PART 9903 - CONTRACT COVERAGE

9903.101 Cost Accounting Standards.

9903.102 OMB approval under the Paperwork Reduction Act.

Subpart 9903.2 - CAS Program Requirements

9903.201 Contract requirements.

9903.201-2 Types of CAS coverage.

9903.201-3 Solicitation provisions.

9903.201-7 Cognizant Federal agency responsibilities.

9903.201-8 Compliant accounting changes due to external restructuring activities.

9903.202 Disclosure requirements.

9903.202-1 General requirements.

9903.202-2 Impracticality of submission.

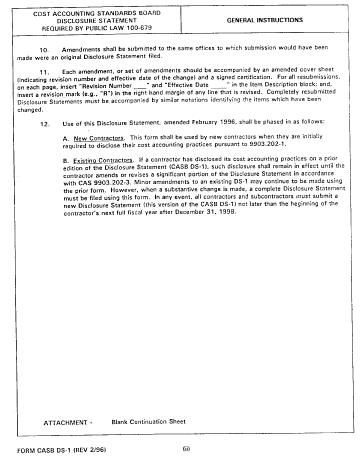

9903.202-3 Amendments and revisions.

9903.202-4 Privileged and confidential information.

9903.202-5 Filing Disclosure Statements.

9903.202-6 Adequacy of Disclosure Statement.

9903.202-8 Subcontractor Disclosure Statements.

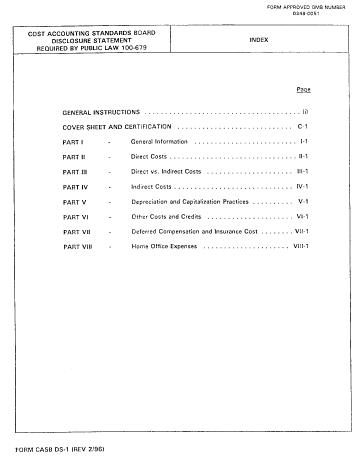

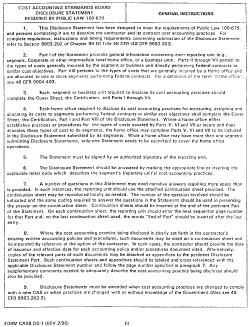

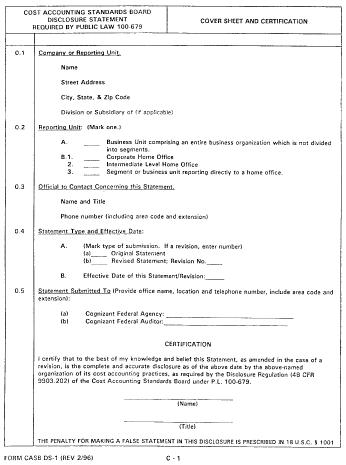

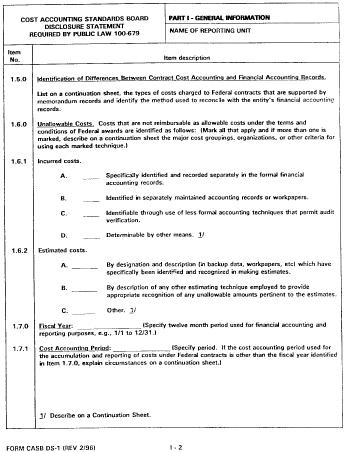

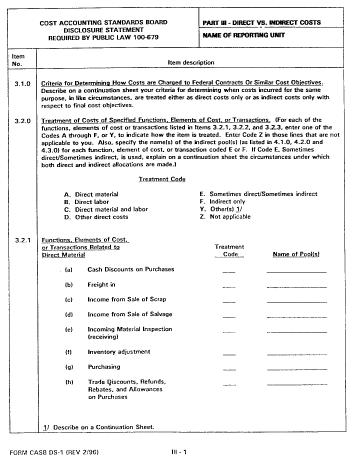

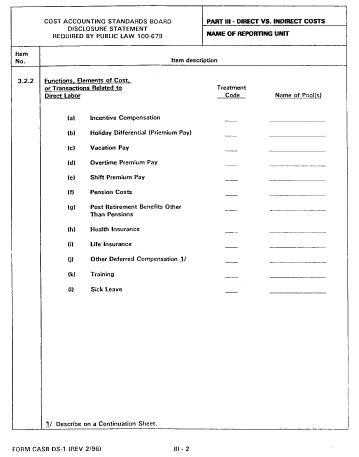

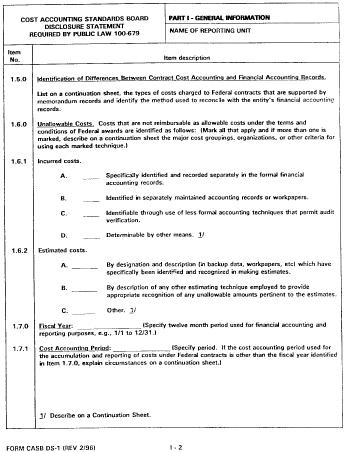

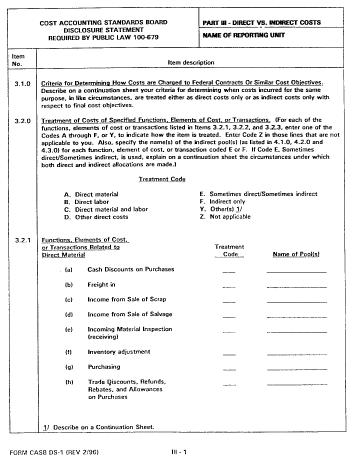

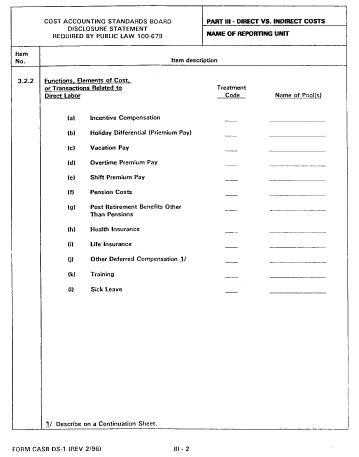

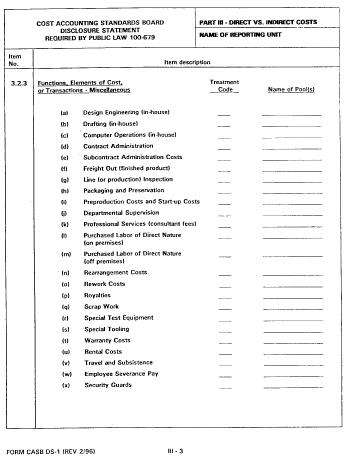

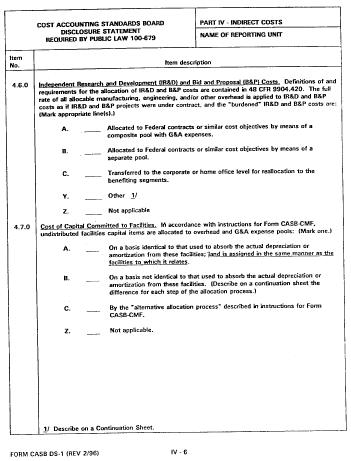

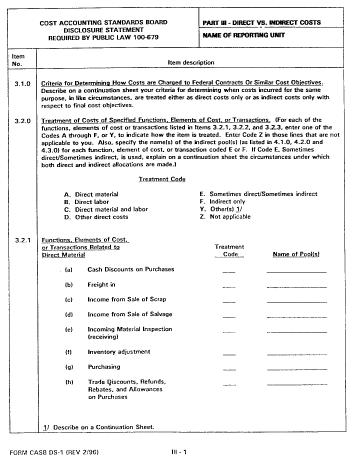

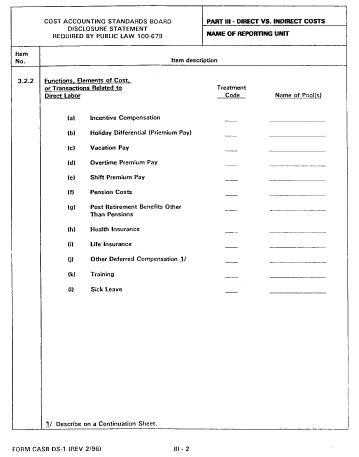

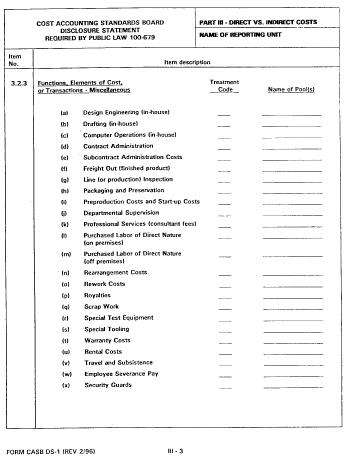

9903.202-9 Illustration of Disclosure Statement Form, CASB-DS-1.

9903.202-10 Illustration of Disclosure Statement Form, CASB DS-2.

Subpart 9903.3 - CAS Rules and Regulations

9903.302-1 Cost accounting practice.

9903.302-2 Change to a cost accounting practice.

9903.303 Effect of filing Disclosure Statement.

Subpart 9903.1 - General

9903.101 Cost Accounting Standards.

Public Law 100-679 (41 U.S.C. 422) requires certain contractors and subcontractors to comply with Cost Accounting Standards (CAS) and to disclose in writing and follow consistently their cost accounting practices.

9903.102 OMB approval under the Paperwork Reduction Act.

The Paperwork Reduction Act of 1980 (Pub. L. 96-511) imposes a requirement on Federal agencies to obtain approval from the Office of Management and Budget (OMB) before collecting information from ten or more members of the public. The information collection and recordkeeping requirements contained in this regulation have been approved by OMB. OMB has assigned Control Numbers 0348-0051 and 0348-0055 to the paperwork, recordkeeping and forms associated with this regulation.

Subpart 9903.2 - CAS Program Requirements

9903.201 Contract requirements.

9903.201-1 CAS applicability.

(a) This subsection describes the rules for determining whether a proposed contract or subcontract is exempt from CAS. (See 9904 or 9905, as applicable.) Negotiated contracts not exempt in accordance with 9903.201-1(b) shall be subject to CAS. A CAS-covered contract may be subject to full, modified or other types of CAS coverage. The rules for determining the applicable type of CAS coverage are in 9903.201-2.

(b) The following categories of contracts and subcontracts are exempt from all CAS requirements:

(1) Sealed bid contracts.

(2) Negotiated contracts and subcontracts not in excess of the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C. 1502(b)(1)(B)). For purposes of this paragraph (b)(2), an order issued by one segment to another segment shall be treated as a subcontract.

(3) Contracts and subcontracts with small businesses.

(4) Contracts and subcontracts with foreign governments or their agents or instrumentalities or, insofar as the requirements of CAS other than 9904.401 and 9904.402 are concerned, any contract or subcontract awarded to a foreign concern.

(5) Contracts and subcontracts in which the price is set by law or regulation.

(6) Contracts and subcontracts authorized in 48 CFR 12.207 for the acquisition of commercial items.

(7) Contracts or subcontracts of less than $7.5 million, provided that, at the time of award, the business unit of the contractor or subcontractor is not currently performing any CAS-covered contracts or subcontracts valued at $7.5 million or greater.

(8)-(12) [Reserved]

(13) Subcontractors under the NATO PHM Ship program to be performed outside the United States by a foreign concern.

(14) [Reserved]

(15) Firm-fixed-price contracts or subcontracts awarded on the basis of adequate price competition without submission of certified cost or pricing data.

9903.201-2 Types of CAS coverage.

(a) Full coverage. Full coverage requires that the business unit comply with all of the CAS specified in part 9904 that are in effect on the date of the contract award and with any CAS that become applicable because of later award of a CAS-covered contract. Full coverage applies to contractor business units that -

(1) Receive a single CAS-covered contract award of $50 million or more; or

(2) Received $50 million or more in net CAS-covered awards during its preceding cost accounting period.

(b) Modified coverage.

(1) Modified CAS coverage requires only that the contractor comply with Standard 9904.401, Consistency in Estimating, Accumulating, and Reporting Costs, Standard 9904.402, Consistency in Allocating Costs Incurred for the Same Purpose, Standard 9904.405, Accounting for Unallowable Costs and Standard 9904.406, Cost Accounting Standard - Cost Accounting Period. Modified, rather, than full, CAS coverage may be applied to a covered contract of less than $50 million awarded to a business unit that received less than $50 million in net CAS-covered awards in the immediately preceding cost accounting period.

(2) If any one contract is awarded with modified CAS coverage, all CAS-covered contracts awarded to that business unit during that cost accounting period must also have modified coverage with the following exception: if the business unit receives a single CAS-covered contract award of $50 million or more, that contract must be subject to full CAS coverage. Thereafter, any covered contract awarded in the same cost accounting period must also be subject to full CAS coverage.

(3) A contract awarded with modified CAS coverage shall remain subject to such coverage throughout its life regardless of changes in the business unit's CAS status during subsequent cost accounting periods.

(c) Coverage for educational institutions -

(1) Regulatory requirements. Parts 9903 and 9905 apply to educational institutions except as otherwise provided in this paragraph (c) and at 9903.202-1(f).

(2) Definitions.

(i) The following term is prominent in parts 9903 and 9905. Other terms defined elsewhere in this chapter 99 shall have the meanings ascribed to them in those definitions unless paragraph (c)(2)(ii) of this subsection below requires otherwise.

Educational institution means a public or nonprofit institution of higher education, e.g., an accredited college or university, as defined in section 1201(a) of Public Law 89-329, November 8, 1965, Higher Education Act of 1965; (20 U.S.C. 1141(a)).

(ii) The following modifications of terms defined elsewhere in this chapter 99 are applicable to educational institutions:

Business unit means any segment of an educational institution, or an entire educational institution which is not divided into segments.

Segment means one of two or more divisions, campus locations, or other subdivisions of an educational institution that operate as independent organizational entities under the auspices of the parent educational institution and report directly to an intermediary group office or the governing central system office of the parent educational institution. Two schools of instruction operating under one division, campus location or other subdivision would not be separate segments unless they follow different cost accounting practices, for example, the School of Engineering should not be treated as a separate segment from the School of Humanities if they both are part of the same division's cost accounting system and are subject to the same cost accounting practices. The term includes Government-owned contractor-operated (GOCO) facilities, Federally Funded Research and Developments Centers (FFRDCs), and joint ventures and subsidiaries (domestic and foreign) in which the institution has a majority ownership. The term also includes those joint ventures and subsidiaries (domestic and foreign) in which the institution has less than a majority of ownership, but over which it exercises control.

(3) Applicable standards. Coverage for educational institutions requires that the business unit comply with all of the CAS specified in part 9905 that are in effect on the date of the contract award and with any CAS that become applicable because of later award of a CAS-covered contract. This coverage applies to business units that receive negotiated contracts in excess of the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C. 1502(b)(1)(B)), except for CAS-covered contracts awarded to FFRDCs operated by an educational institution.

(4) FFRDCs. Negotiated contracts awarded to an FFRDC operated by an educational institution are subject to the full or modified CAS coverage prescribed in paragraphs (a) and (b) of this subsection. CAS-covered FFRDC contracts shall be excluded from the institution's universe of contracts when determining CAS applicability and disclosure requirements for contracts other than those to be performed by the FFRDC.

(5) Contract clauses. The contract clause at 9903.201-4(e) shall be incorporated in each negotiated contract and subcontract awarded to an educational institution when the negotiated contract or subcontract price exceeds the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C. 1502(b)(1)(B)). For CAS-covered contracts awarded to an FFRDC operated by an educational institution, however, the full or modified CAS contract clause specified at 9903.201-4(a) or (c), as applicable, shall be incorporated.

(6) Continuity in fully CAS-covered contracts. Where existing contracts awarded to an educational institution incorporate full CAS coverage, the contracting officer may continue to apply full CAS coverage, as prescribed at 9903.201-2(a), in future awards made to that educational institution.

(d) Subcontracts. Subcontract awards subject to CAS require the same type of CAS coverage as would prime contracts awarded to the same business unit. In measuring total net CAS-covered awards for a year, a transfer by one segment to another shall be deemed to be a subcontract award by the transferor.

(e) Foreign concerns. Contracts with foreign concerns subject to CAS shall only be subject to Standard 9904.401, Consistency in Estimating, Accumulating, and Reporting Costs, and Standard 9904.402, Consistency in Allocating Costs Incurred for the Same Purpose.

9903.201-3 Solicitation provisions.

(a) Cost Accounting Standards Notices and Certification.

(1) The contracting officer shall insert the provision set forth below, Cost Accounting Standards Notices and Certification, in solicitations for proposed contracts subject to CAS as specified in 9903.201. The provision allows offerors to -

(i) Certify their Disclosure Statement status;

(ii) [Reserved]

(iii) Claim exemption from full CAS coverage and elect modified CAS coverage when appropriate; and

(iv) Certify whether award of the contemplated contract would require a change to existing cost accounting practices.

(2) If an award to an educational institution is contemplated prior to July 1, 1997, the contracting officer shall use the basic provision set forth below with its Alternate I, unless the contract is to be performed by an FFRDC (see 9903.201(c)(5)), or the provision at 9903.201(c)(6) applies.

Cost Accounting Standards Notices and Certification (JUL 2011)

Note:

This notice does not apply to small businesses or foreign governments.

This notice is in three parts, identified by Roman numerals I through III.

Offerors shall examine each part and provide the requested information in order to determine Cost Accounting Standards (CAS) requirements applicable to any resultant contract.

If the offeror is an educational institution, Part II does not apply unless the contemplated contract will be subject to full or modified CAS-coverage pursuant to 9903.201-2(c)(5) or 9903.201-2(c)(6).

I. Disclosure Statement - Cost Accounting Practices and Certifications

(a) Any contract in excess of the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C. 1502(b)(1)(B)), resulting from this solicitation, except for those contracts which are exempt as specified in 9903.201-1.

(b) Any offeror submitting a proposal which, if accepted, will result in a contract subject to the requirements of 48 CFR, chapter 99 must, as a condition of contracting, submit a Disclosure Statement as required by 9903.202. When required, the Disclosure Statement must be submitted as a part of the offeror's proposal under this solicitation unless the offeror has already submitted a Disclosure Statement disclosing the practices used in connection with the pricing of this proposal. If an applicable Disclosure Statement has already been submitted, the offeror may satisfy the requirement for submission by providing the information requested in paragraph (c) of Part I of this provision.

Caution: In the absence of specific regulations or agreement, a practice disclosed in a Disclosure Statement shall not, by virtue of such disclosure, be deemed to be a proper, approved, or agreed-to-practice for pricing proposals or accumulating and reporting contract performance cost data.

(c) Check the appropriate box below:

□ (1) Certificate of Concurrent Submission of Disclosure Statement.

The offeror hereby certifies that, as a part of the offer, copies of the Disclosure Statement have been submitted as follows: (i) Original and one copy to the cognizant Administrative Contracting Officer (ACO) or cognizant Federal agency official authorized to act in that capacity, as applicable, and (ii) one copy to the cognizant Federal auditor.

(Disclosure must be on Form No. CASB DS-1 or CASB DS-2, as applicable. Forms may be obtained from the cognizant ACO or cognizant Federal agency official acting in that capacity and/or from the looseleaf version of the Federal Acquisition Regulation.)

Date of Disclosure Statement:

Name and Address of Cognizant ACO or Federal Official where filed:

The offeror further certifies that the practices used in estimating costs in pricing this proposal are consistent with the cost accounting practices disclosed in the Disclosure Statement.

□ (2) Certificate of Previously Submitted Disclosure Statement. The offeror hereby certifies that the required Disclosure Statement was filed as follows:

Date of Disclosure Statement:

Name and Address of Cognizant ACO or Federal Official where filed:

The offeror further certifies that the practices used in estimating costs in pricing this proposal are consistent with the cost accounting practices disclosed in the applicable Disclosure Statement.

□ (3) Certificate of Monetary Exemption.

The offeror hereby certifies that the offeror, together with all divisions, subsidiaries, and affiliates under common control, did not receive net awards of negotiated prime contracts and subcontracts subject to CAS totaling $50 million or more in the cost accounting period immediately preceding the period in which this proposal was submitted.

The offeror further certifies that if such status changes before an award resulting from this proposal, the offeror will advise the Contracting Officer immediately.

□ (4) Certificate of Interim Exemption.

The offeror hereby certifies that (i) the offeror first exceeded the monetary exemption for disclosure, as defined in (3) above, in the cost accounting period immediately preceding the period in which this offer was submitted and (ii) in accordance with 9903.202-1, the offeror is not yet required to submit a Disclosure Statement. The offeror further certifies that if an award resulting from this proposal has not been made within 90 days after the end of that period, the offeror will immediately submit a revised certificate to the Contracting Officer, in the form specified under subparagraph (c)(1) or (c)(2) of Part I of this provision, as appropriate, to verify submission of a completed Disclosure Statement.

CAUTION: Offerors currently required to disclose because they were awarded a CAS-covered prime contract or subcontract of $50 million or more in the current cost accounting period may not claim this exemption (4). Further, the exemption applies only in connection with proposals submitted before expiration of the 90-day period following the cost accounting period in which the monetary exemption was exceeded.

II. Cost Accounting Standards - Eligibility for Modified Contact Coverage

If the offeror is eligible to use the modified provisions of 9903.201-2(b) and elects to do so, the offeror shall indicate by checking the box below. Checking the box below shall mean that the resultant contract is subject to the Disclosure and Consistency of Cost Accounting Practices clause in lieu of the Cost Accounting Standards clause.

□ The offeror hereby claims an exemption from the Cost Accounting Standards clause under the provisions of 9903.201-2(b) and certifies that the offeror is eligible for use of the Disclosure and Consistency of Cost Accounting Practices clause because during the cost accounting period immediately preceding the period in which this proposal was submitted, the offeror received less than $50 million in awards of CAS-covered prime contracts and subcontracts. The offeror further certifies that if such status changes before an award resulting from this proposal, the offeror will advise the Contracting Officer immediately.

CAUTION: An offeror may not claim the above eligibility for modified contract coverage if this proposal is expected to result in the award of a CAS-covered contract of $50 million or more or if, during its current cost accounting period, the offeror has been awarded a single CAS-covered prime contract or subcontract of $50 million or more.

III. Additional Cost Accounting Standards Applicable to Existing Contracts

The offeror shall indicate below whether award of the contemplated contract would, in accordance with subparagraph (a)(3) of the Cost Accounting Standards clause, require a change in established cost accounting practices affecting existing contracts and subcontracts.

□ Yes □ No

(End of provision)

Alternate I (OCT 1994). Insert the following subparagraph (5) at the end of Part I of the basic clause:

□ (5) Certificate of Disclosure Statement Due Date by Educational Institution. If the offeror is an educational institution that, under the transition provisions of 9903.202-1(f), is or will be required to submit a Disclosure Statement after receipt of this award, the offeror hereby certifies that (check one and complete):

□ (a) A Disclosure Statement filing Due Date of ______ has been established with the cognizant Federal agency.

□ (b) The Disclosure Statement will be submitted within the six month period ending ______ months after receipt of this award.

Name and Address of Cognizant ACO or Federal Official where Disclosure Statement is to be filed:

(End of Alternate I)

9903.201-4 Contract clauses.

(a) Cost Accounting Standards.

(1) The contracting officer shall insert the clause set forth below, Cost Accounting Standards, in negotiated contracts, unless the contract is exempted (see 9903.201-1), the contract is subject to modified coverage (see 9903.201-2), or the clause prescribed in paragraph (e) of this section is used.

(2) The clause below requires the contractor to comply with all CAS specified in part 9904, to disclose actual cost accounting practices (applicable to CAS-covered contracts only), and to follow disclosed and established cost accounting practices consistently.

Cost Accounting Standards (JUL 2011)

(a) Unless the contract is exempt under 9903.201-1 and 9903.201-2, the provisions of 9903 are incorporated herein by reference and the Contractor in connection with this contract, shall -

(1) (CAS-covered Contracts Only) By submission of a Disclosure Statement, disclosed in writing the Contractor's cost accounting practices as required by 9903.202-1 through 9903.202-5 including methods of distinguishing direct costs from indirect costs and the basis used for allocating indirect costs. The practices disclosed for this contract shall be the same as the practices currently disclosed and applied on all other contracts and subcontracts being performed by the Contractor and which contain a Cost Accounting Standards (CAS) clause. If the Contractor has notified the Contracting Officer that the Disclosure Statement contains trade secrets, and commercial or financial information which is privileged and confidential, the Disclosure Statement shall be protected and shall not be released outside of the Government.

(2) Follow consistently the Contractor's cost accounting practices in accumulating and reporting contract performance cost data concerning this contract. If any change in cost accounting practices is made for the purposes of any contract or subcontract subject to CAS requirements, the change must be applied prospectively to this contract and the Disclosure Statement must be amended accordingly. If the contract price or cost allowance of this contract is affected by such changes, adjustment shall be made in accordance with subparagraph (a)(4) or (a)(5) of this clause, as appropriate.

(3) Comply with all CAS, including any modifications and interpretations indicated thereto contained in part 9904, in effect on the date of award of this contract or, if the Contractor has submitted cost or pricing data, on the date of final agreement on price as shown on the Contractor's signed certificate of current cost or pricing data. The Contractor shall also comply with any CAS (or modifications to CAS) which hereafter become applicable to a contract or subcontract of the Contractor. Such compliance shall be required prospectively from the date of applicability of such contract or subcontract.

(4)

(i) Agree to an equitable adjustment as provided in the Changes clause of this contract if the contract cost is affected by a change which, pursuant to subparagraph (a)(3) of this clause, the Contractor is required to make to the Contractor's established cost accounting practices.

(ii) Negotiate with the Contracting Officer to determine the terms and conditions under which a change may be made to a cost accounting practice, other than a change made under other provisions of subparagraph (a)(4) of this clause; provided that no agreement may be made under this provision that will increase costs paid by the United States.

