is an established practice of the contractor and is consistently used for managing and controlling the business, and appropriate accruals, deferrals or other adjustments are made with respect to such annual periods.

(e) The contracting parties may agree to use an annual period which does not coincide precisely with the cost accounting period for developing the data used in establishing an allocation base: Provided,

(1) The practice is necessary to obtain significant administrative convenience,

(2) The practice is consistently followed by the contractor,

(3) The annual period used is representative of the activity of the cost accounting period for which the indirect costs to be allocated are accumulated, and