(iii) When the parties agree to a change to a cost accounting practice, other than a change under subdivision (a)(4)(i) of this clause, negotiate an equitable adjustment as provided in the Changes clause of this contract.

(5) Agree to an adjustment of the contract price or cost allowance, as appropriate, if the Contractor or a subcontractor fails to comply with an applicable Cost Accounting Standard, or to follow any cost accounting practice consistently and such failure results in any increased costs paid by the United States. Such adjustment shall provide for recovery of the increased costs to the United States, together with interest thereon computed at the annual rate established under section 6621(a)(2) of the Internal Revenue Code of 1986 (26 U.S.C. 6621(a)(2)) for such period, from the time the payment by the United States was made to the time the adjustment is effected. In no case shall the Government recover costs greater than the increased cost to the Government, in the aggregate, on the relevant contracts subject to the price adjustment, unless the Contractor made a change in its cost accounting practices of which it was aware or should have been aware at the time of price negotiations and which it failed to disclose to the Government.

(b) If the parties fail to agree whether the Contractor or a subcontractor has complied with an applicable CAS in part 9904 or a CAS rule or regulation in part 9903 and as to any cost adjustment demanded by the United States, such failure to agree will constitute a dispute under the Contract Disputes Act (41 U.S.C. 601).

(c) The Contractor shall permit any authorized representatives of the Government to examine and make copies of any documents, papers, or records relating to compliance with the requirements of this clause.

(d) The contractor shall include in all negotiated subcontracts which the Contractor enters into, the substance of this clause, except paragraph (b), and shall require such inclusion in all other subcontracts, of any tier, including the obligation to comply with all CAS in effect on the subcontractor's award date or if the subcontractor has submitted cost or pricing data, on the date of final agreement on price as shown on the subcontractor's signed Certificate of Current Cost or Pricing Data. If the subcontract is awarded to a business unit which pursuant to 9903.201-2 is subject to other types of CAS coverage, the substance of the applicable clause set forth in 9903.201-4 shall be inserted. This requirement shall apply only to negotiated subcontracts in excess of the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C. 1502(b)(1)(B)), except that the requirement shall not apply to negotiated subcontracts otherwise exempt from the requirement to include a CAS clause as specified in 9903.201-1.

(End of clause)

(b) [Reserved]

(c) Disclosure and Consistency of Cost Accounting Practices.

(1) The contracting officer shall insert the clause set forth below, Disclosure and Consistency of Cost Accounting Practices, in negotiated contracts when the contract amount is over the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C. 1502(b)(1)(B)), but less than $50 million, and the offeror certifies it is eligible for and elects to use modified CAS coverage (see 9903.201-2, unless the clause prescribed in paragraph (d) of this subsection is used).

(2) The clause below requires the contractor to comply with CAS 9904.401, 9904.402, 9904.405, and 9904.406, to disclose (if it meets certain requirements) actual cost accounting practices, and to follow consistently disclosed and established cost accounting practices.

Disclosure and Consistency of Cost Accounting Practices (JUL 2011)

(a) The Contractor, in connection with this contract, shall -

(1) Comply with the requirements of 9904.401, Consistency in Estimating, Accumulating, and Reporting Costs; 9904.402, Consistency in Allocating Costs Incurred for the Same Purpose; 9904.405, Accounting for Unallowable Costs; and 9904.406, Cost Accounting Standard - Cost Accounting Period, in effect on the date of award of this contract, as indicated in part 9904.

(2) (CAS-covered Contracts Only) If it is a business unit of a company required to submit a Disclosure Statement, disclose in writing its cost accounting practices as required by 9903.202-1 through 9903.202-5. If the Contractor has notified the Contracting Officer that the Disclosure Statement contains trade secrets and commercial or financial information which is privileged and confidential, the Disclosure Statement shall be protected and shall not be released outside of the Government.

(3)

(i) Follow consistently the Contractor's cost accounting practices. A change to such practices may be proposed, however, by either the Government or the Contractor, and the Contractor agrees to negotiate with the Contracting Officer the terms and conditions under which a change may be made. After the terms and conditions under which the change is to be made have been agreed to, the change must be applied prospectively to this contract, and the Disclosure Statement, if affected, must be amended accordingly.

(ii) The Contractor shall, when the parties agree to a change to a cost accounting practice and the Contracting Officer has made the finding required in 9903.201-6(c) that the change is desirable and not detrimental to the interests of the Government, negotiate an equitable adjustment as provided in the Changes clause of this contract. In the absence of the required finding, no agreement may be made under this contract clause that will increase costs paid by the United States.

(4) Agree to an adjustment of the contract price or cost allowance, as appropriate, if the Contractor or a subcontractor fails to comply with the applicable CAS or to follow any cost accounting practice, and such failure results in any increased costs paid by the United States. Such adjustment shall provide for recovery of the increased costs to the United States, together with interest thereon computed at the annual rate established under section 6621(a)(2) of the Internal Revenue Code of 1986 (26 U.S.C. 6621(a)(2)) for such period, from the time the payment by the United States was made to the time the adjustment is effected.

(b) If the parties fail to agree whether the Contractor has complied with an applicable CAS rule, or regulation as specified in parts 9903 and 9904 and as to any cost adjustment demanded by the United States, such failure to agree will constitute a dispute under the Contract Disputes Act (41 U.S.C. 601).

(c) The Contractor shall permit any authorized representatives of the Government to examine and make copies of any documents, papers, and records relating to compliance with the requirements of this clause.

(d) The Contractor shall include in all negotiated subcontracts, which the Contractor enters into, the substance of this clause, except paragraph (b), and shall require such inclusion in all other subcontracts of any tier, except that -

(1) If the subcontract is awarded to a business unit which pursuant to 9903.201-2 is subject to other types of CAS coverage, the substance of the applicable clause set forth in 9903.201-4 shall be inserted.

(2) This requirement shall apply only to negotiated subcontracts in excess of the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C. 1502(b)(1)(B)).

(3) The requirement shall not apply to negotiated subcontracts otherwise exempt from the requirement to include a CAS clause as specified in 9903.201-1.

(End of clause)

(d) [Reserved]

(e) Cost Accounting Standards - Educational Institutions.

(1) The contracting officer shall insert the clause set forth below, Cost Accounting Standards - Educational Institution, in negotiated contracts awarded to educational institutions, unless the contract is exempted (see 9903.201-1), the contract is to be performed by an FFRDC (see 9903.201-2(c)(5)), or the provision at 9903.201-2(c)(6) applies.

(2) The clause below requires the educational institution to comply with all CAS specified in part 9905, to disclose actual cost accounting practices as required by 9903.202-1(f), and to follow disclosed and established cost accounting practices consistently.

Cost Accounting Standards - Educational Institutions (JUL 2011)

(a) Unless the contract is exempt under 9903.201-1 and 9903.201-2, the provisions of part 9903 are incorporated herein by reference and the Contractor in connection with this contract, shall -

(1) (CAS-covered Contracts Only) If a business unit of an educational institution required to submit a Disclosure Statement, disclose in writing the Contractor's cost accounting practices as required by 9903.202-1 through 9903.202-5 including methods of distinguishing direct costs from indirect costs and the basis used for accumulating and allocating indirect costs. The practices disclosed for this contract shall be the same as the practices currently disclosed and applied on all other contracts and subcontracts being performed by the Contractor and which contain a Cost Accounting Standards (CAS) clause. If the Contractor has notified the Contracting Officer that the Disclosure Statement contains trade secrets, and commercial or financial information which is privileged and confidential, the Disclosure Statement shall be protected and shall not be released outside of the Government.

(2) Follow consistently the Contractor's cost accounting practices in accumulating and reporting contract performance cost data concerning this contract. If any change in cost accounting practices is made for the purposes of any contract or subcontract subject to CAS requirements, the change must be applied prospectively to this contract and the Disclosure Statement, if required, must be amended accordingly. If an accounting principle change mandated under Office of Management and Budget (OMB) Circular A-21, Cost Principles for Educational Institutions, requires that a change in the Contractor's cost accounting practices be made after the date of this contract award, the change must be applied prospectively to this contract and the Disclosure Statement, if required, must be amended accordingly. If the contract price or cost allowance of this contract is affected by such changes, adjustment shall be made in accordance with subparagraph (a)(4) or (a)(5) of this clause, as appropriate.

(3) Comply with all CAS, including any modifications and interpretations indicated thereto contained in 48 CFR part 9905, in effect on the date of award of this contract or, if the Contractor has submitted cost or pricing data, on the date of final agreement on price as shown on the Contractor's signed certificate of current cost or pricing data. The Contractor shall also comply with any CAS (or modifications to CAS) which hereafter become applicable to a contract or subcontract of the Contractor. Such compliance shall be required prospectively from the date of applicability to such contract or subcontract.

(4)

(i) Agree to an equitable adjustment as provided in the Changes clause of this contract if the contract cost is affected by a change which, pursuant to subparagraph (a)(3) of this clause, the Contractor is required to make to the Contractor's established cost accounting practices.

(ii) Negotiate with the Contracting Officer to determine the terms and conditions under which a change may be made to a cost accounting practice, other than a change made under other provisions of subparagraph (a)(4) of this clause; provided that no agreement may be made under this provision that will increase costs paid by the United States.

(iii) When the parties agree to a change to a cost accounting practice, other than a change under subdivision (a)(4)(i) or (a)(4)(iv) of this clause, negotiate an equitable adjustment as provided in the Changes clause of this contract.

(iv) Agree to an equitable adjustment as provided in the Changes clause of this contract, if the contract cost is materially affected by an OMB Circular A-21 accounting principle amendment which, on becoming effective after the date of contract award, requires the Contractor to make a change to the Contractor's established cost accounting practices.

(5) Agree to an adjustment of the contract price or cost allowance, as appropriate, if the Contractor or a subcontractor fails to comply with an applicable Cost Accounting Standard, or to follow any cost accounting practice consistently and such failure results in any increased costs paid by the United States. Such adjustment shall provide for recovery of the increased costs to the United States, together with interest thereon computed at the annual rate established under section 6621(a)(2) of the Internal Revenue Code of 1986 (26 U.S.C. 6621(a)(2)) for such period, from the time the payment by the United States was made to the time the adjustment is effected. In no case shall the Government recover costs greater than the increased cost to the Government, in the aggregate, on the relevant contracts subject to the price adjustment, unless the Contractor made a change in its cost accounting practices of which it was aware or should have been aware at the time of price negotiations and which it failed to disclose to the Government.

(b) If the parties fail to agree whether the Contractor or a subcontractor has complied with an applicable CAS or a CAS rule or regulation in 9903 and as to any cost adjustment demanded by the United States, such failure to agree will constitute a dispute under the Contract Disputes Act (41 U.S.C. 601).

(c) The Contractor shall permit any authorized representatives of the Government to examine and make copies of any documents, papers, or records relating to compliance with the requirements of this clause.

(d) The Contractor shall include in all negotiated subcontracts which the Contractor enters into, the substance of this clause, except paragraph (b), and shall require such inclusion in all other subcontracts, of any tier, including the obligation to comply with all applicable CAS in effect on the subcontractor's award date or if the subcontractor has submitted cost or pricing data, on the date of final agreement on price as shown on the subcontractor's signed Certificate of Current Cost or Pricing Data, except that -

(1) If the subcontract is awarded to a business unit which pursuant to 9903.201-2 is subject to other types of CAS coverage, the substance of the applicable clause set forth in 9903.201-4 shall be inserted; and

(2) This requirement shall apply only to negotiated subcontracts in excess of the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C 1502(b)(1)B)).

(3) The requirement shall not apply to negotiated subcontracts otherwise exempt from the requirement to include a CAS clause as specified in 9903.201-1.

(End of clause)

(f) Disclosure and Consistency of Cost Accounting Practices - Foreign Concerns.

(1) The contracting officer shall insert the clause set forth below, Disclosure and Consistency of Cost Accounting Practices - Foreign Concerns, in negotiated contracts when the contract is with a foreign concern and the contract is not otherwise exempt under 9903.201-1 (see 9903.201-2(e)).

(2) The clause below requires the contractor to comply with 9904.401 and 9904.402, to disclose (if it meets certain requirements) actual cost accounting practices, and to follow consistently disclosed and established cost accounting practices.

Disclosure and Consistency of Cost Accounting Practices - Foreign Concerns (JUL 2011)

(a) The Contractor, in connection with this contract, shall -

(1) Comply with the requirements of 9904.401, Consistency in Estimating, Accumulating, and Reporting Costs; and 9904.402, Consistency in Allocating Costs Incurred for the Same Purpose, in effect on the date of award of this contract, as indicated in part 9904.

(2) (CAS-covered Contracts Only) If it is a business unit of a company required to submit a Disclosure Statement, disclose in writing its cost accounting practices as required by 9903.202-1 through 9903.202-5. If the Contractor has notified the Contracting Officer that the Disclosure Statement contains trade secrets and commercial or financial information which is privileged and confidential, the Disclosure Statement shall be protected and shall not be released outside of the Government.

(3)

(i) Follow consistently the Contractor's cost accounting practices. A change to such practices may be proposed, however, by either the Government or the Contractor, and the Contractor agrees to negotiate with the Contracting Officer the terms and conditions under which a change may be made. After the terms and conditions under which the change is to be made have been agreed to, the change must be applied prospectively to this contract, and the Disclosure Statement, if affected, must be amended accordingly.

(ii) The Contractor shall, when the parties agree to a change to a cost accounting practice and the Contracting Officer has made the finding required in 9903.201-6(c) that the change is desirable and not detrimental to the interests of the Government, negotiate an equitable adjustment as provided in the Changes clause of this contract. In the absence of the required finding, no agreement may be made under this contract clause that will increase costs paid by the United States.

(4) Agree to an adjustment of the contract price or cost allowance, as appropriate, if the Contractor or a subcontractor fails to comply with the applicable CAS or to follow any cost accounting practice, and such failure results in any increased costs paid by the United States. Such adjustment shall provide for recovery of the increased costs to the United States, together with interest thereon computed at the annual rate established under section 6621(a)(2) of the Internal Revenue Code of 1986 (26 U.S.C. 6621(a)(2)) for such period, from the time the payment by the United States was made to the time the adjustment is effected.

(b) If the parties fail to agree whether the Contractor has complied with an applicable CAS rule, or regulation as specified in parts 9903 and 9904 and as to any cost adjustment demanded by the United States, such failure to agree will constitute a dispute under the Contract Disputes Act (41 U.S.C. 601).

(c) The Contractor shall permit any authorized representatives of the Government to examine and make copies of any documents, papers, and records relating to compliance with the requirements of this clause.

(d) The Contractor shall include in all negotiated subcontracts, which the Contractor enters into, the substance of this clause, except paragraph (b), and shall require such inclusion in all other subcontracts of any tier, except that -

(1) If the subcontract is awarded to a business unit which pursuant to 9903.201-2 is subject to other types of CAS coverage, the substance of the applicable clause set forth in 9903.201-4 shall be inserted.

(2) This requirement shall apply only to negotiated subcontracts in excess of the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C. 1502(b)(1)

(3) The requirement shall not apply to negotiated subcontracts otherwise exempt from the requirement to include a CAS clause as specified in 9903.201-1.

(End of clause)

9903.201-5 Waiver.

(a) The head of an executive agency may waive the applicability of the Cost Accounting Standards for a contract or subcontract with a value of less than $15 million, if that official determines, in writing, that the business unit of the contractor or subcontractor that will perform the work -

(1) Is primarily engaged in the sale of commercial items; and

(2) Would not otherwise be subject to the Cost Accounting Standards under this Chapter.

(b) The head of an executive agency may waive the applicability of the Cost Accounting Standards for a contract or subcontract under exceptional circumstances when necessary to meet the needs of the agency. A determination to waive the applicability of the Cost Accounting Standards by the agency head shall be set forth in writing, and shall include a statement of the circumstances justifying the waiver.

(c) The head of an executive agency may not delegate the authority under paragraphs (a) and (b) of this section, to any official below the senior policymaking level in the agency.

(d) The head of each executive agency shall report the waivers granted under paragraphs (a) and (b) of this section, for that agency, to the Cost Accounting Standards Board, on an annual basis, not later than 90 days after the close of the Government's fiscal year.

(e) Upon request of an agency head or his designee, the Cost Accounting Standards Board may waive all or any part of the requirements of 9903.201-4(a), Cost Accounting Standards, or 9903.201-4(c), Disclosure and Consistency of Cost Accounting Practices, with respect to a contract subject to the Cost Accounting Standards. Any request for a waiver shall describe the proposed contract or subcontract for which the waiver is sought and shall contain -

(1) An unequivocal statement that the proposed contractor or subcontractor refuses to accept a contract containing all or a specified part of a CAS clause and the specific reason for that refusal;

(2) A statement as to whether the proposed contractor or subcontractor has accepted any prime contract or subcontract containing a CAS clause;

(3) The amount of the proposed award and the sum of all awards by the agency requesting the waiver to the proposed contractor or subcontractor in each of the preceding 3 years;

(4) A statement that no other source is available to satisfy the agency's needs on a timely basis;

(5) A statement of alternative methods considered for fulfilling the need and the agency's reasons for rejecting them;

(6) A statement of steps being taken by the agency to establish other sources of supply for future contracts for the products or services for which a waiver is being requested; and

(7) Any other information that may be useful in evaluating the request.

(f) Except as provided by the Cost Accounting Standards Board, the authority in paragraph (e) of this section shall not be delegated.

9903.201-6 Findings.

(a) Required change -

(1) Finding. Prior to making any equitable adjustment under the provisions of paragraph (a)(4)(i) of the contract clause set forth in 9903.201-4(a) or 9903.201-4(e), or paragraph (a)(3)(i) of the contract clause set forth in 9903.201-4(c), the Contracting Officer shall make a finding that the practice change was required to comply with a CAS, modification or interpretation thereof, that subsequently became applicable to the contract; or, for planned changes being made in order to remain CAS compliant, that the former practice was in compliance with applicable CAS and the planned change is necessary for the contractor to remain in compliance.

(2) Required change means a change in cost accounting practice that a contractor is required to make in order to comply with applicable Standards, modifications, or interpretations thereto, that subsequently become applicable to an existing CAS-covered contract due to the receipt of another CAS-covered contract or subcontract. It also includes a prospective change to a disclosed or established cost accounting practice when the cognizant Federal agency official determines that the former practice was in compliance with applicable CAS and the change is necessary for the contractor to remain in compliance.

(b) Unilateral change -

(1) Findings. Prior to making any contract price or cost adjustment(s) under the change provisions of paragraph (a)(4)(ii) of the contract clause set forth in 9903.201-4(a) or 9903.201-4(e), or paragraph (a)(3)(ii) of the contract clause set forth in 9903.201-4(c), the Contracting Officer shall make a finding that the contemplated contract price and cost adjustments will protect the United States from payment of increased costs, in the aggregate; and that the net effect of the adjustments being made does not result in the recovery of more than the estimated amount of such increased costs.

(2) Unilateral change by a contractor means a change in cost accounting practice from one compliant practice to another compliant practice that a contractor with a CAS-covered contract(s) elects to make that has not been deemed desirable by the cognizant Federal agency official and for which the Government will pay no aggregate increased costs.

(3) Action to preclude the payment of aggregate increased costs by the Government. In the absence of a finding pursuant to paragraph (c) of this subsection that a compliant change is desirable, no agreement may be made with regard to a change to a cost accounting practice that will result in the payment of aggregate increased costs by the United States. For these changes, the cognizant Federal agency official shall limit upward contract price adjustments to affected contracts to the amount of downward contract price adjustments of other affected contracts, i.e., no net upward contract price adjustment shall be permitted.

(c) Desirable change -

(1) Finding. Prior to making any equitable adjustment under the provisions of paragraph (a)(4)(iii) of the contract clause set forth in 9903.201-4(a) or 9903.201-4(e), or paragraph (a)(3)(ii) of the contract clause set forth in 9903.201-4(c), the cognizant Federal agency official shall make a finding that the change to a cost accounting practice is desirable and not detrimental to the interests of the Government.

(2) Desirable change means a compliant change to a contractor's established or disclosed cost accounting practices that the cognizant Federal agency official finds is desirable and not detrimental to the Government and is therefore not subject to the no increased cost prohibition provisions of CAS-covered contracts affected by the change. The cognizant Federal agency official's finding need not be based solely on the cost impact that a proposed practice change will have on a contractor's or subcontractor's current CAS-covered contracts. The change to a cost accounting practice may be determined to be desirable even though existing contract prices and/or cost allowances may increase. The determination that the change to a cost accounting practice is desirable, should be made on a case-by-case basis.

(3) Once a determination has been made that a compliant change to a cost accounting practice is a desirable change, associated management actions that also have an impact on contract costs should be considered when negotiating contract price or cost adjustments that may be needed to equitably resolve the overall cost impact of the aggregated actions.

(4) Until the cognizant Federal agency official has determined that a change to a cost accounting practice is deemed to be a desirable change, the change shall be considered to be a change for which the Government will not pay increased costs, in the aggregate.

(d) Noncompliant cost accounting practices -

(1) Findings. Prior to making any contract price or cost adjustment(s) under the provisions of paragraph (a)(5) of the contract clause set forth in 9903.201-4(a) or 9903.201-4(e), or paragraph (a)(4) of the contract clause set forth in 9903.201-4(c), the Contracting Officer shall make a finding that the contemplated contract price and cost adjustments will protect the United States from payment of increased costs, in the aggregate; and that the net effect of the adjustments being made does not result in the recovery of more than the estimated amount of such increased costs. While individual contract prices, including cost ceilings or target costs, as applicable, may be increased as well as decreased to resolve an estimating noncompliance, the aggregate value of all contracts affected by the estimating noncompliance shall not be increased.

9903.201-7 Cognizant Federal agency responsibilities.

(a) The requirements of part 9903 shall, to the maximum extent practicable, be administered by the cognizant Federal agency responsible for a particular contractor organization or location, usually the Federal agency responsible for negotiating indirect cost rates on behalf of the Government. The cognizant Federal agency should take the lead role in administering the requirements of part 9903 and coordinating CAS administrative actions with all affected Federal agencies. When multiple CAS-covered contracts or more than one Federal agency are involved, agencies should discourage Contracting Officers from individually administering CAS on a contract-by-contract basis. Coordinated administrative actions will provide greater assurances that individual contractors follow their cost accounting practices consistently under all their CAS-covered contracts and that changes in cost accounting practices or CAS noncompliance issues are resolved, equitably, in a uniform overall manner.

(b) Federal agencies shall prescribe regulations and establish internal policies and procedures governing how agencies will administer the requirements of CAS-covered contracts, with particular emphasis on inter-agency coordination activities. Procedures to be followed when an agency is and is not the cognizant Federal agency should be clearly delineated. Internal agency policies and procedures shall provide for the designation of the agency office(s) or officials responsible for administering CAS under the agency's CAS-covered contracts at each contractor business unit and the delegation of necessary contracting authority to agency individuals authorized to administer the terms and conditions of CAS-covered contracts, e.g., Administrative Contracting Officers (ACOs) or other agency officials authorized to perform in that capacity. Agencies are urged to coordinate on the development of such regulations.

9903.201-8 Compliant accounting changes due to external restructuring activities.

The contract price and cost adjustment requirements of this part 9903 are not applicable to compliant cost accounting practice changes directly associated with external restructuring activities that are subject to and meet the requirements of 10 U.S.C. 2325.

9903.202 Disclosure requirements.

9903.202-1 General requirements.

(a) A Disclosure Statement is a written description of a contractor's cost accounting practices and procedures. The submission of a new or revised Disclosure Statement is not required for any non-CAS-covered contract or from any small business concern.

(b) Completed Disclosure Statements are required in the following circumstances:

(1) Any business unit that is selected to receive a CAS-covered contract or subcontract of $50 million or more shall submit a Disclosure Statement before award.

(2) Any company which, together with its segments, received net awards of negotiated prime contracts and subcontracts subject to CAS totaling $50 million or more in its most recent cost accounting period, must submit a Disclosure Statement before award of its first CAS-covered contract in the immediately following cost accounting period. However, if the first CAS-covered contract is received within 90 days of the start of the cost accounting period, the contractor is not required to file until the end of 90 days.

(c) When a Disclosure Statement is required, a separate Disclosure Statement must be submitted for each segment whose costs included in the total price of any CAS-covered contract or subcontract exceed the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C. 1502(b)(1)(B)) unless

(i) The contract or subcontract is of the type or value exempted by 9903.201-1 or

(ii) In the most recently completed cost accounting period the segment's CAS-covered awards are less than 30 percent of total segment sales for the period and less than $10 million.

(d) Each corporate or other home office that allocates costs to one or more disclosing segments performing CAS-covered contracts must submit a Part VIII of the Disclosure Statement.

(e) Foreign contractors and subcontractors who are required to submit a Disclosure Statement may, in lieu of filing a Form No CASB-DS-1, make disclosure by using a disclosure form prescribed by an agency of its Government, provided that the Cost Accounting Standards Board determines that the information disclosed by that means will satisfy the objectives of Public Law 100-679. The use of alternative forms has been approved for the contractors of the following countries:

(1) Canada.

(2) Federal Republic of Germany.

(3) United Kingdom.

(f) Educational institutions - disclosure requirements.

(1) Educational institutions receiving contracts subject to the CAS specified in part 9905 are subject to the requirements of 9903.202, except that completed Disclosure Statements are required in the following circumstances.

(2) Basic requirement. For CAS-covered contracts placed on or after January 1, 1996, completed Disclosure Statements are required as follows:

(i) Any business unit of an educational institution that is selected to receive a CAS-covered contract or subcontract in excess of the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C. 1502(b)(1)(B)), and is part of a college or university location listed in Exhibit A of Office of Management and Budget (OMB) Circular A-21 shall submit a Disclosure Statement before award. A Disclosure Statement is not required; however, if the listed entity can demonstrate that the net amount of Federal contract and financial assistance awards received during its immediately preceding cost accounting period was less than $25 million.

(ii) Any business unit that is selected to receive a CAS-covered contract or subcontract of $25 million or more shall submit a Disclosure Statement before award.

(iii) Any educational institution which, together with its segments, received net awards of negotiated prime contracts and subcontracts subject to CAS totaling $25 million or more in its most recent cost accounting period, of which, at least one award exceeded $1 million, must submit a Disclosure Statement before award of its first CAS-covered contract in the immediately following cost accounting period. However, if the first CAS-covered contract is received within 90 days of the start of the cost accounting period, the institution is not required to file until the end of 90 days.

(3) Transition period requirement. For CAS-covered contracts placed on or before December 31, 1995, completed Disclosure Statements are required as follows:

(i) For business units that are selected to receive a CAS-covered contract or subcontract in excess of the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C. 1502(b)(1)(B)), and are part of the first 20 college or university locations (i.e., numbers 1 through 20) listed in Exhibit A of OMB Circular A-21, Disclosure Statements shall be submitted within six months after the date of contract award.

(ii) For business units that are selected to receive a CAS-covered contract or subcontract in excess of the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C. 1502(b)(1)(B)), and are part of a college or university location that is listed as one of the institutions numbered 21 through 50, in Exhibit A of OMB Circular A-21, Disclosure Statements shall be submitted during the six month period ending twelve months after the date of contract award.

(iii) For business units that are selected to receive a CAS-covered contract or subcontract in excess of the Truth in Negotiations Act (TINA) threshold, as adjusted for inflation (41 U.S.C. 1908 and 41 U.S.C. 1502(b)(1)(B)), and are part of a college or university location that is listed as one of the institutions numbered 51 through 99, in Exhibit A of OMB Circular A-21, Disclosure Statements shall be submitted during the six month period ending eighteen months after the date of contract award.

(iv) For any other business unit that is selected to receive a CAS-covered contract or subcontract of $25 million or more, a Disclosure Statement shall be submitted within six months after the date of contract award.

(4) Transition period due dates. The educational institution and cognizant Federal agency should establish a specific due date within the periods prescribed in 9903.202-1(f)(3) when a Disclosure Statement is required under a CAS-covered contract placed on or before December 31, 1995.

(5) Transition period waiver authority. For a CAS-covered contract to be awarded during the period January 1, 1996, through June 30, 1997, the awarding agency may waive the preaward Disclosure Statement submission requirement specified in 9903.202-1(f)(2) when a due date for the submission of a Disclosure Statement has previously been established by the cognizant Federal agency and the educational institution under the provisions of 9903.202-1(f) (3) and (4).

Caution: This waiver authority is not available unless the cognizant Federal agency and the educational institution have established a disclosure statement due date pursuant to a written agreement executed prior to January 1, 1996, and award is made prior to the established disclosure statement due date.

9903.202-2 Impracticality of submission.

The agency head may determine that it is impractical to secure the Disclosure Statement, although submission is required, and authorize contract award without obtaining the Statement. He shall, within 30 days of having done so, submit a report to the Cost Accounting Standards Board setting forth all material facts. This authority may not be delegated.

9903.202-3 Amendments and revisions.

Contractors and subcontractors are responsible for maintaining accurate Disclosure Statements and complying with disclosed practices. Amendments and revisions to Disclosure Statements may be submitted at any time and may be proposed by either the contractor or the Government. Resubmission of complete, updated, Disclosure Statements is discouraged except when extensive changes require it to assist the review process.

9903.202-4 Privileged and confidential information.

If the offeror or contractor notifies the contracting officer that the Disclosure Statement contains trade secrets and commercial or financial information, which is privileged and confidential, the Disclosure Statement shall be protected and shall not be released outside the Government.

9903.202-5 Filing Disclosure Statements.

(a) Disclosure must be on Form Number CASB DS-1 or CASB DS-2, as applicable. Forms may be obtained from the cognizant Federal agency (cognizant ACO or cognizant Federal agency official authorized to act in that capacity) or from the looseleaf version of the Federal Acquisition Regulation. When requested in advance by a contractor, the cognizant Federal agency may authorize contractor disclosure based on computer generated reproductions of the applicable Disclosure Statement Form.

(b) Offerors are required to file Disclosure Statements as follows:

(1) Original and one copy with the cognizant ACO or cognizant Federal agency official acting in that capacity, as applicable; and

(2) One copy with the cognizant Federal auditor.

(c) Amendments and revisions shall be submitted to the ACO or agency official acting in that capacity, as applicable, and the Federal auditor of the currently cognizant Federal agency.

9903.202-6 Adequacy of Disclosure Statement.

Federal agencies shall prescribe regulations and establish internal procedures by which each will promptly determine on behalf of the Government, when serving as the cognizant Federal agency for a particular contractor location, that a Disclosure Statement has adequately disclosed the practices required to be disclosed by the Cost Accounting Standards Board's rules, regulations and Standards. The determination of adequacy shall be distributed to all affected agencies. Agencies are urged to coordinate on the development of such regulations.

9903.202-7 [Reserved]

9903.202-8 Subcontractor Disclosure Statements.

(a) The contractor or higher tier subcontractor is responsible for administering the CAS requirements contained in subcontracts.

(b) If the subcontractor has previously furnished a Disclosure Statement to an ACO, the subcontractor may satisfy the submission requirement by identifying to the contractor or higher tier subcontractor the ACO to whom it was submitted.

(c)

(1) If the subcontractor considers the Disclosure Statement (or other similar information) privileged or confidential, the subcontractor may submit it directly to the ACO and auditor cognizant of the subcontractor, notifying the contractor or higher tier subcontractor. A preaward determination of adequacy is not required in such cases. Instead, the ACO cognizant of the subcontractor shall

(i) Notify the auditor that the adequacy review will be performed during the postaward compliance review and, upon completion,

(ii) Notify the subcontractor, the contractor or higher tier subcontractor, and the cognizant ACOs of the findings.

(2) Even though a Disclosure Statement is not required, a subcontractor may

(i) Claim that CAS-related reviews by contractors or higher tier subcontractors would reveal proprietary data or jeopardize the subcontractor's competitive position and

(ii) Request that the Government perform the required reviews.

(d) When the Government requires determinations of adequacy or inadequacy, the ACO cognizant of the subcontractor shall make such recommendation to the ACO cognizant of the prime contractor or next higher tier subcontractor. ACOs cognizant of higher tier subcontractors or prime contractors shall not reverse the determination of the ACO cognizant of the subcontractor.

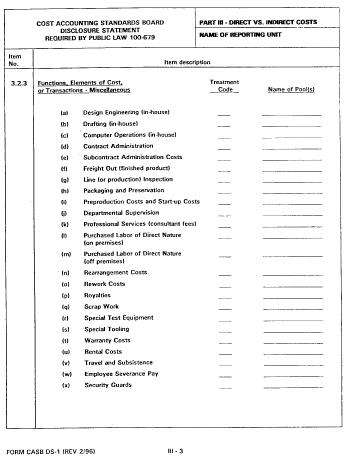

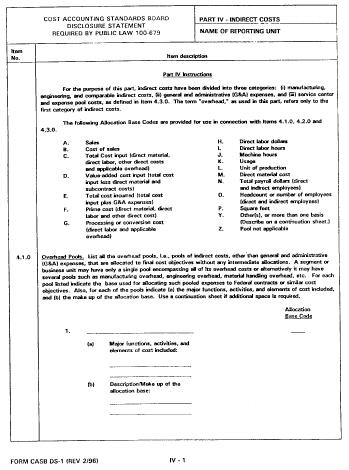

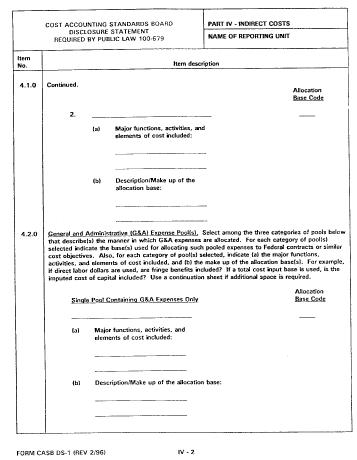

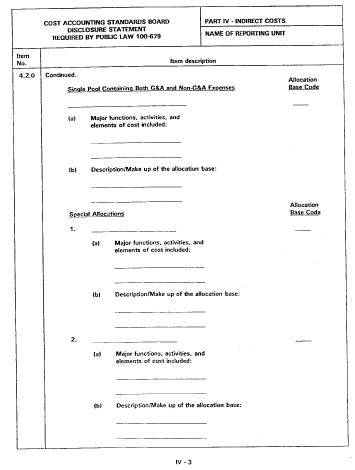

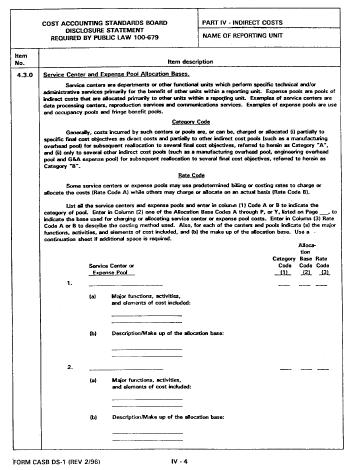

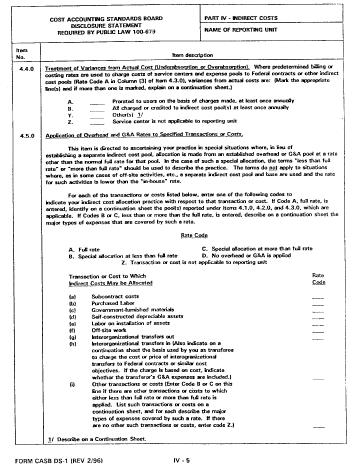

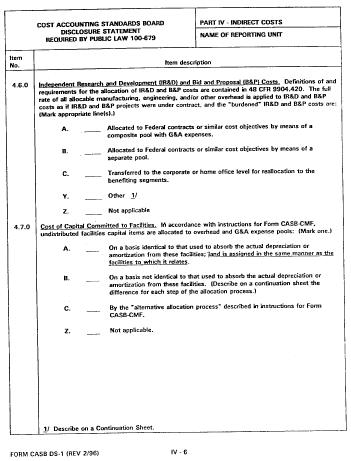

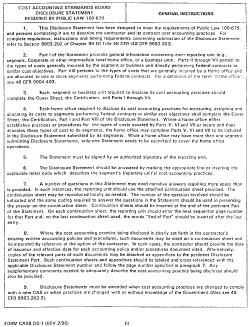

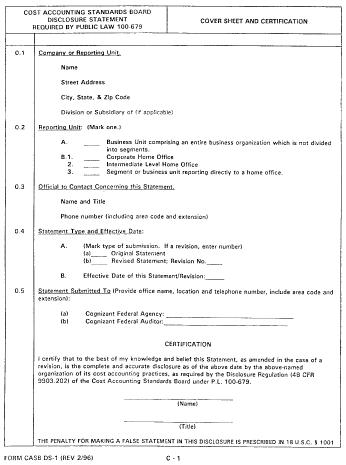

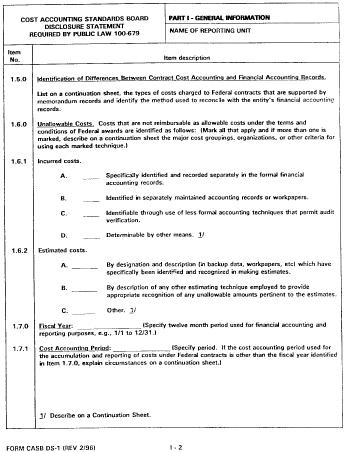

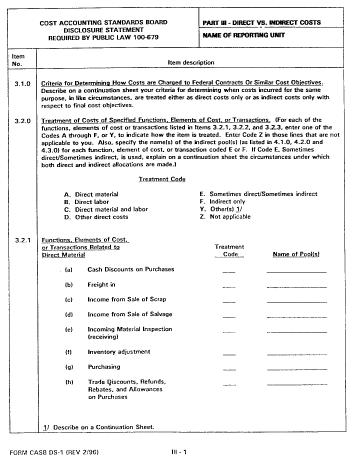

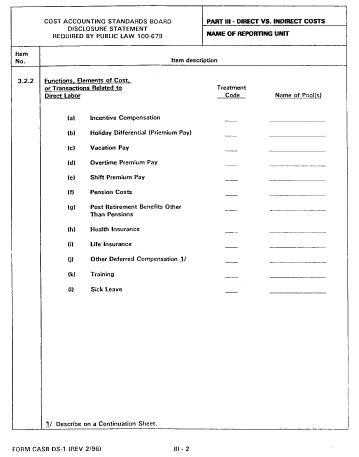

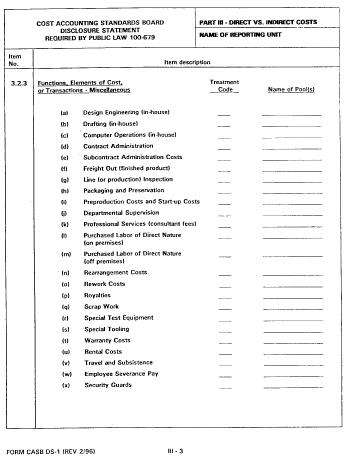

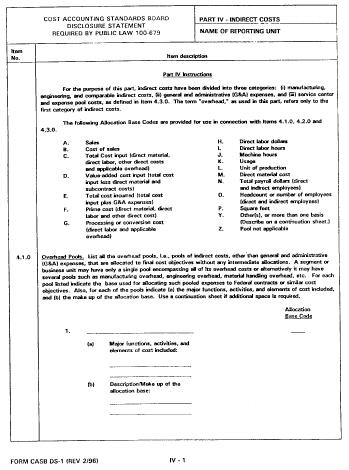

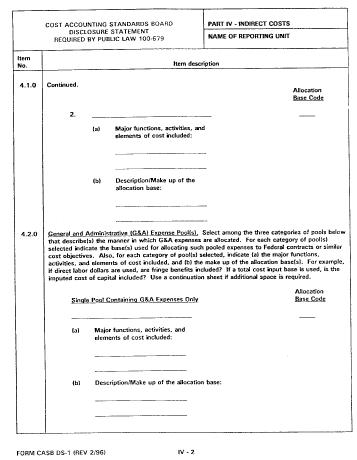

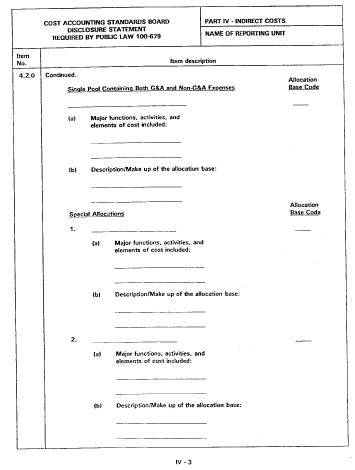

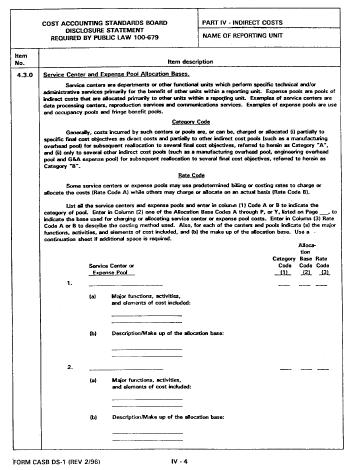

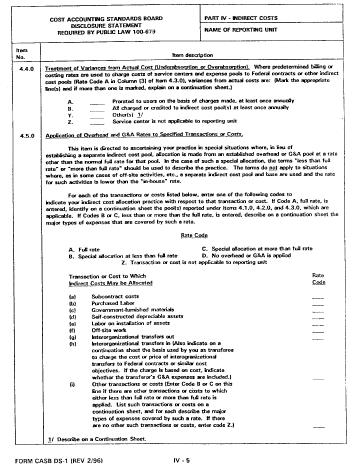

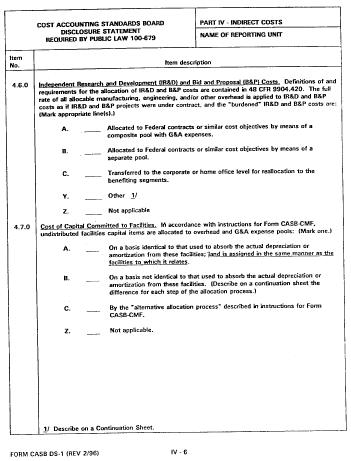

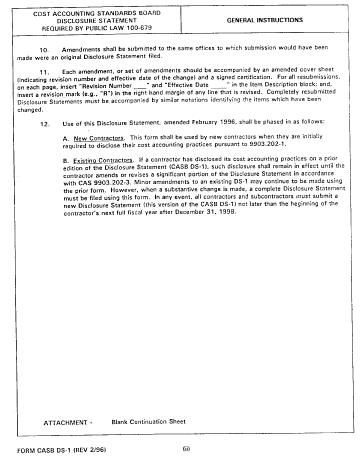

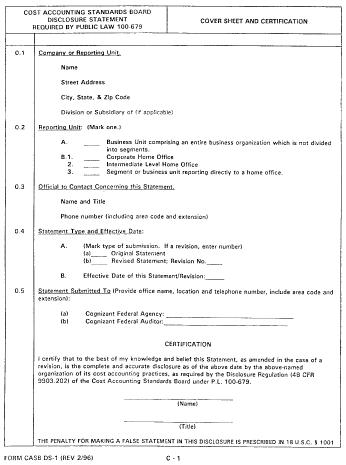

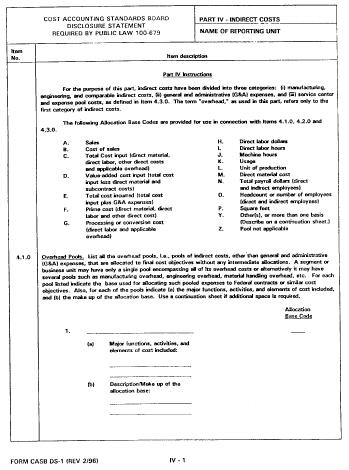

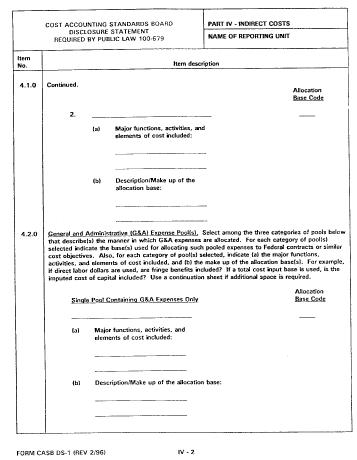

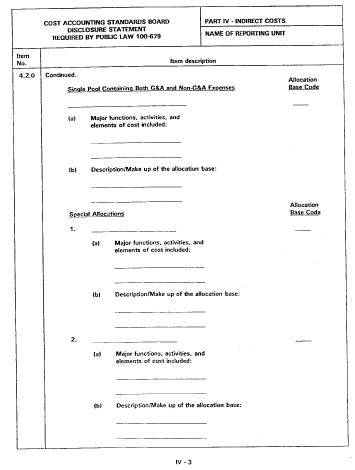

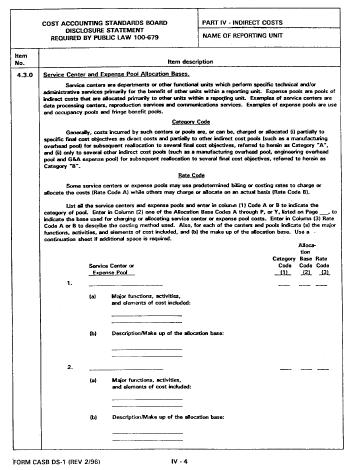

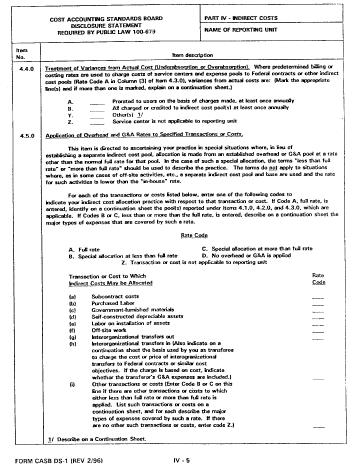

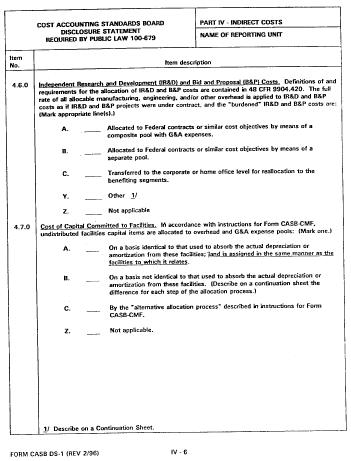

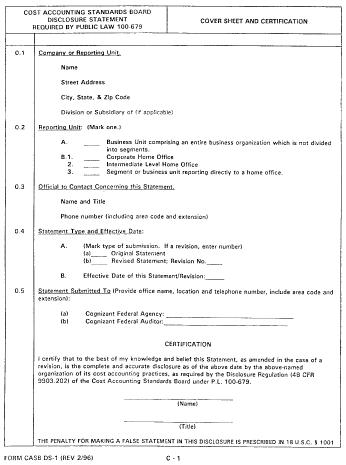

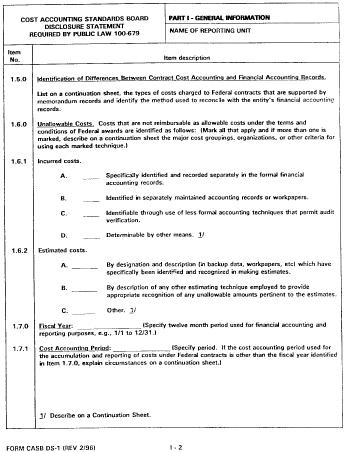

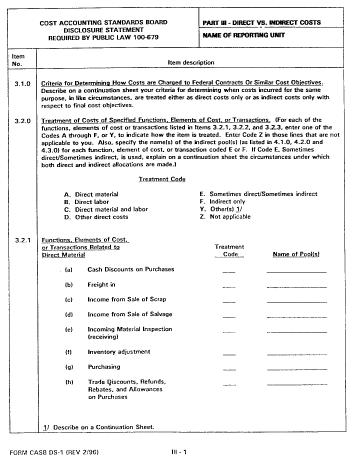

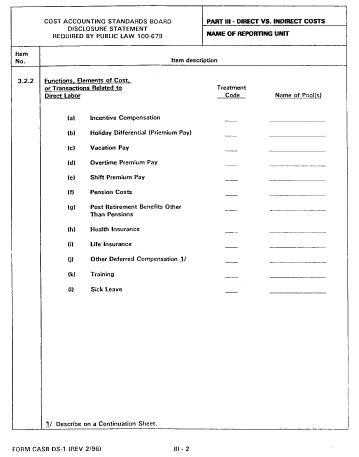

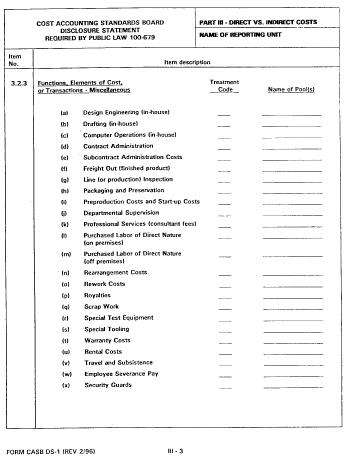

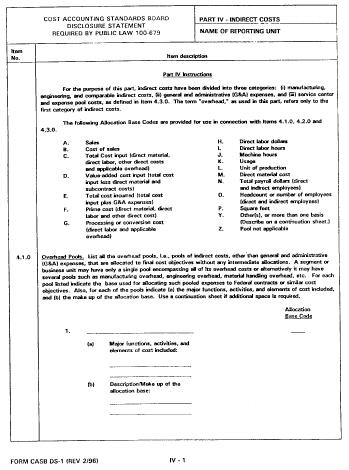

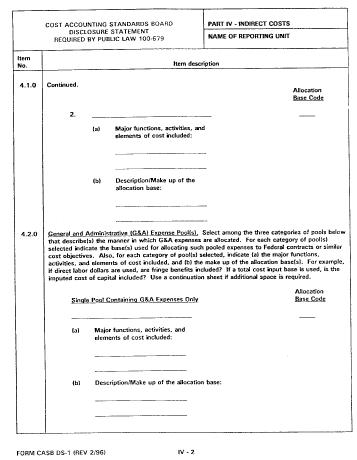

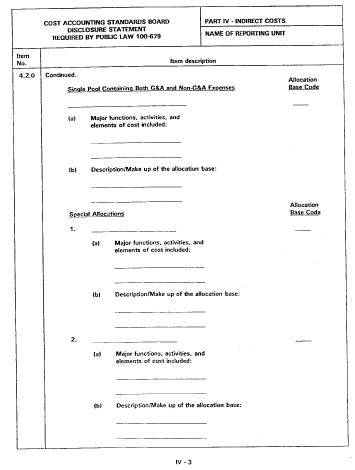

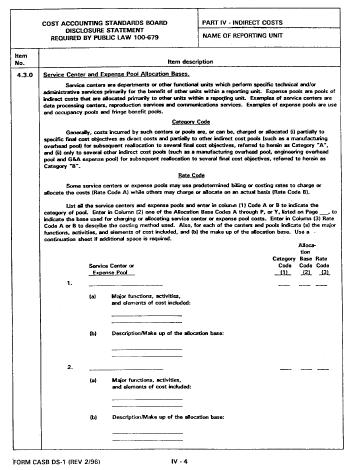

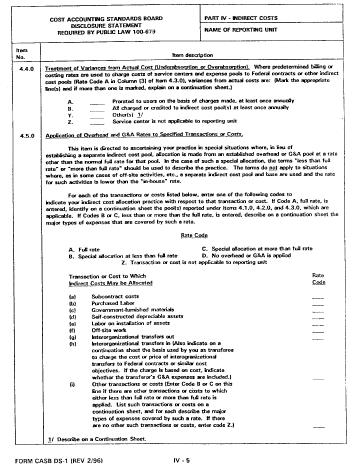

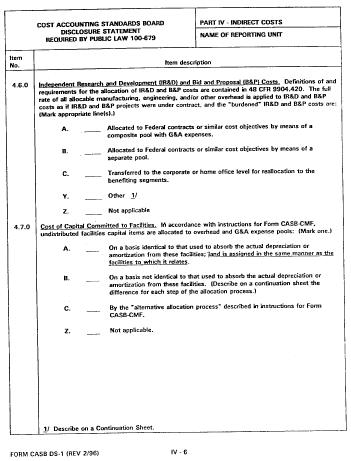

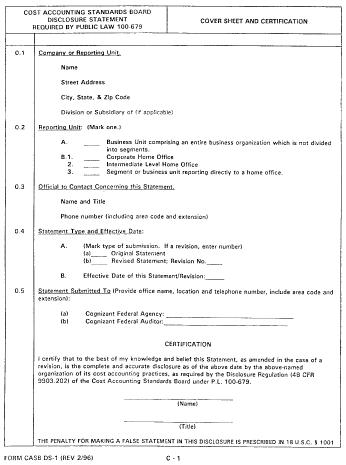

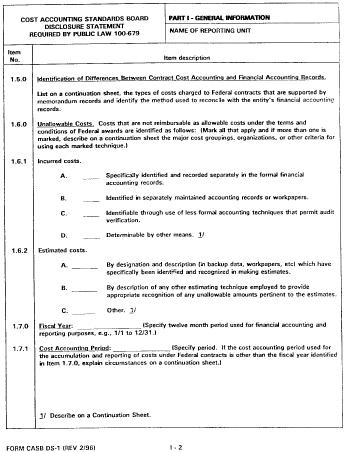

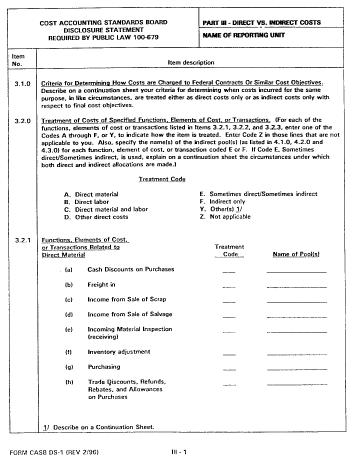

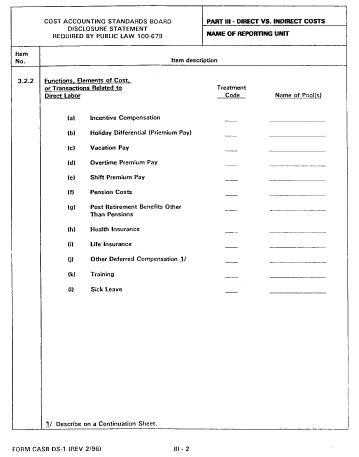

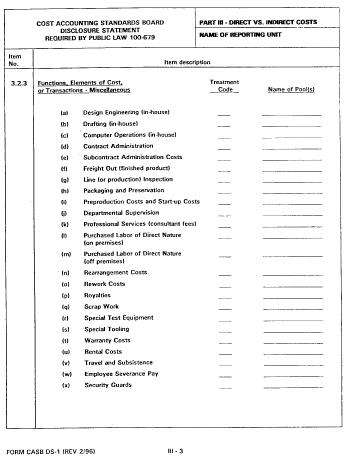

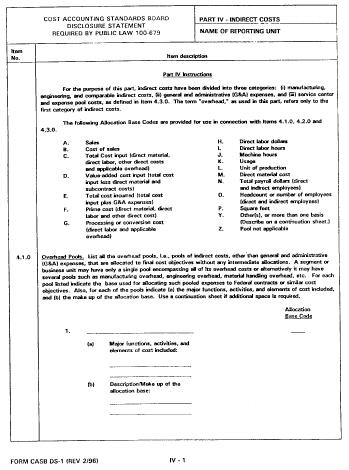

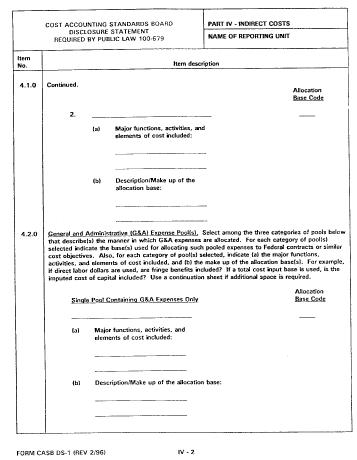

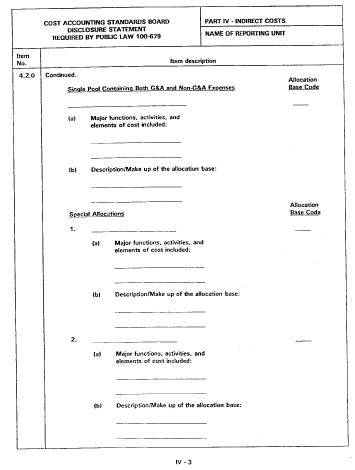

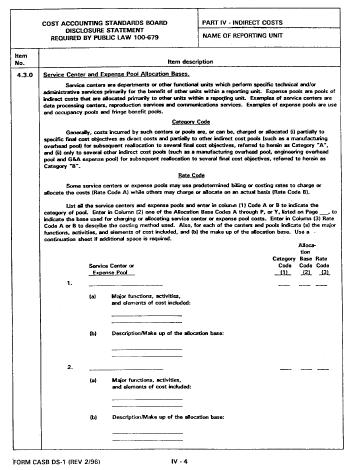

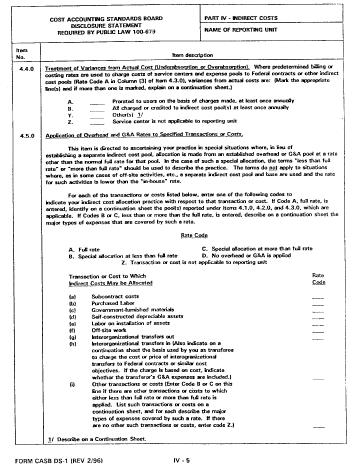

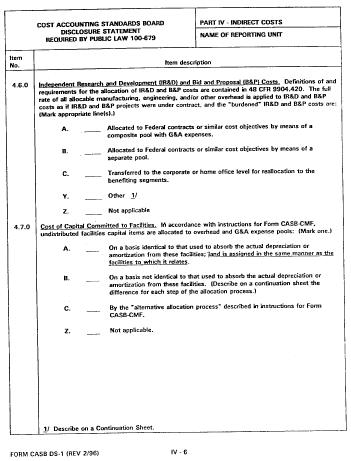

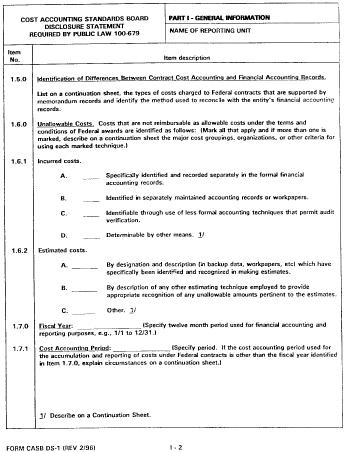

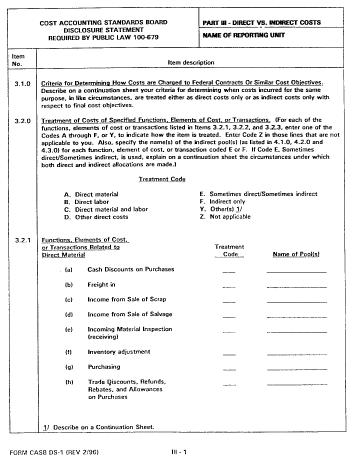

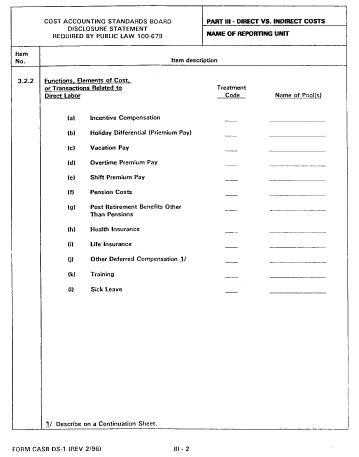

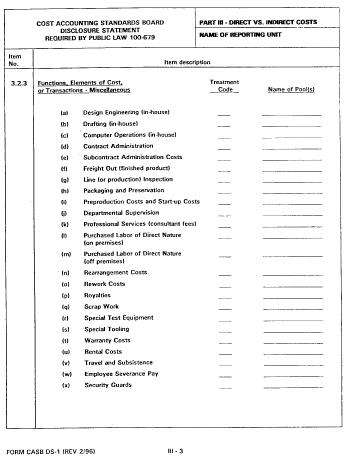

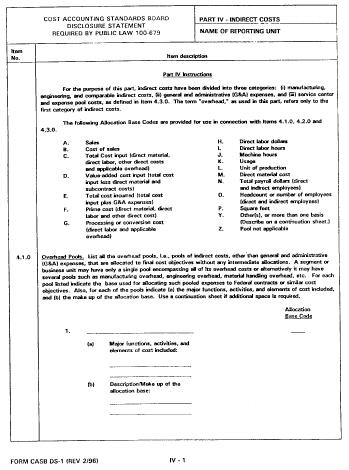

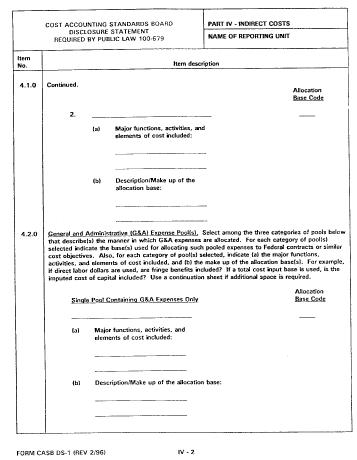

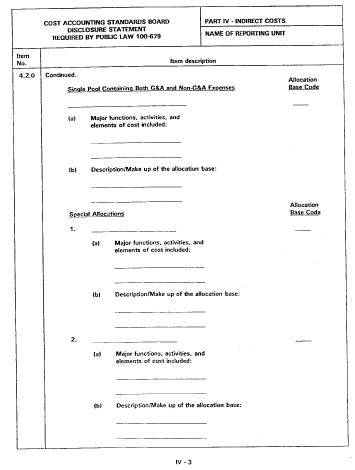

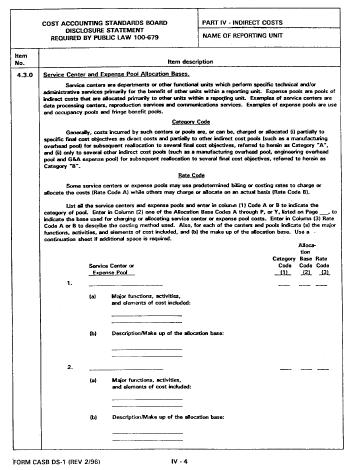

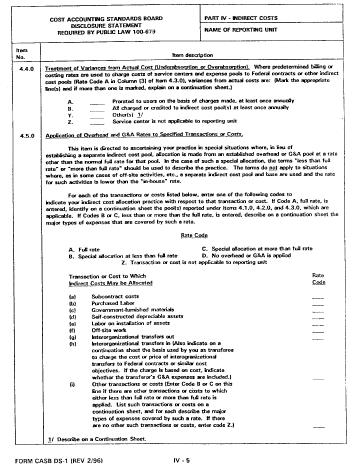

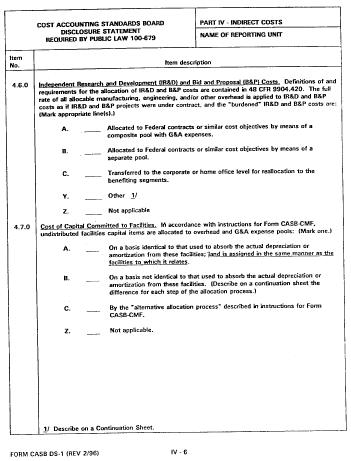

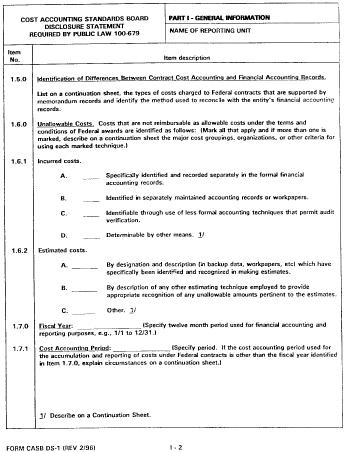

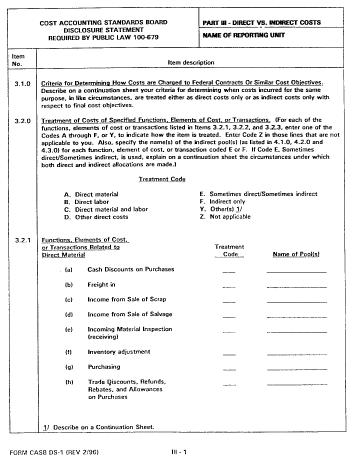

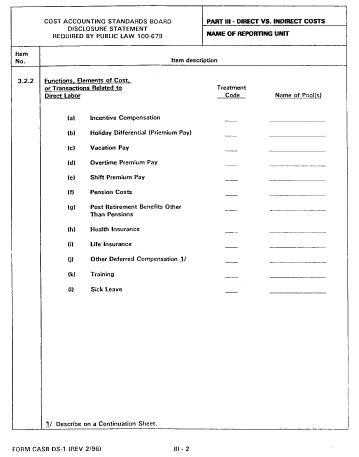

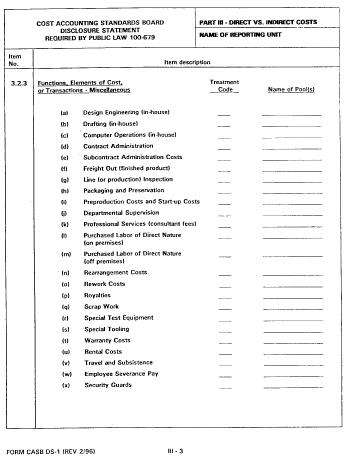

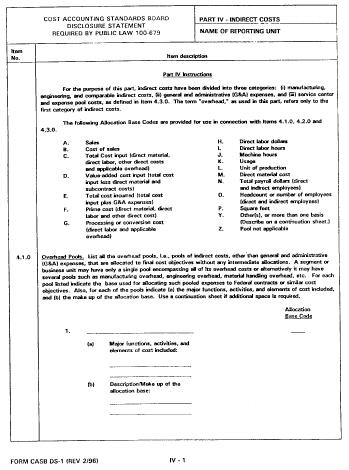

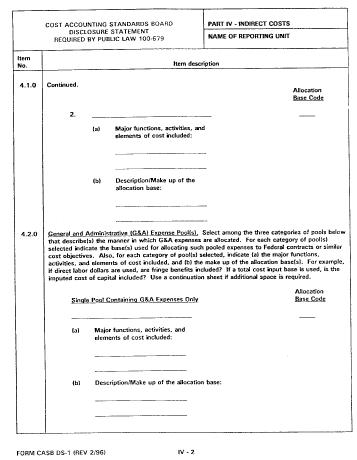

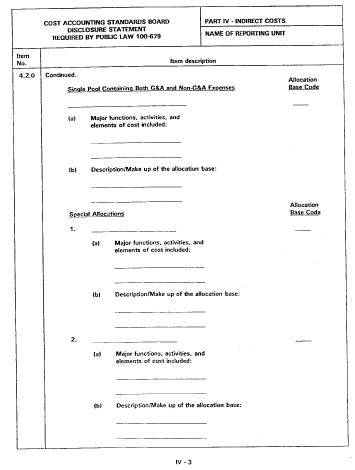

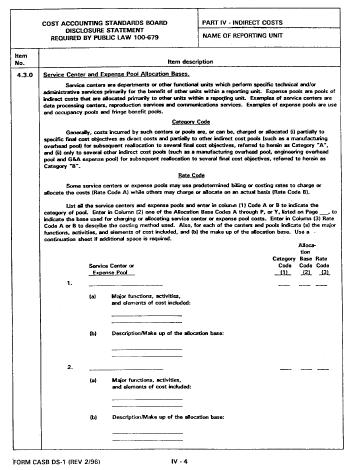

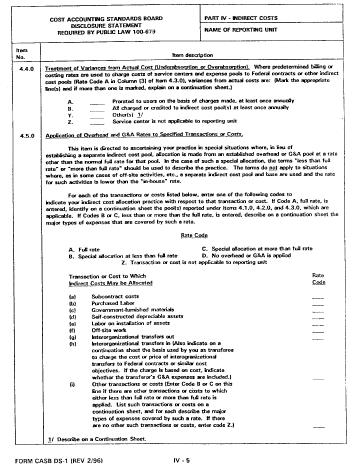

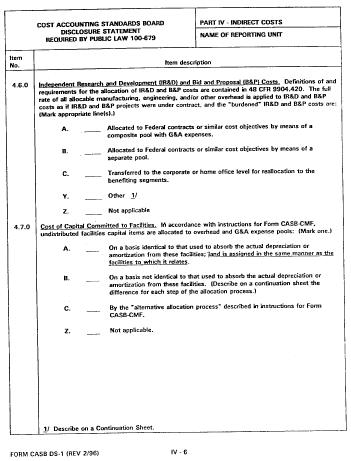

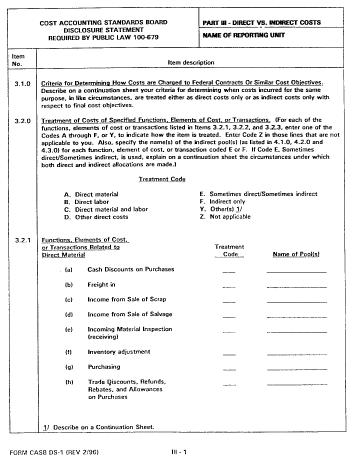

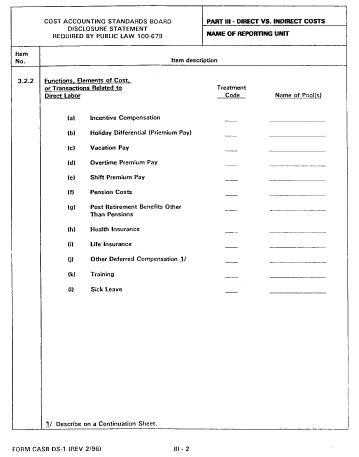

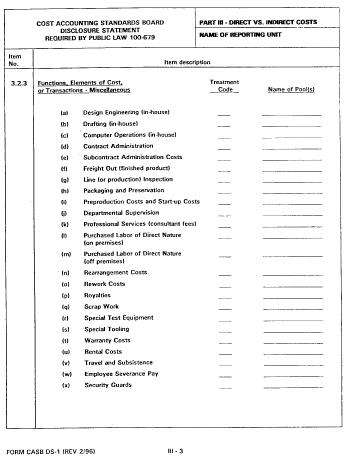

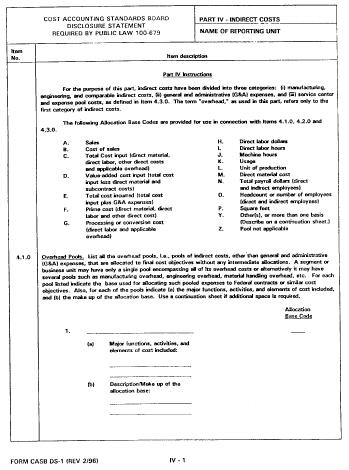

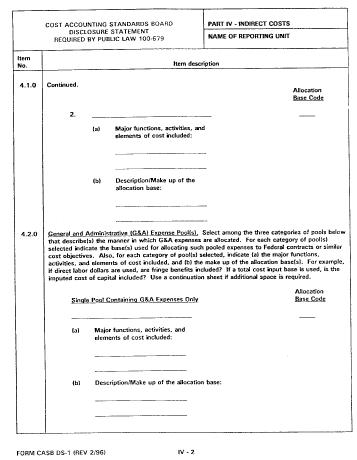

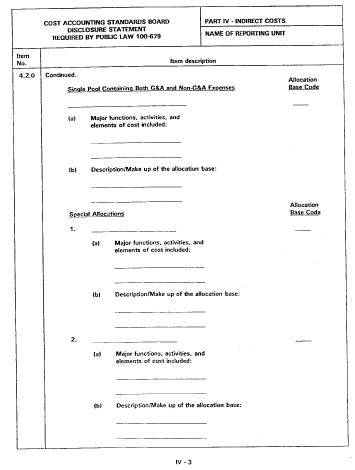

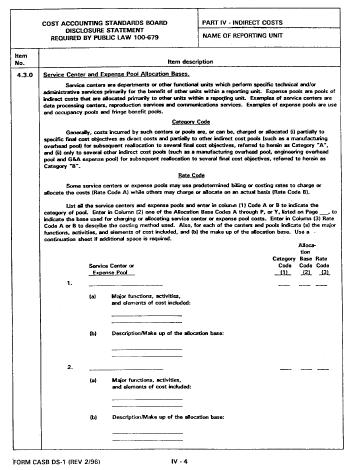

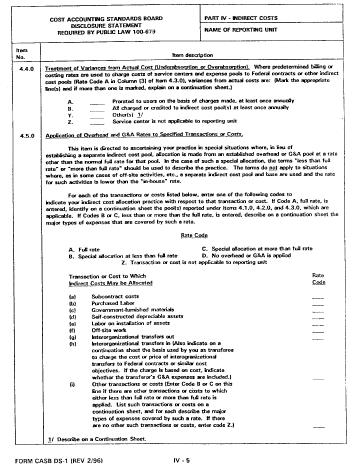

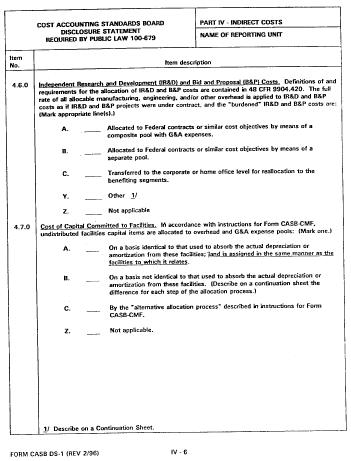

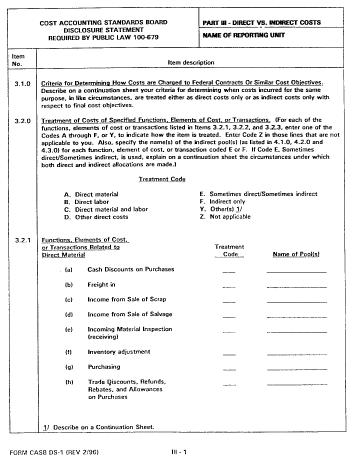

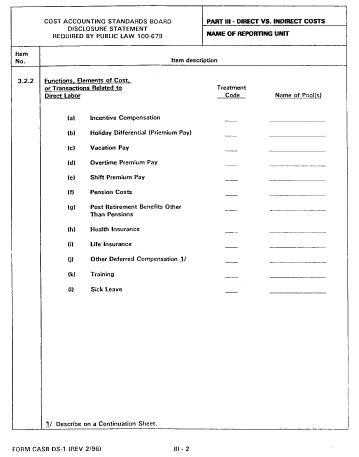

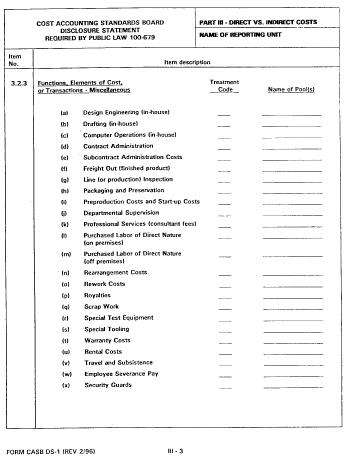

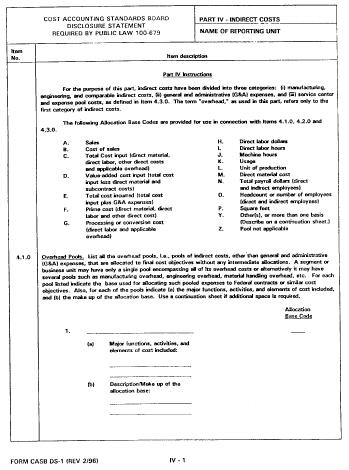

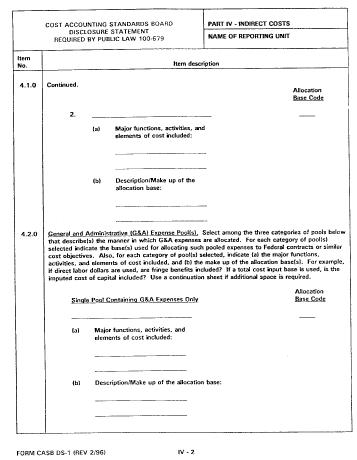

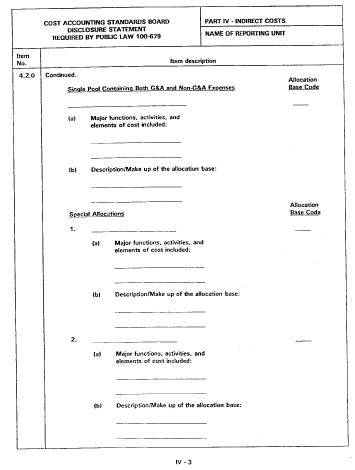

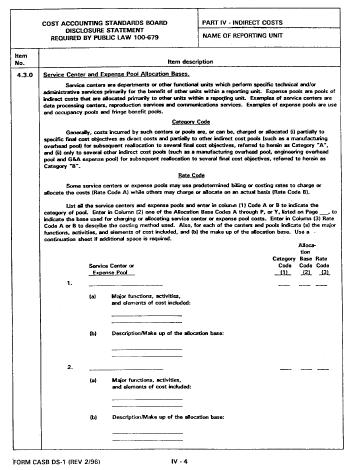

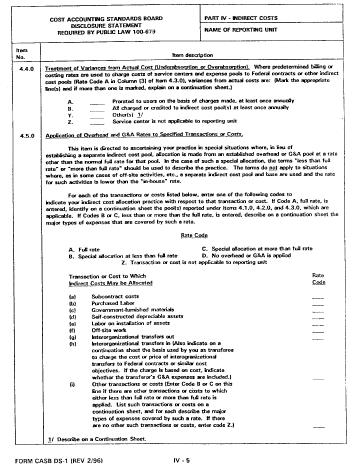

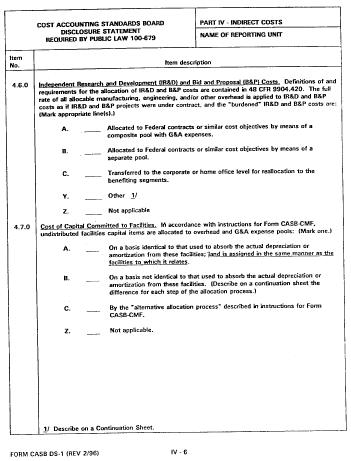

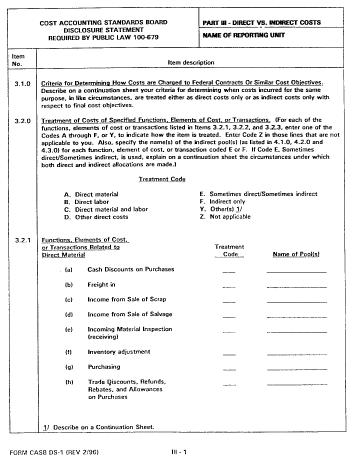

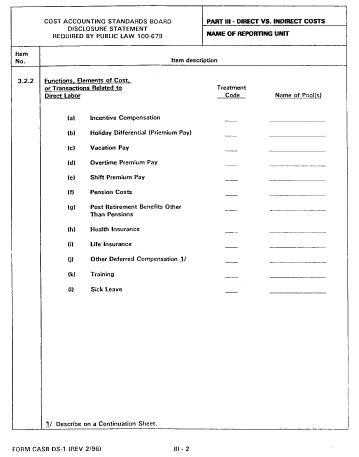

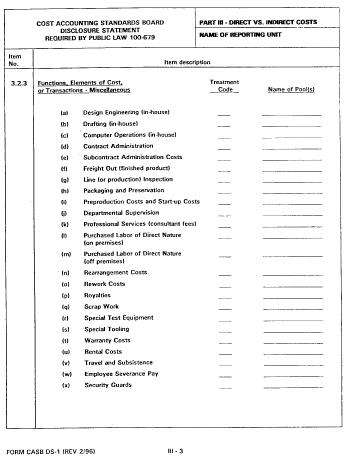

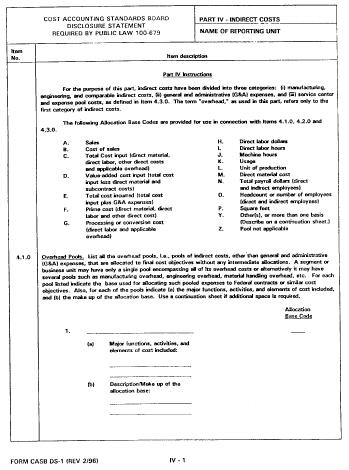

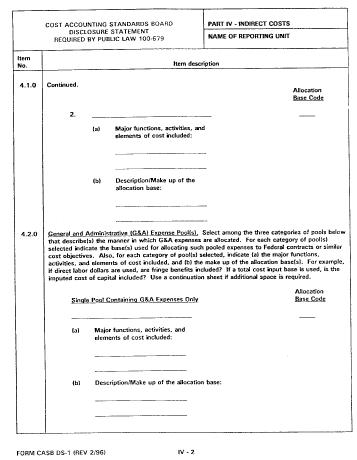

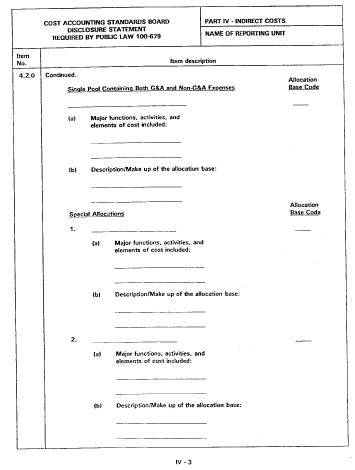

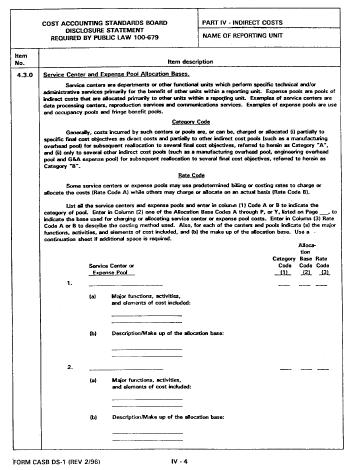

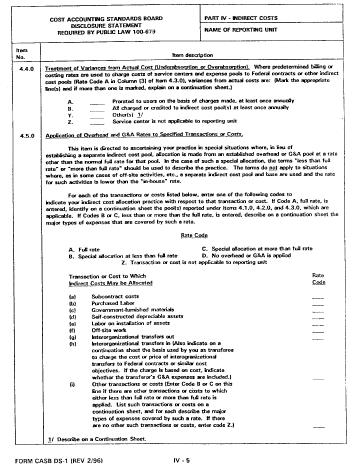

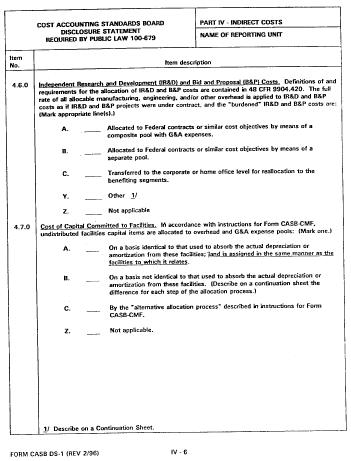

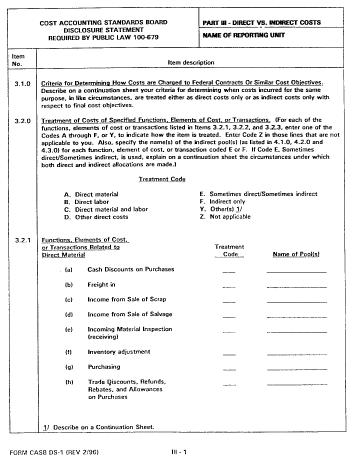

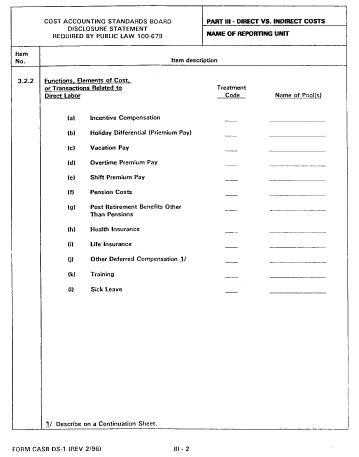

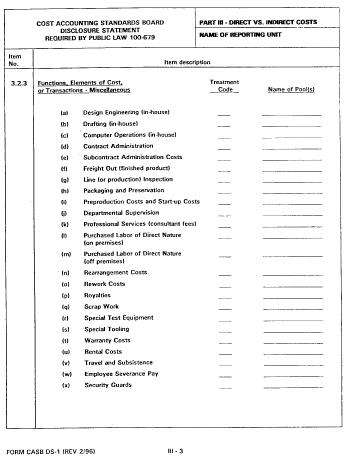

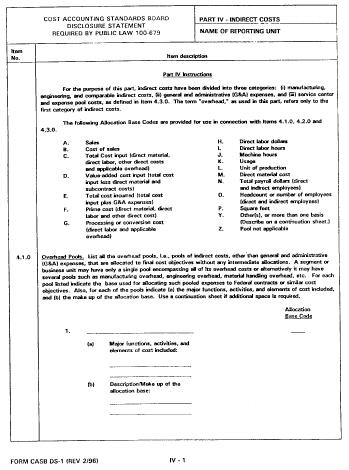

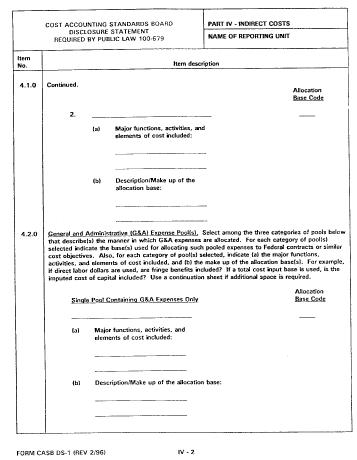

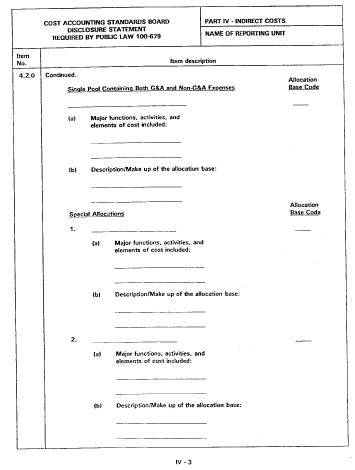

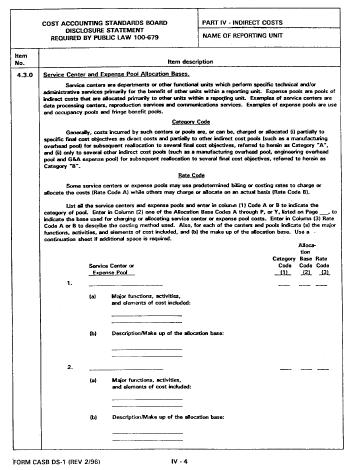

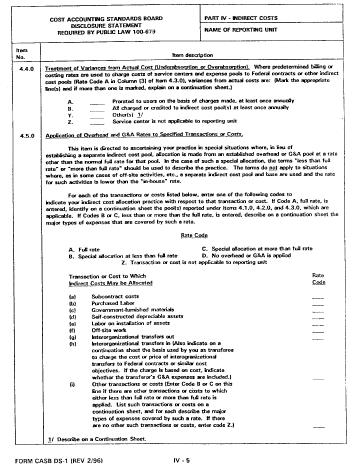

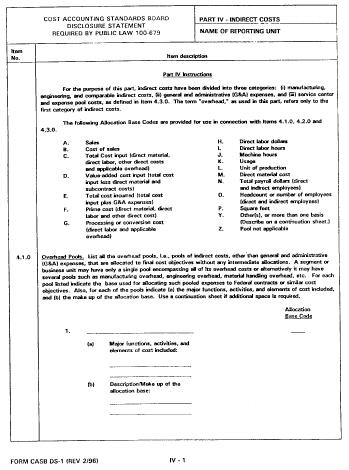

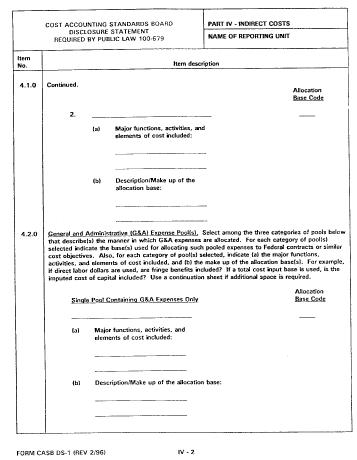

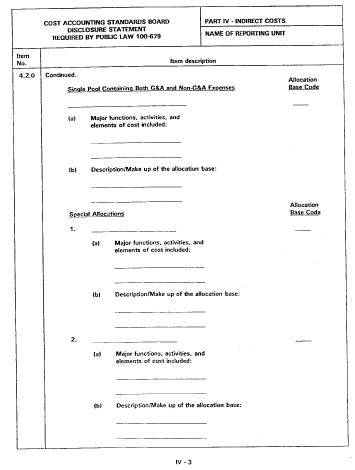

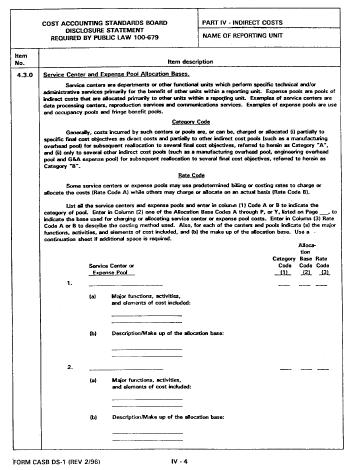

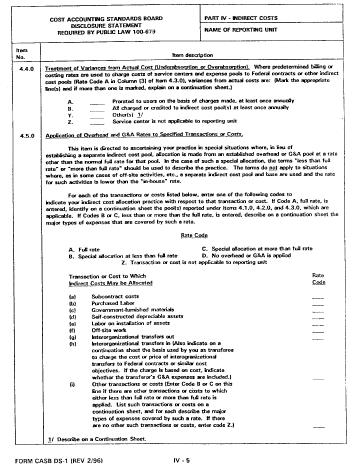

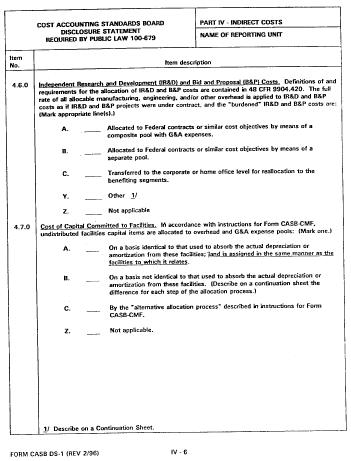

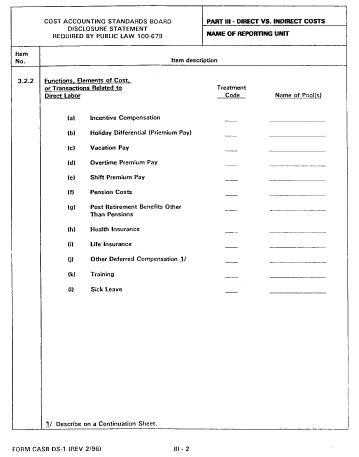

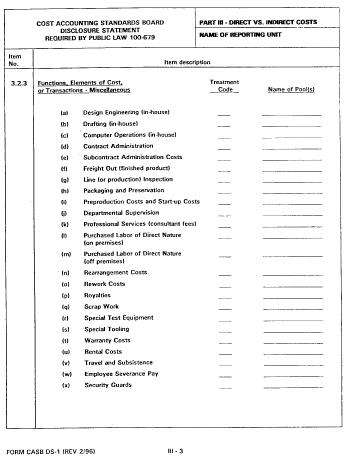

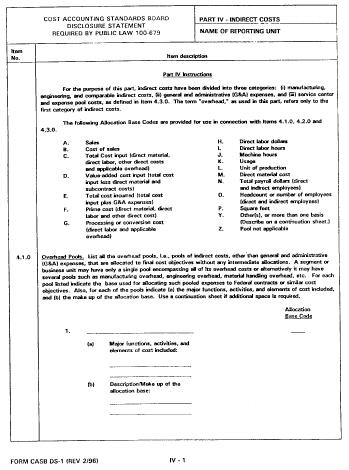

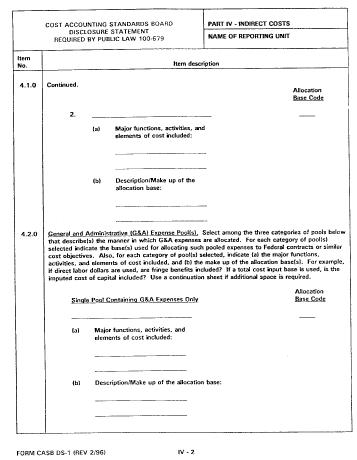

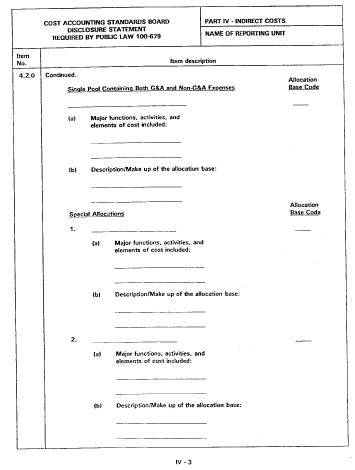

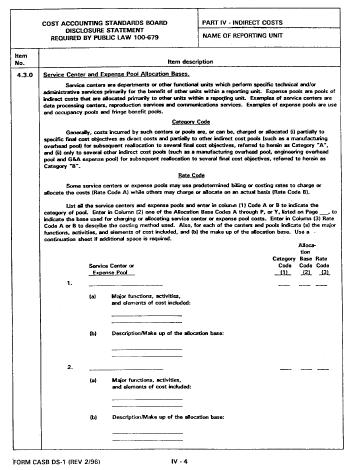

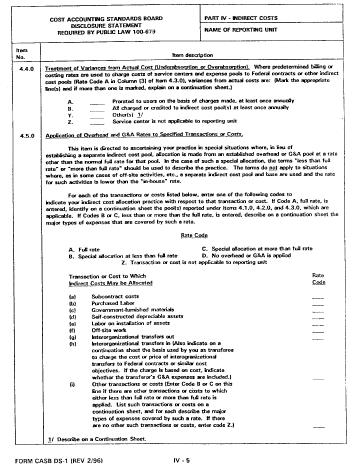

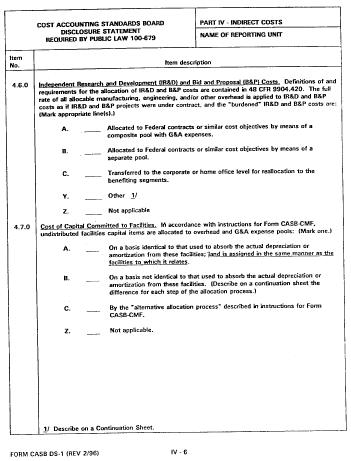

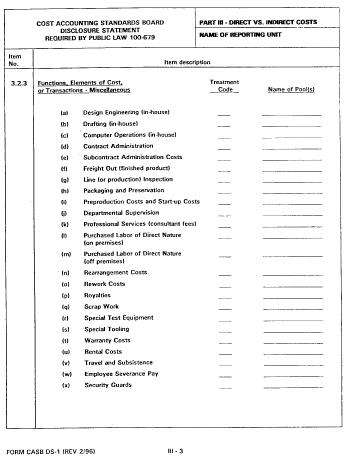

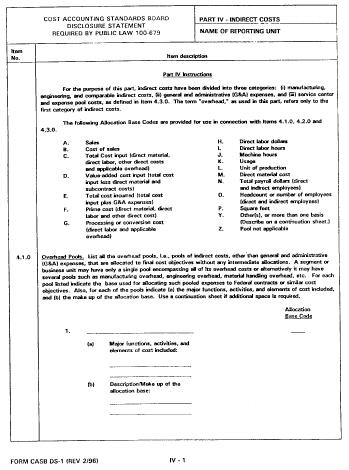

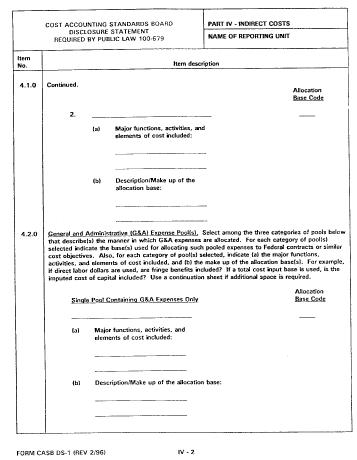

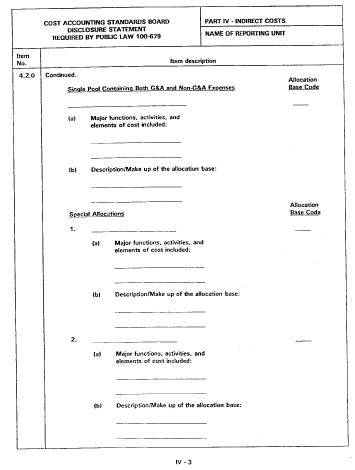

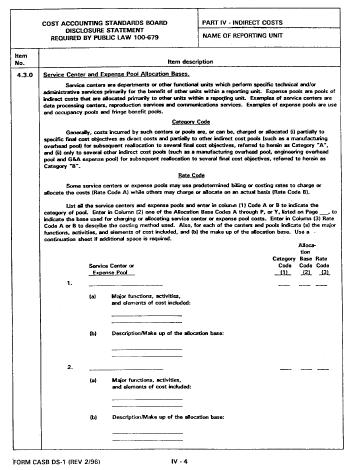

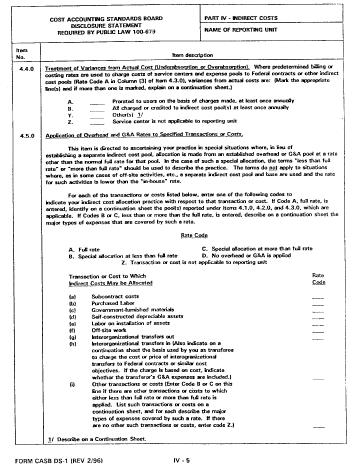

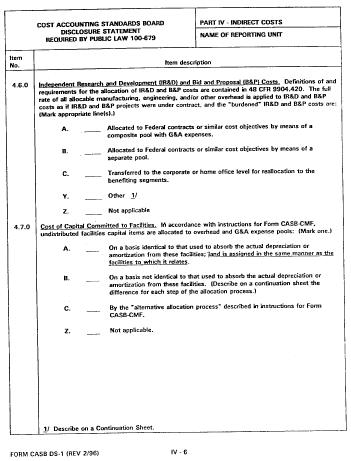

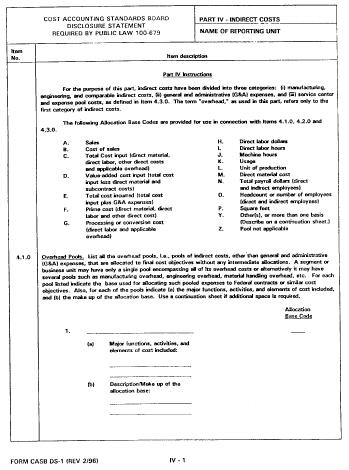

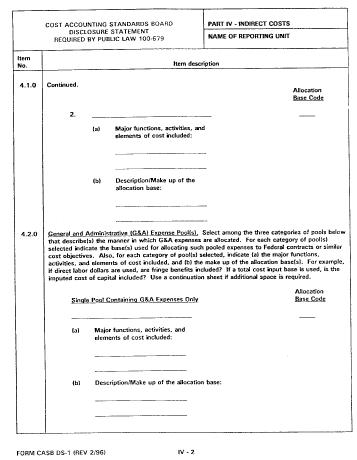

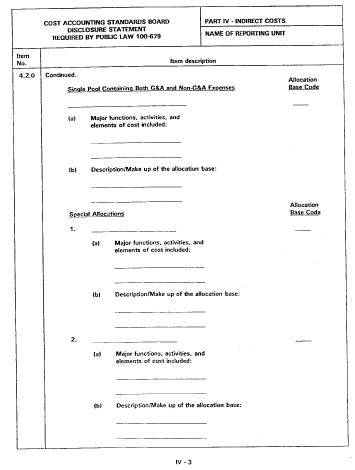

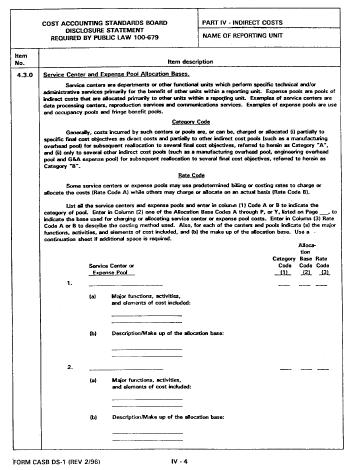

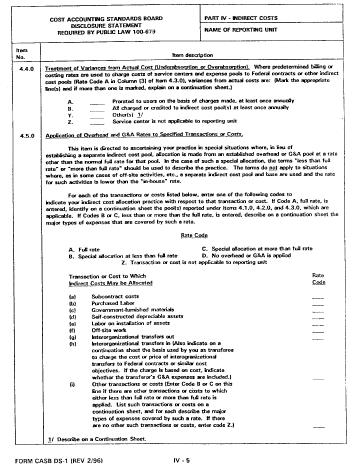

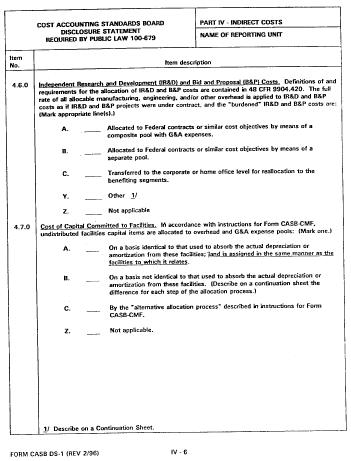

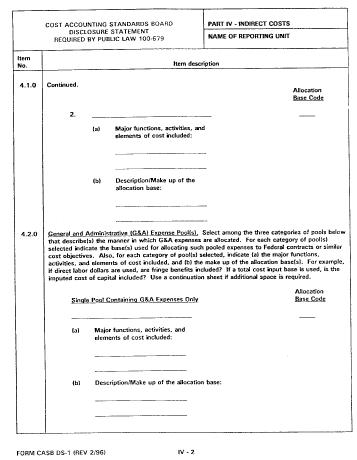

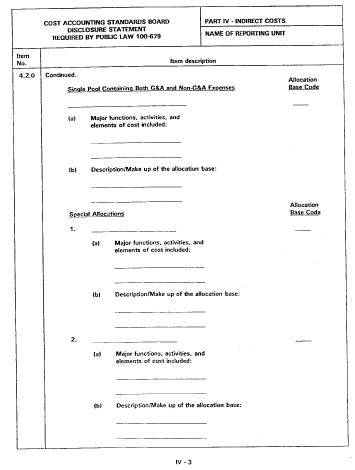

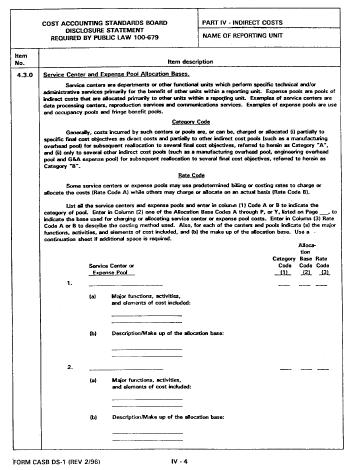

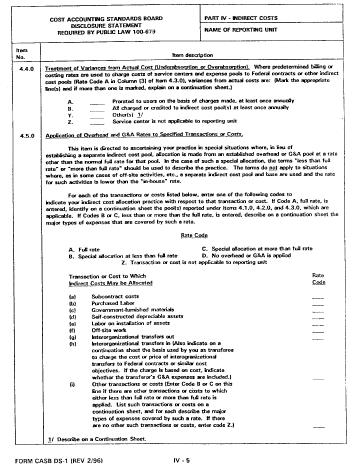

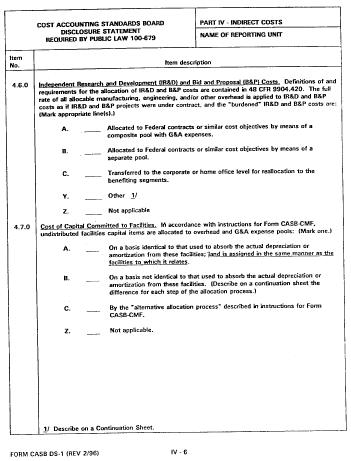

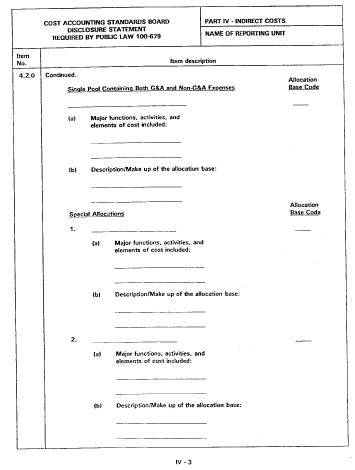

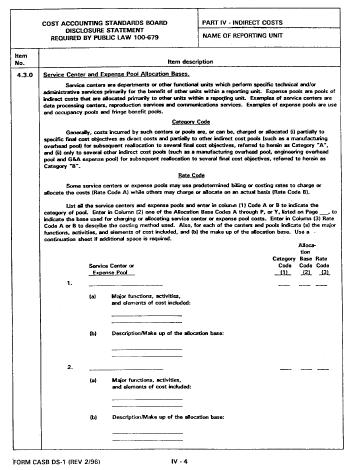

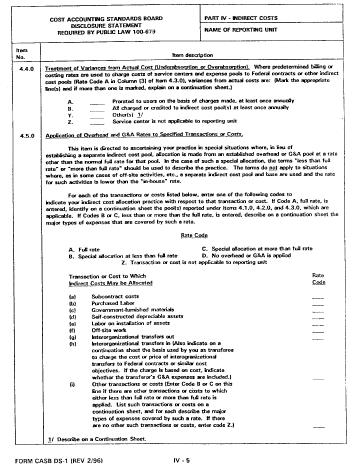

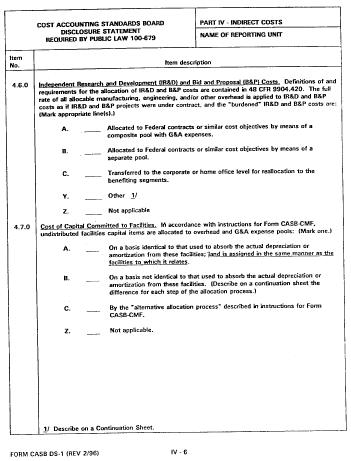

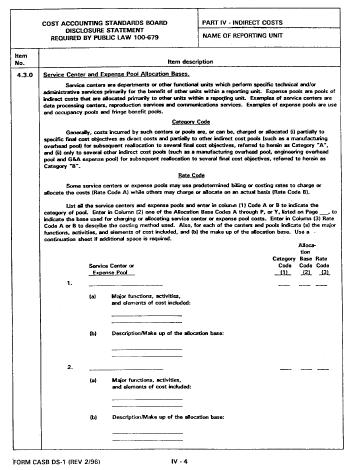

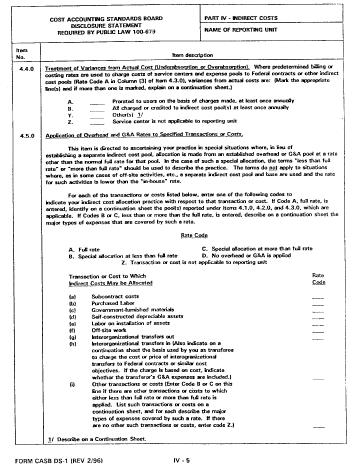

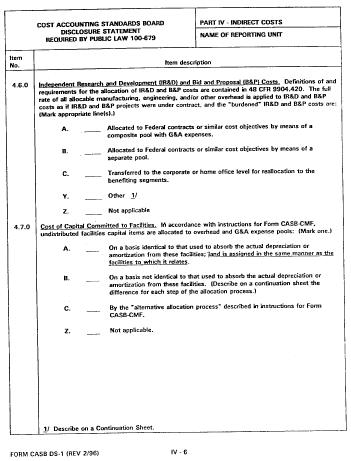

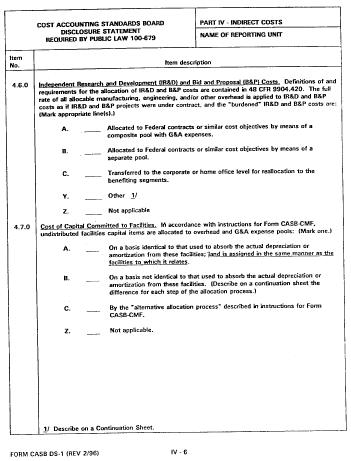

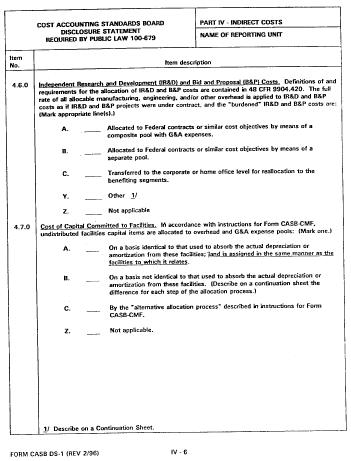

9903.202-9 Illustration of Disclosure Statement Form, CASB-DS-1.

The data which are required to be disclosed are set forth in detail in the Disclosure Statement Form, CASB-DS-1, which is illustrated below:

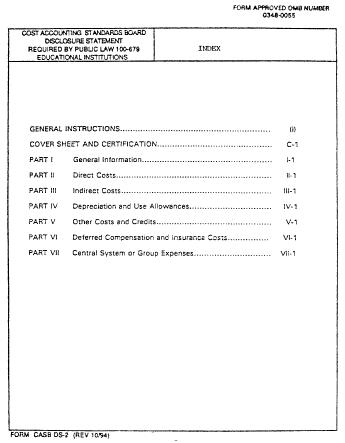

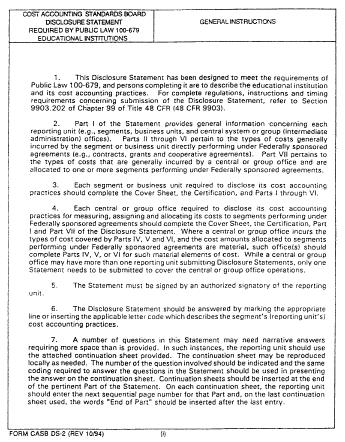

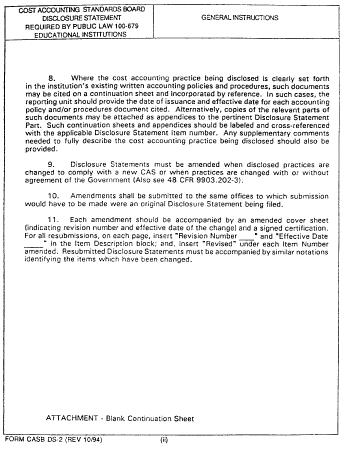

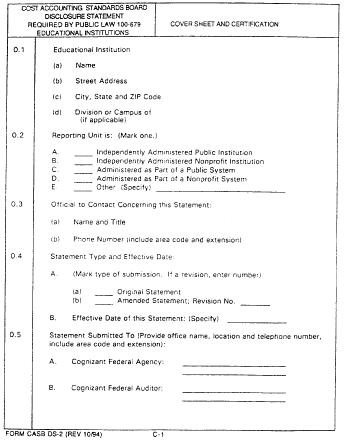

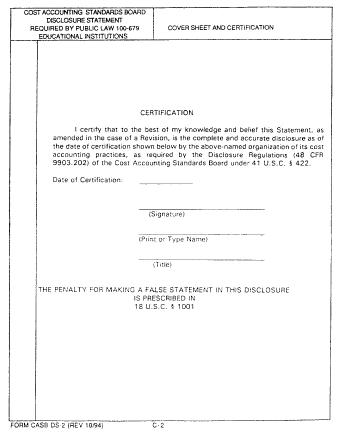

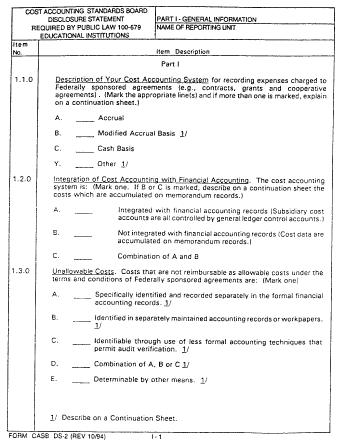

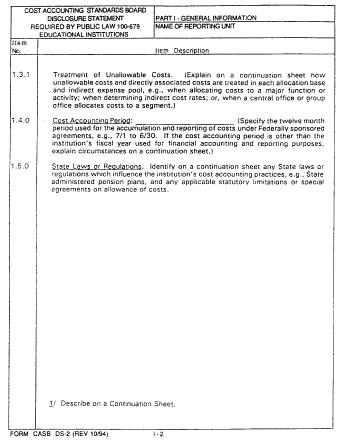

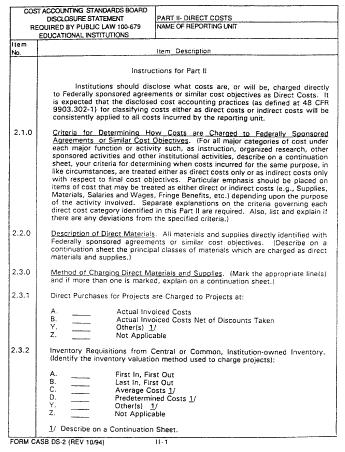

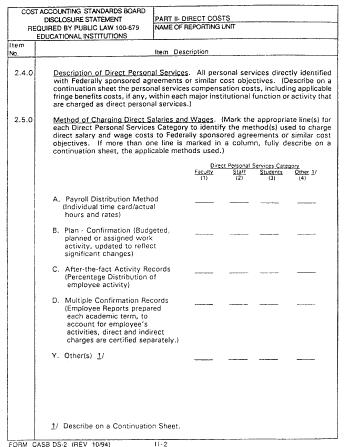

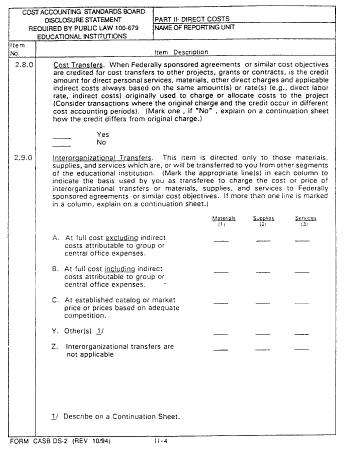

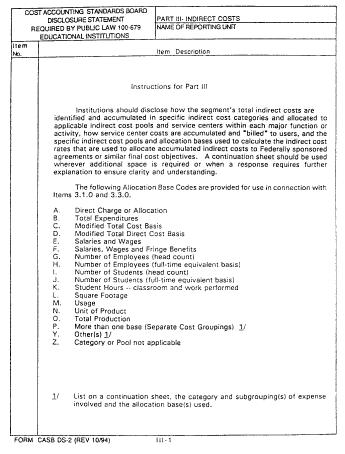

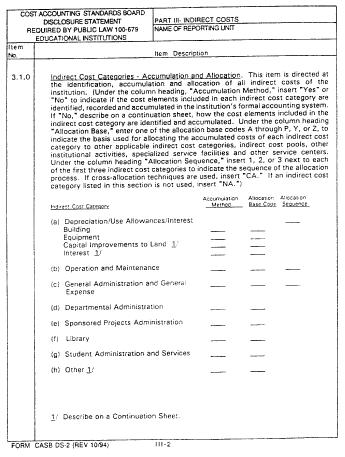

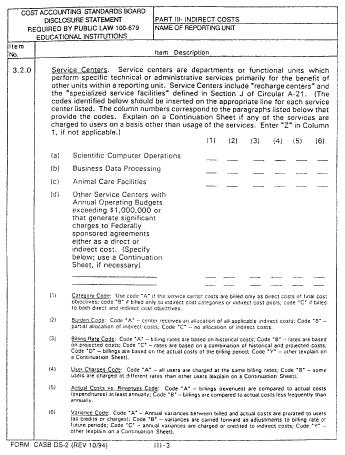

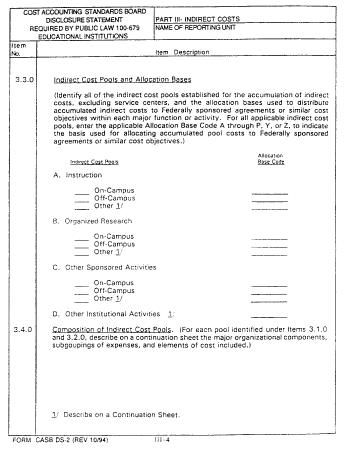

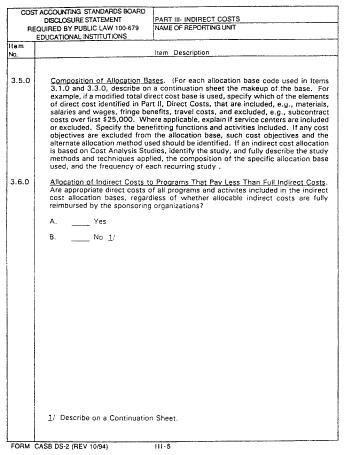

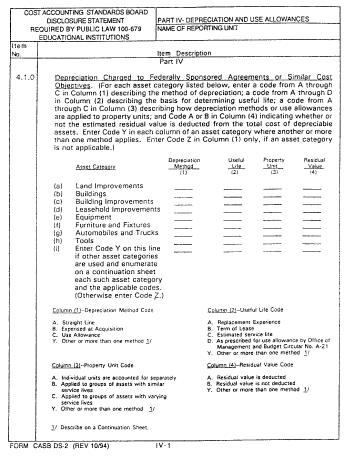

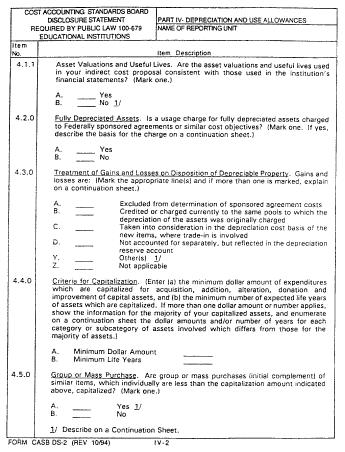

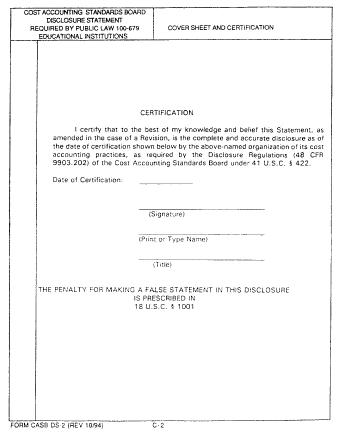

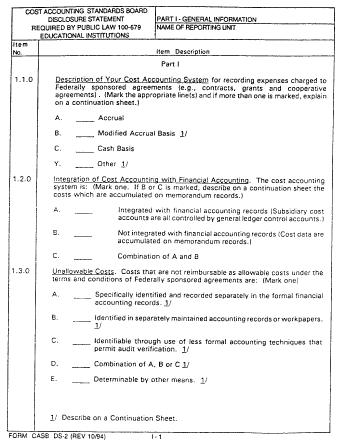

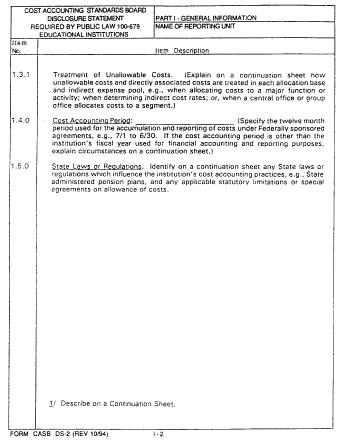

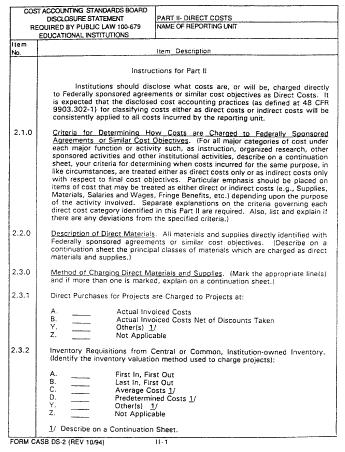

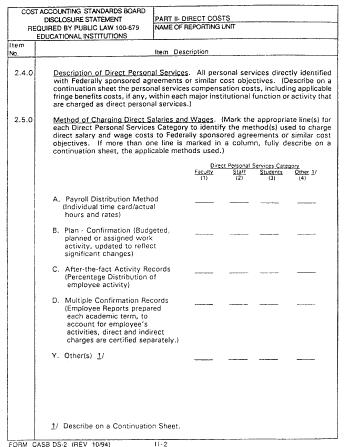

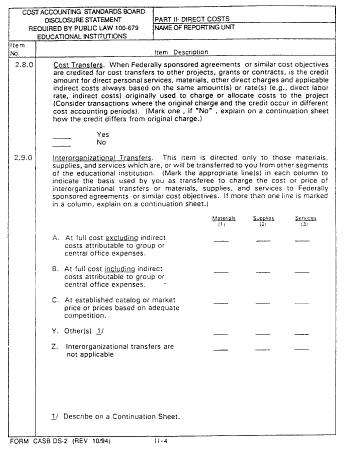

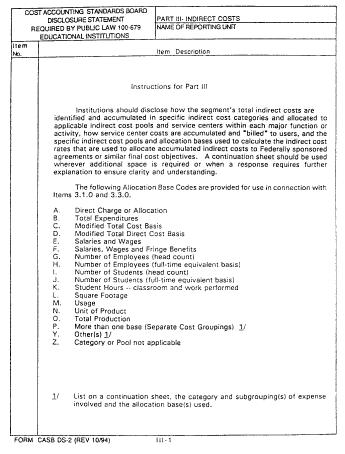

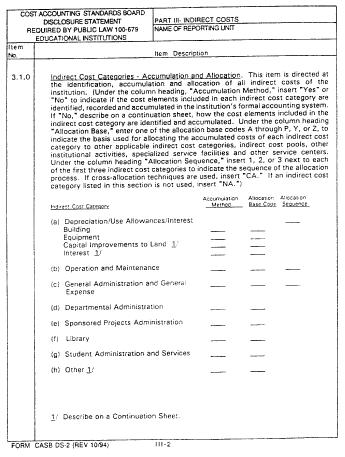

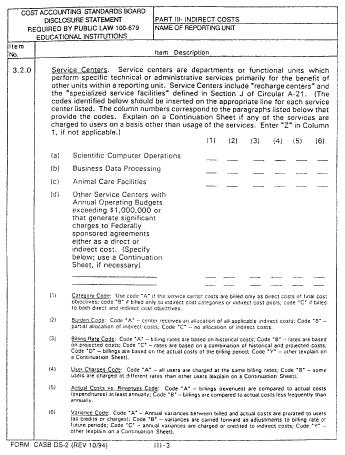

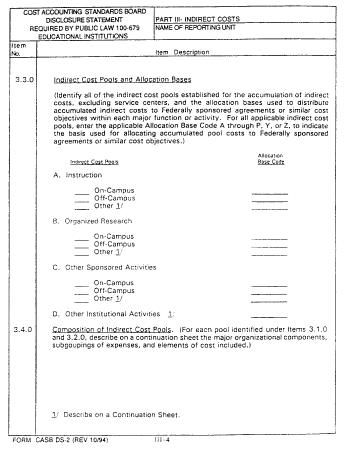

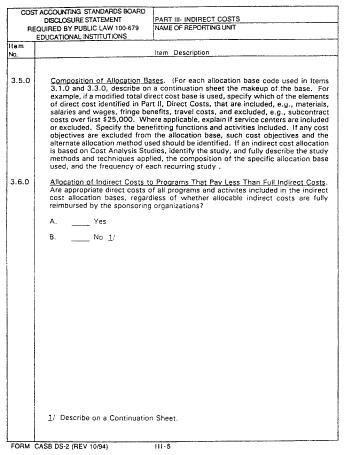

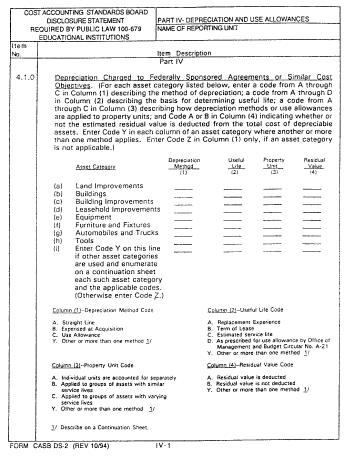

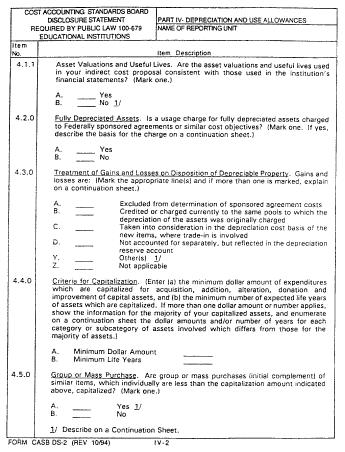

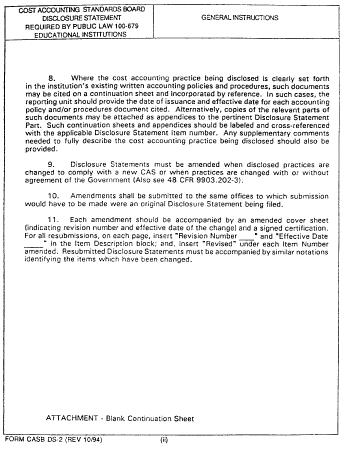

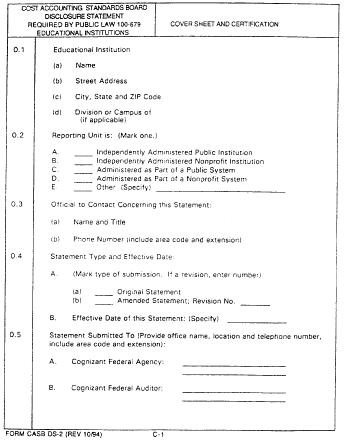

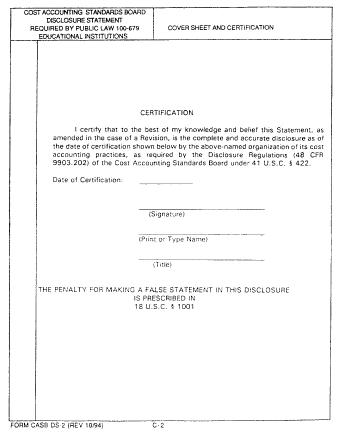

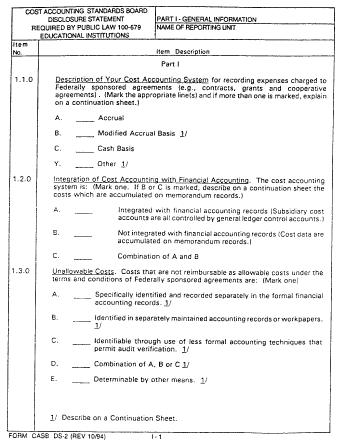

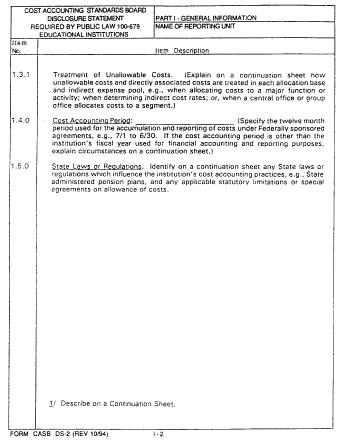

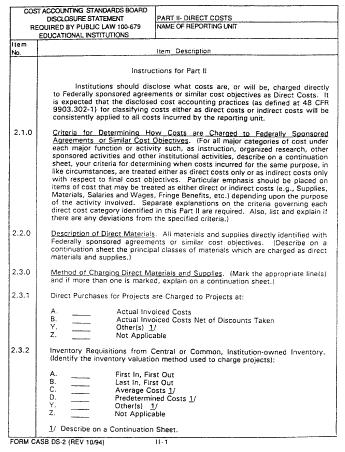

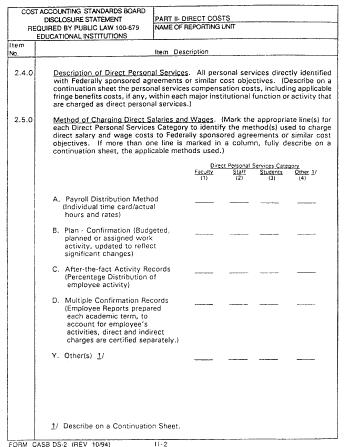

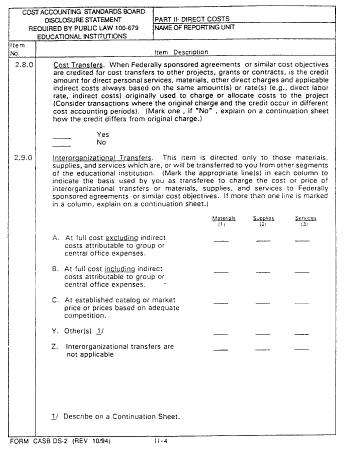

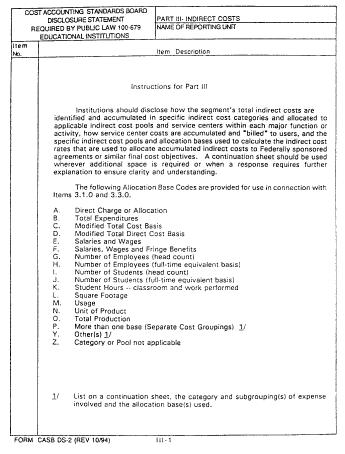

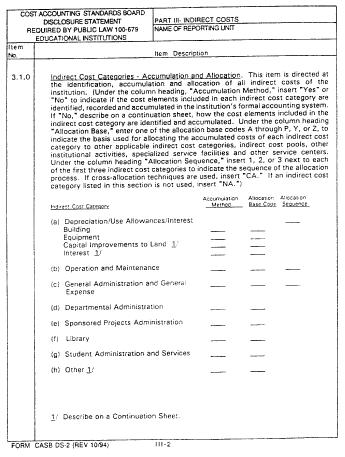

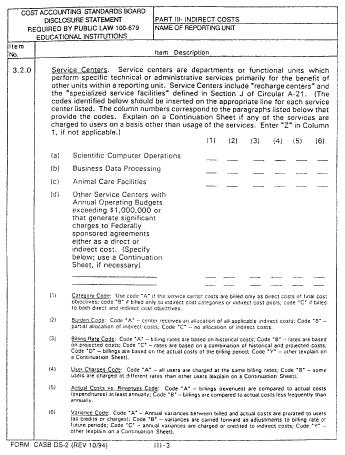

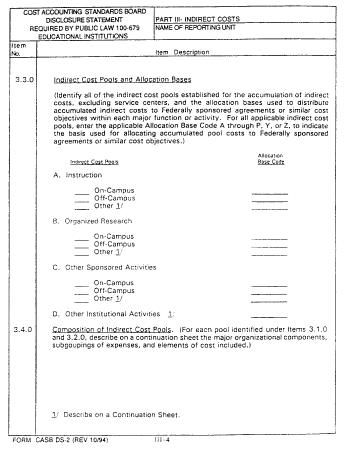

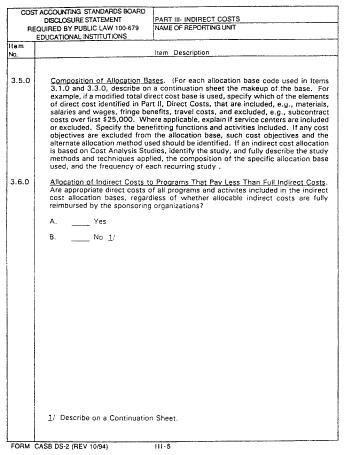

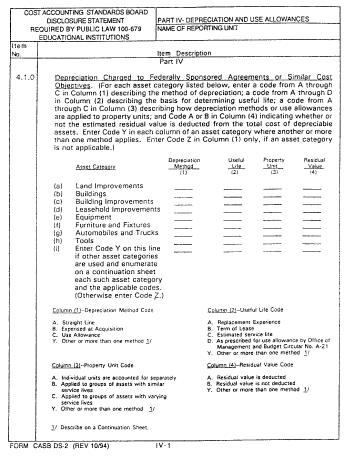

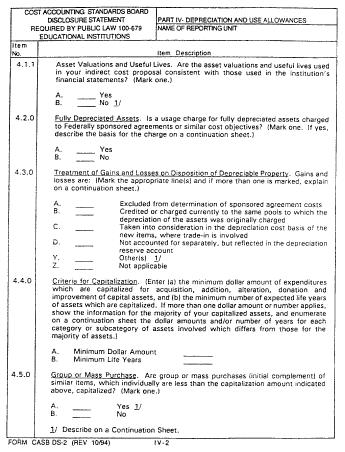

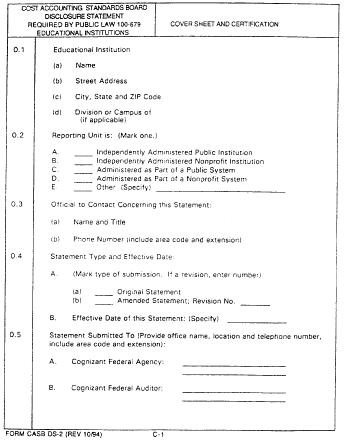

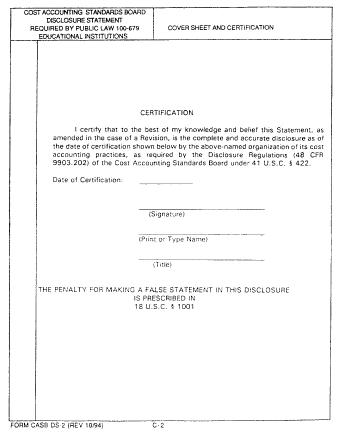

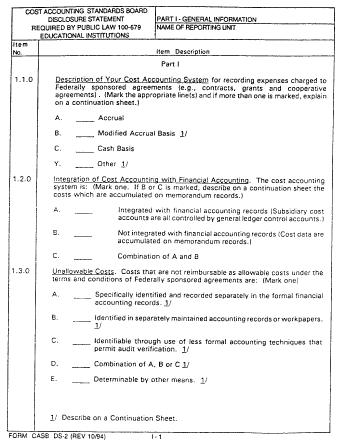

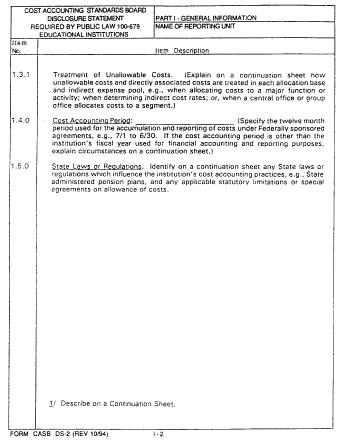

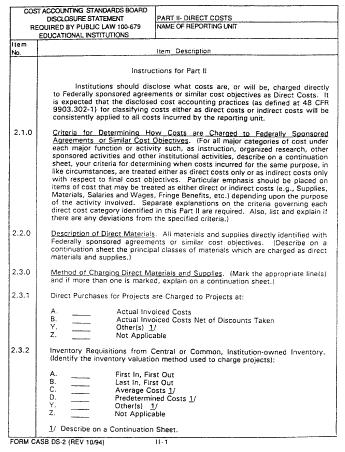

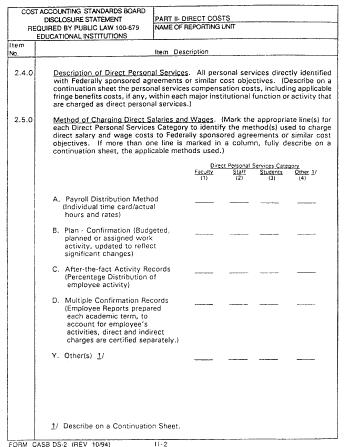

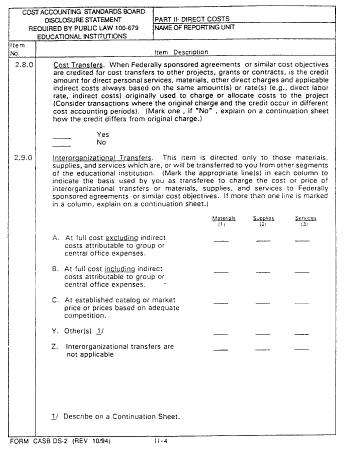

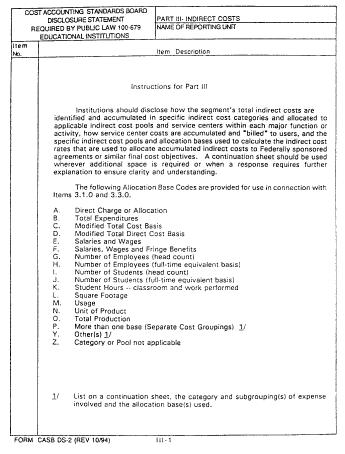

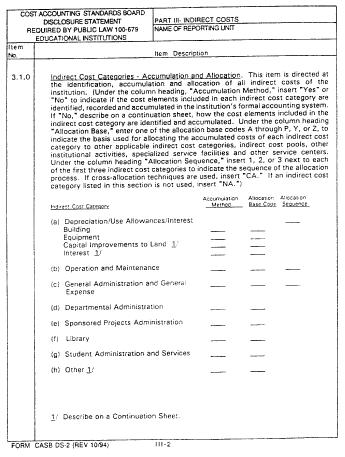

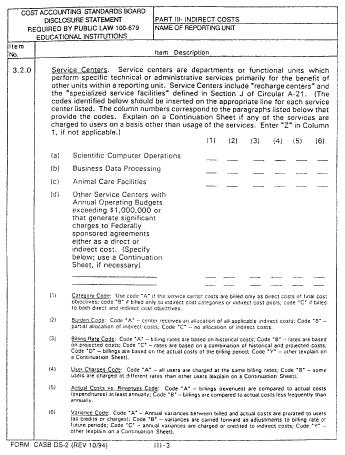

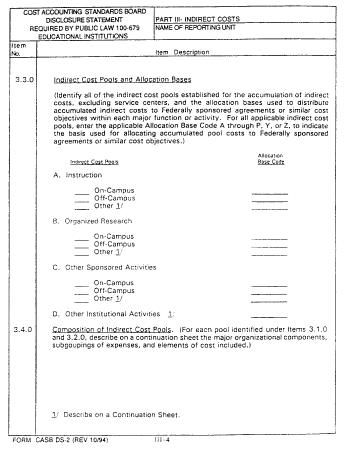

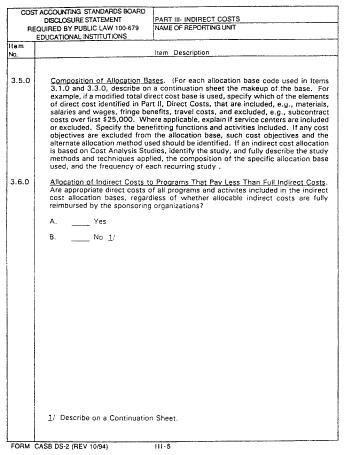

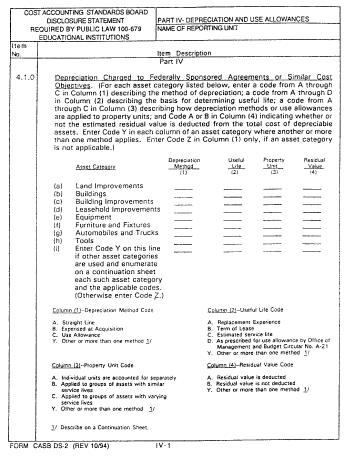

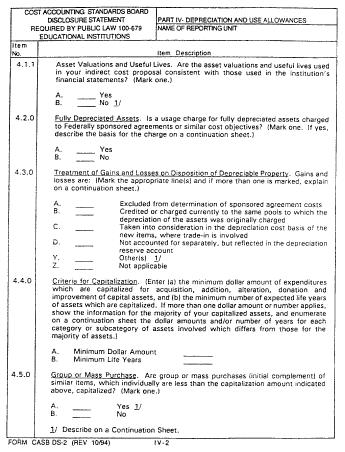

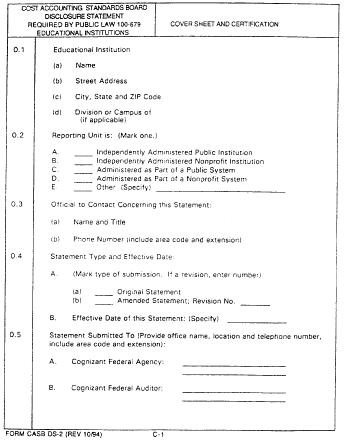

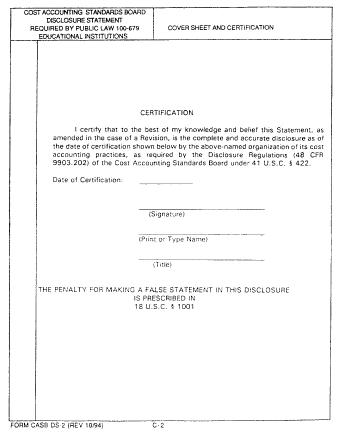

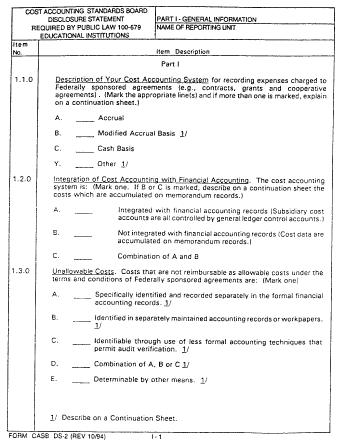

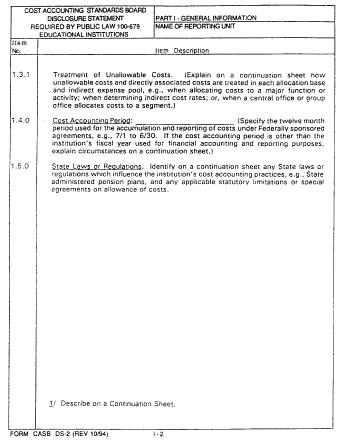

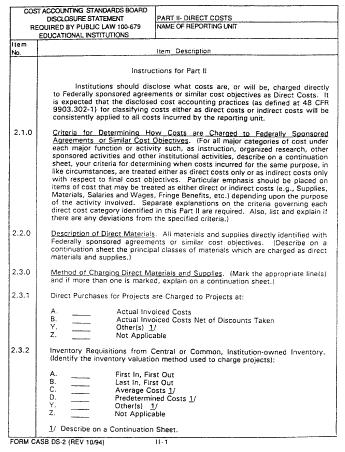

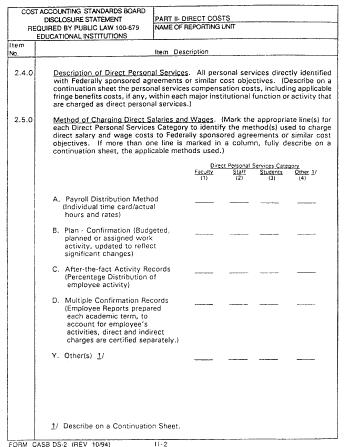

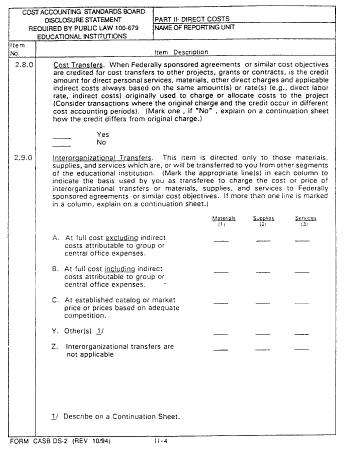

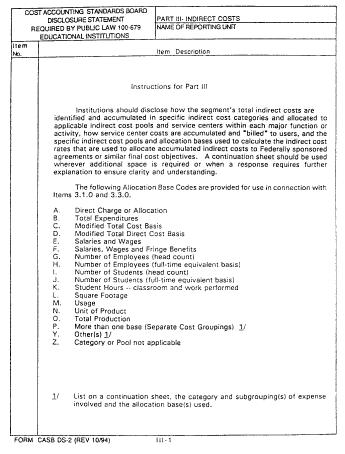

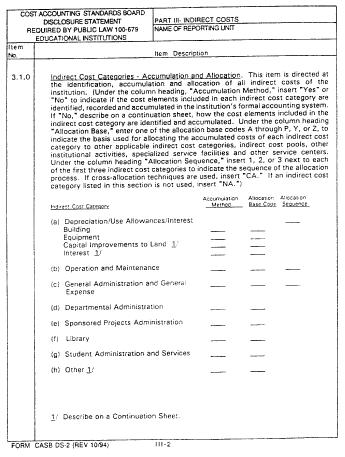

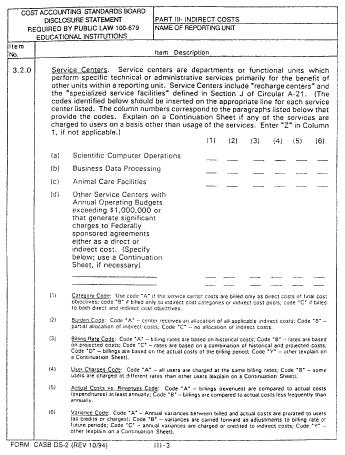

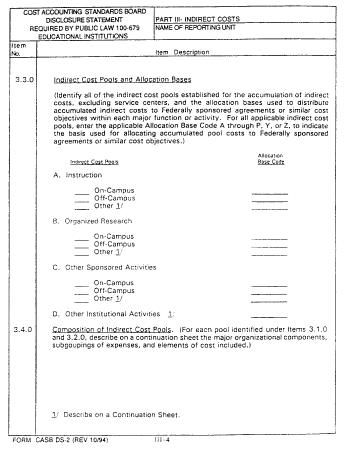

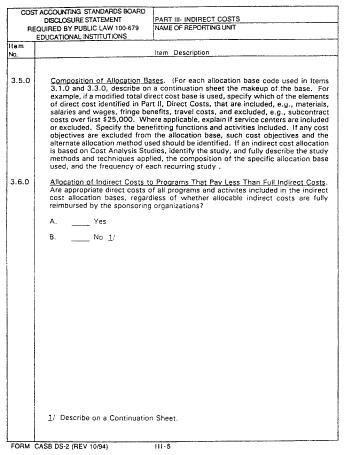

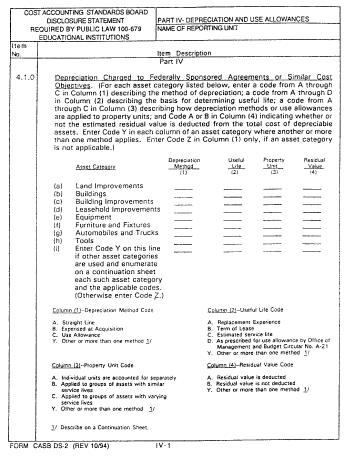

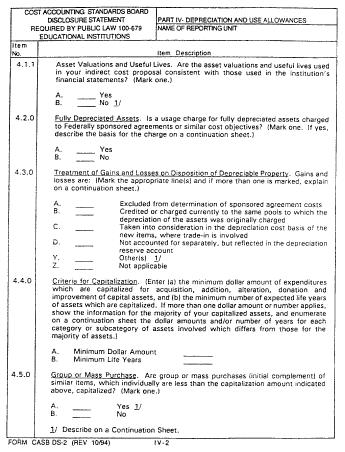

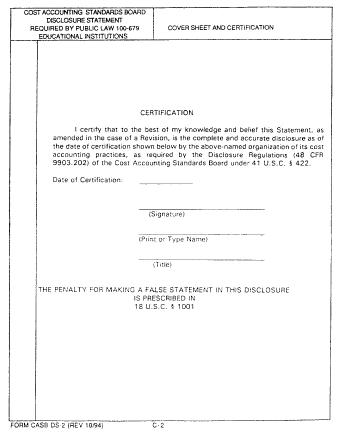

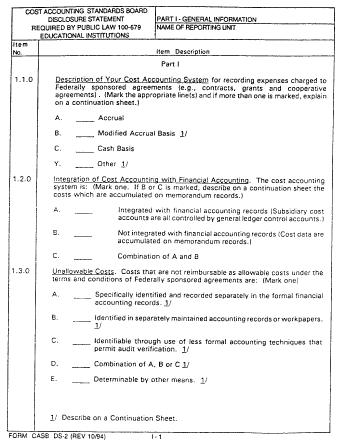

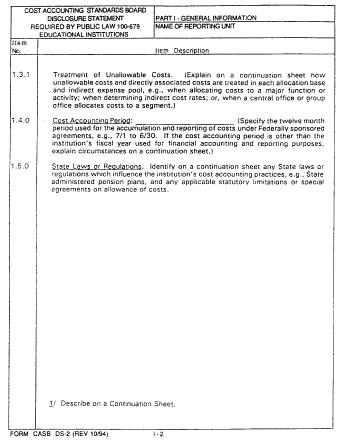

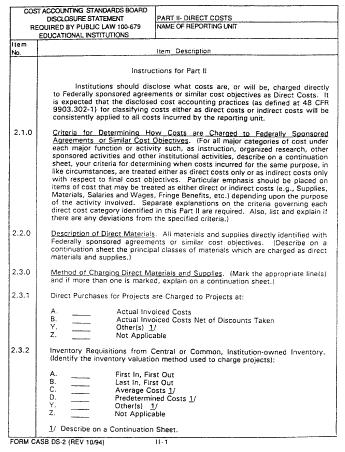

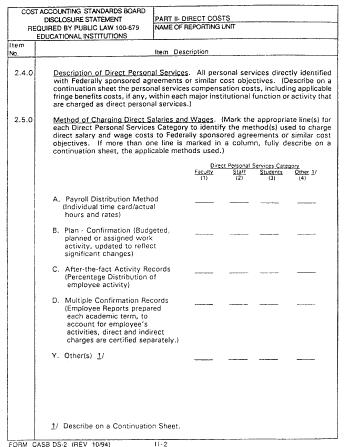

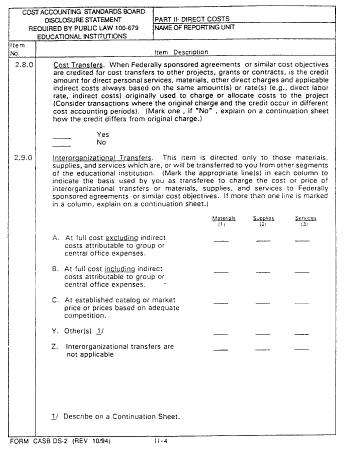

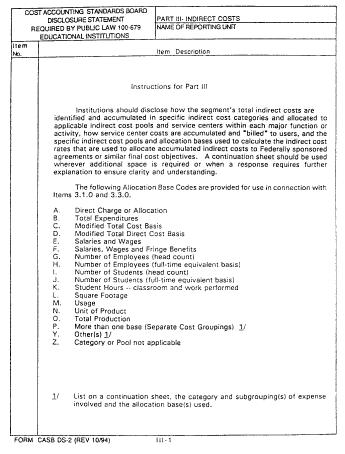

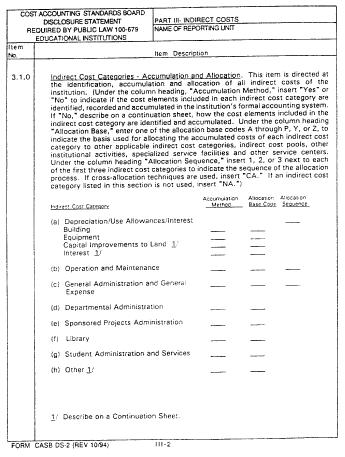

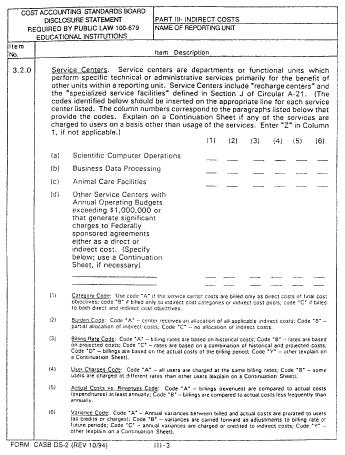

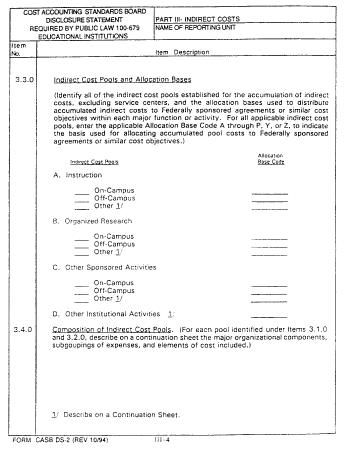

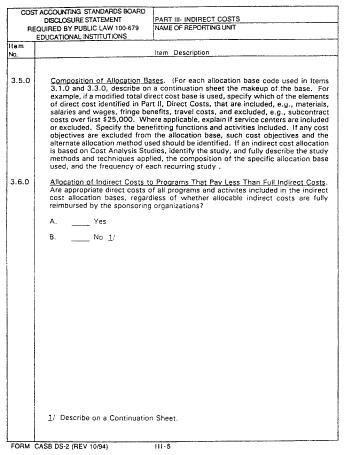

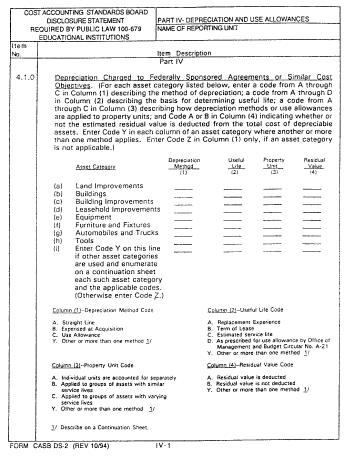

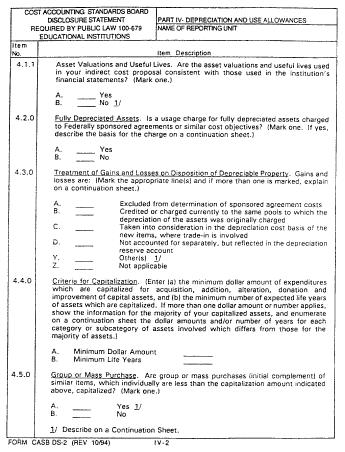

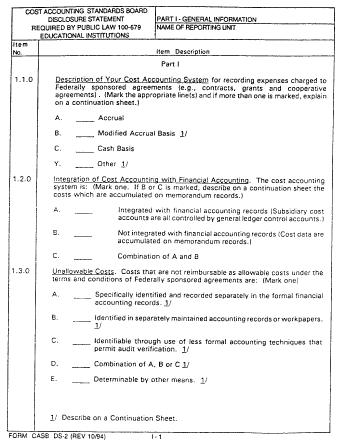

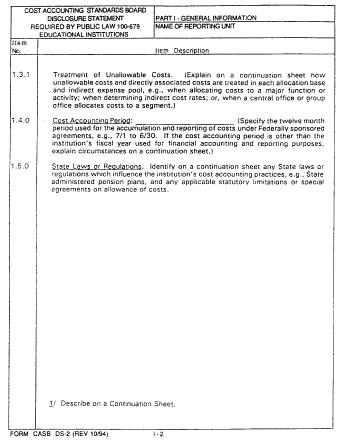

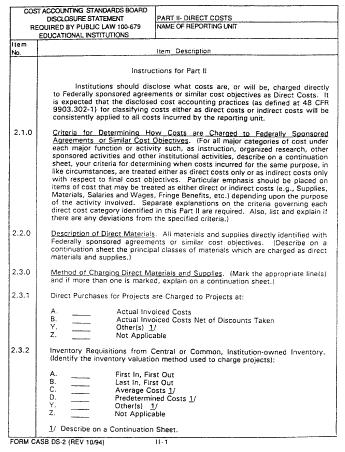

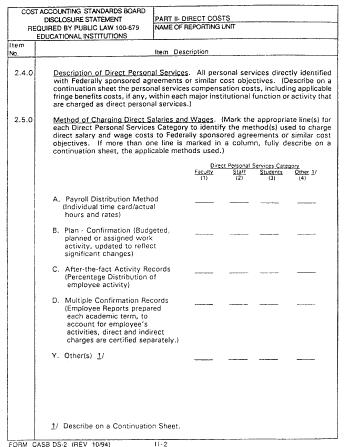

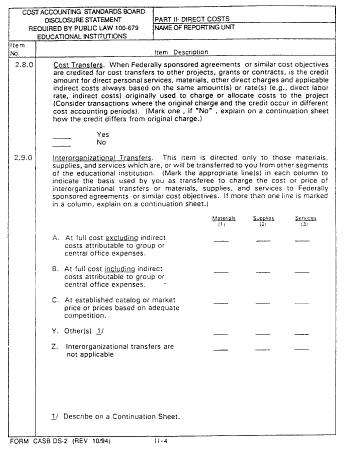

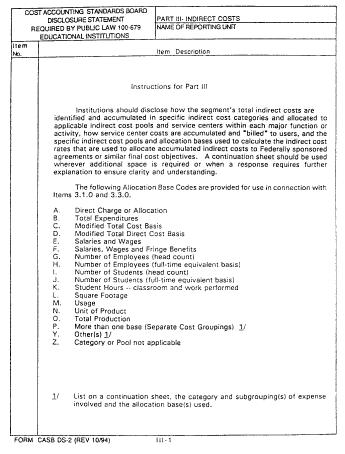

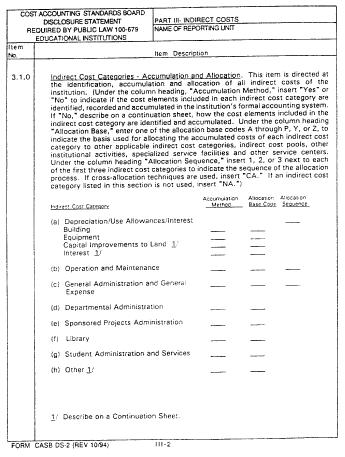

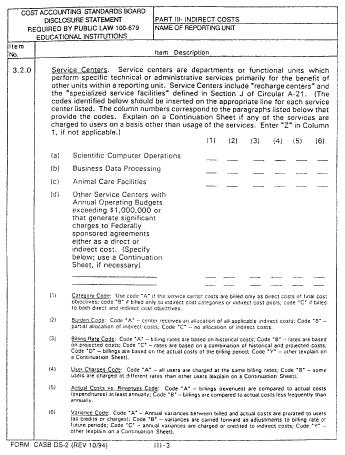

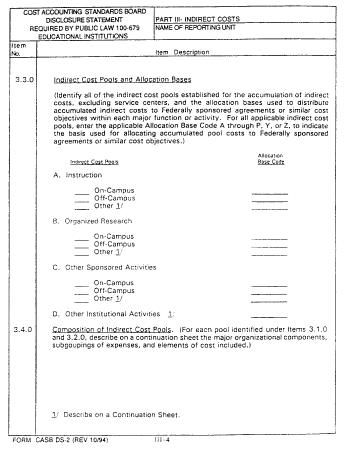

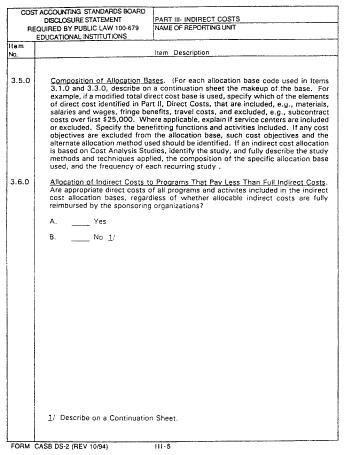

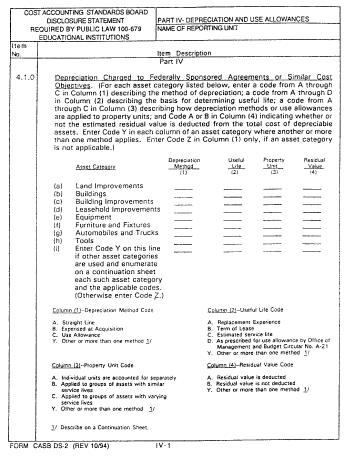

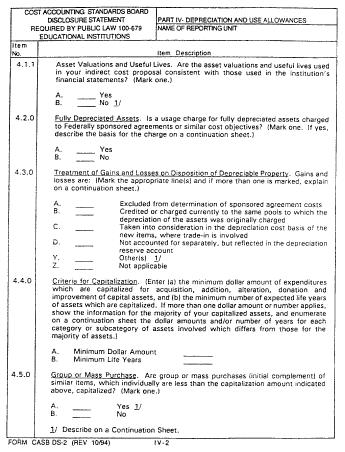

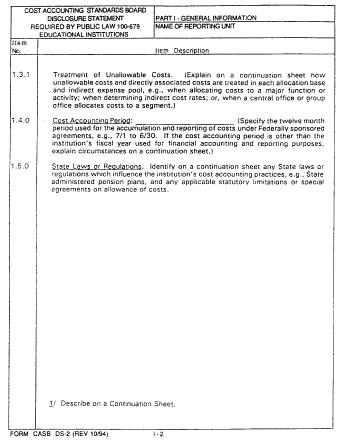

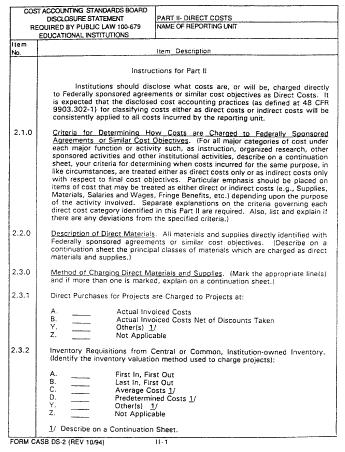

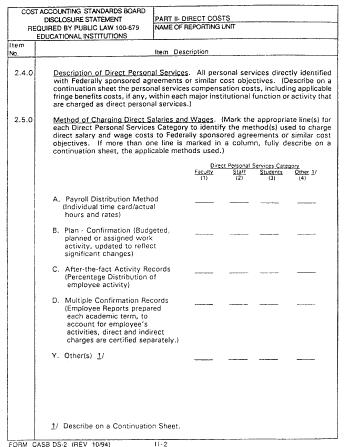

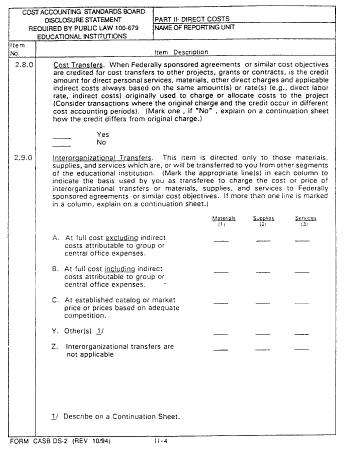

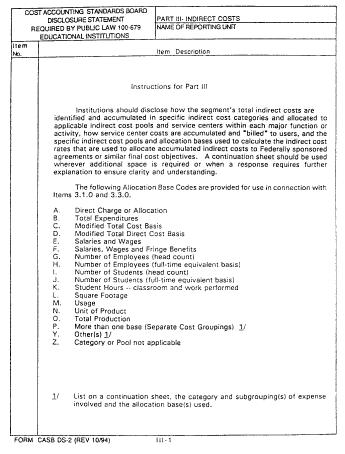

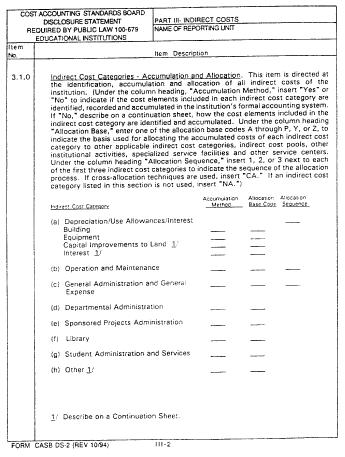

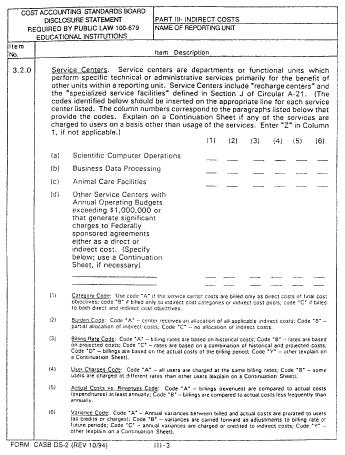

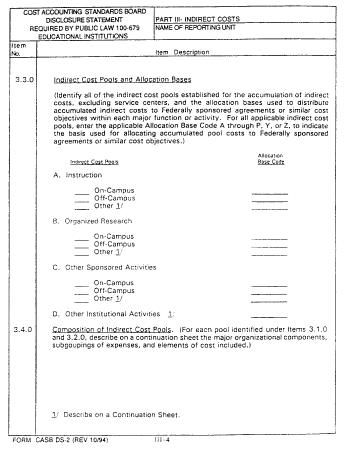

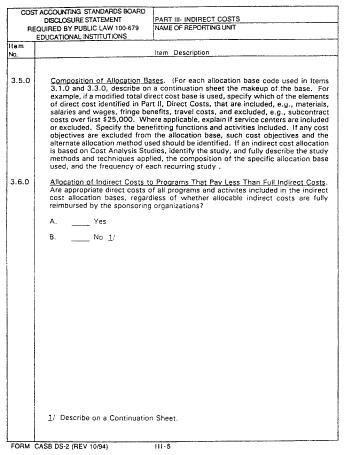

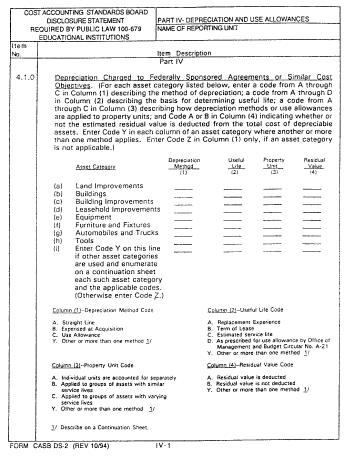

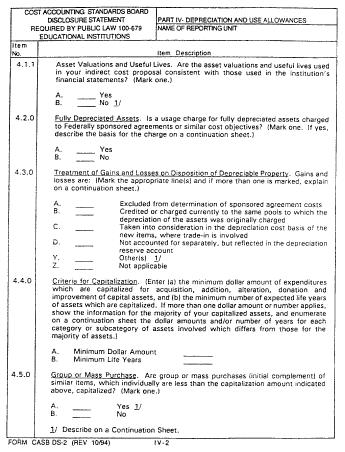

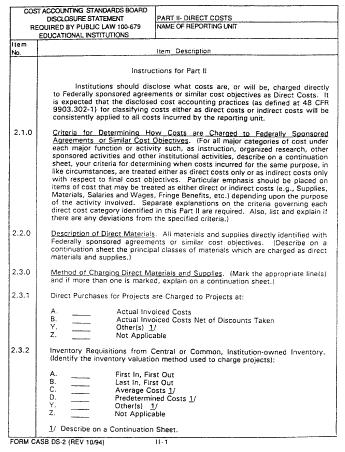

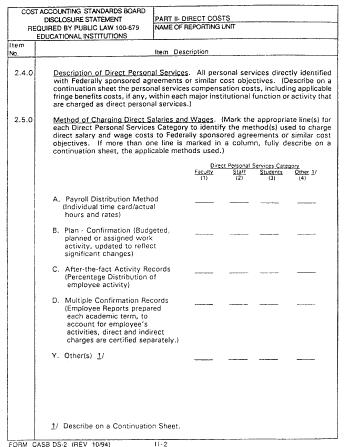

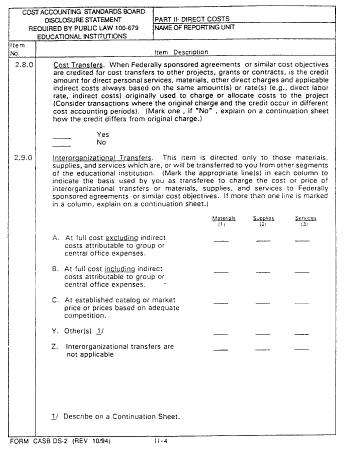

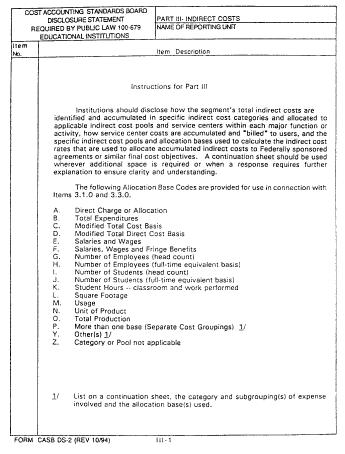

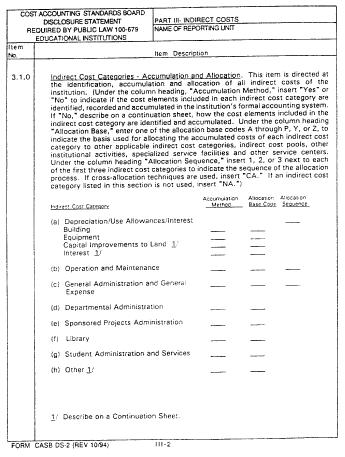

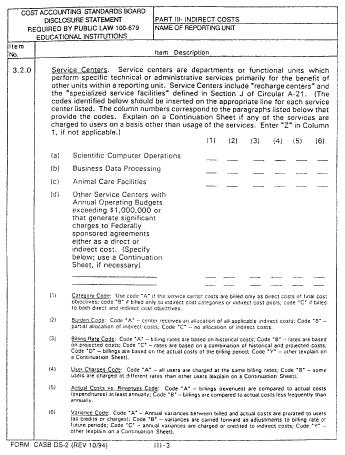

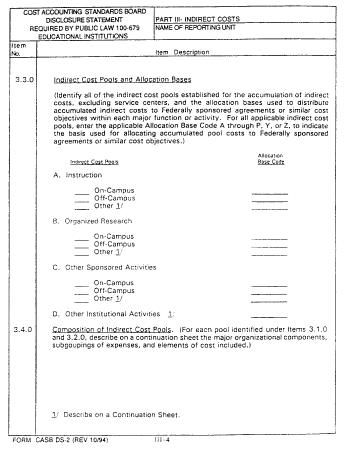

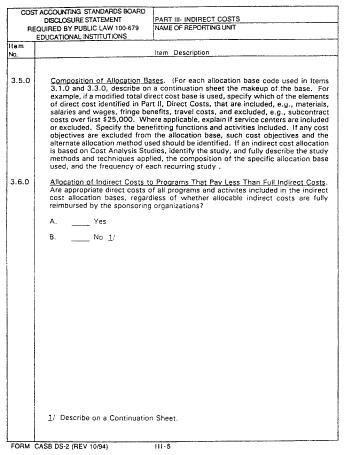

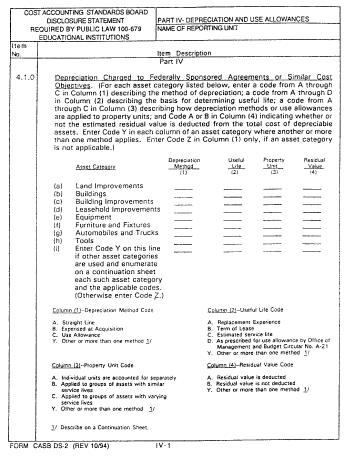

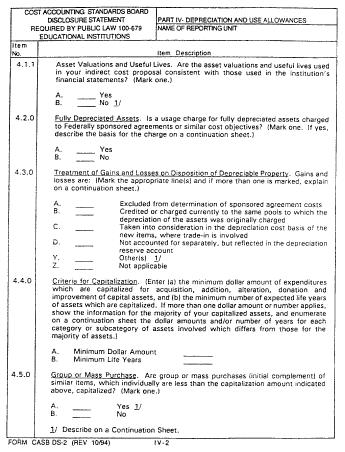

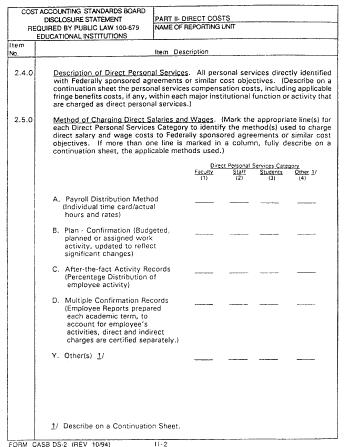

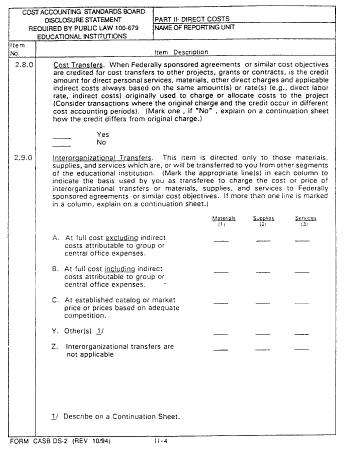

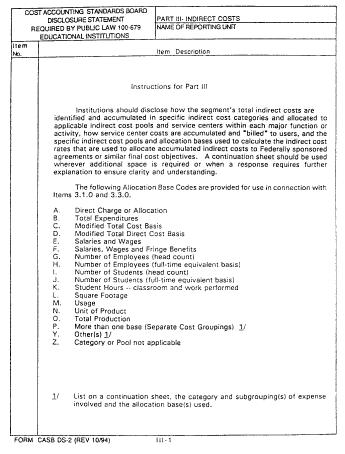

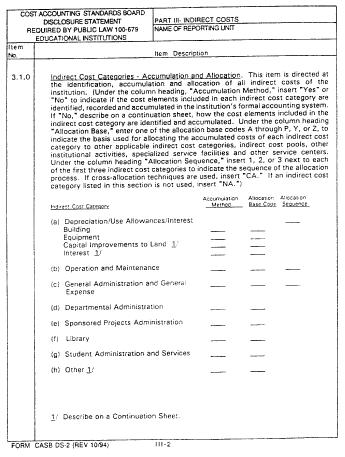

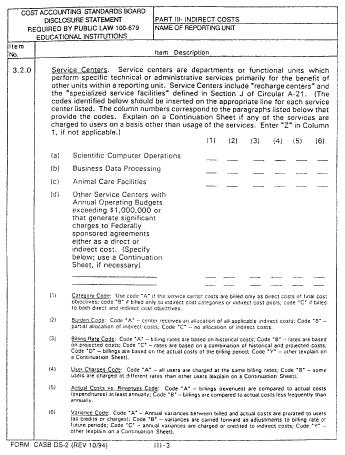

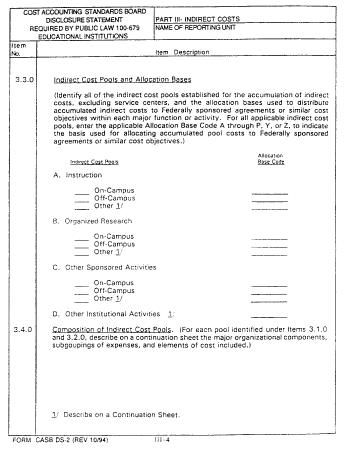

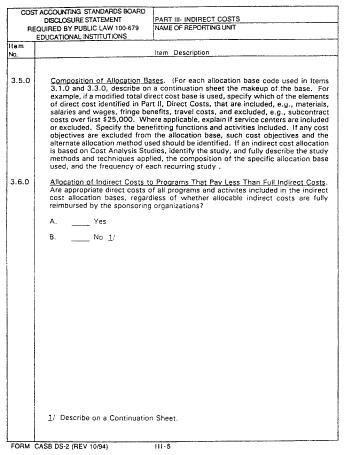

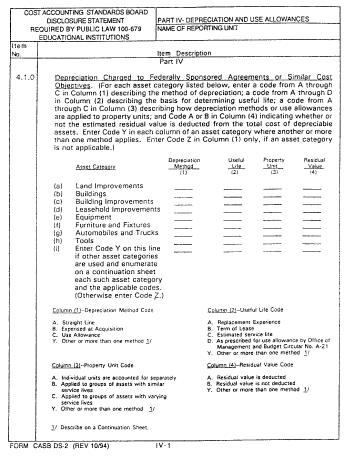

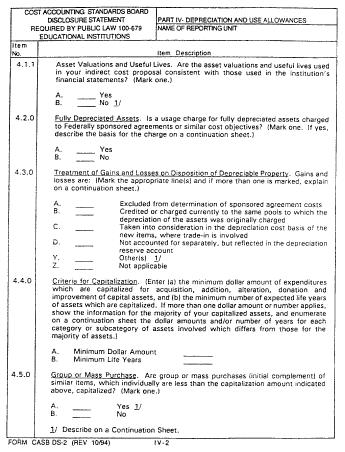

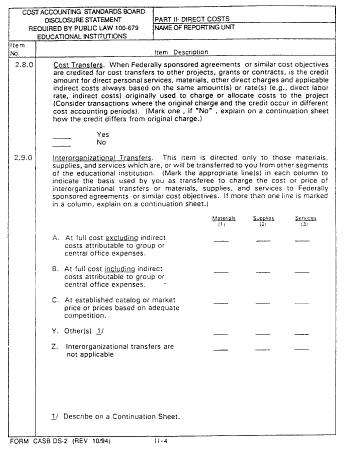

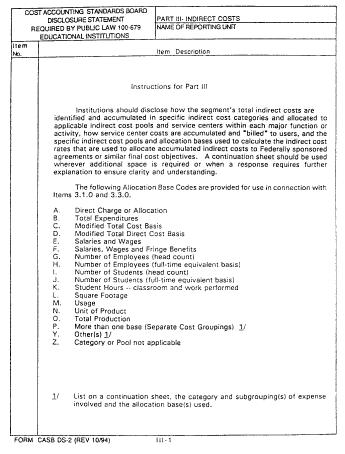

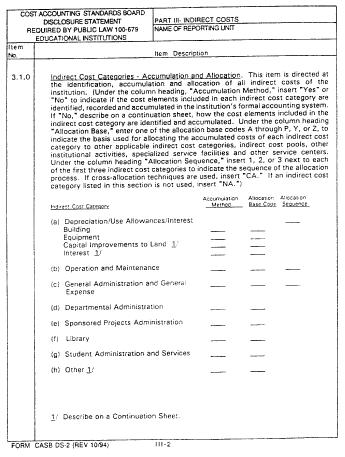

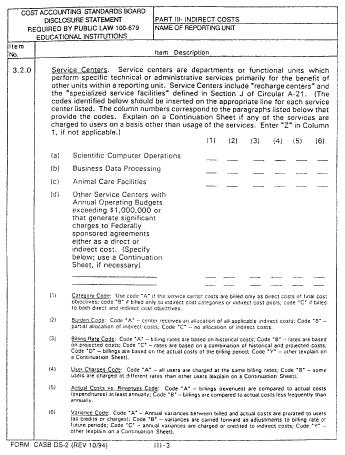

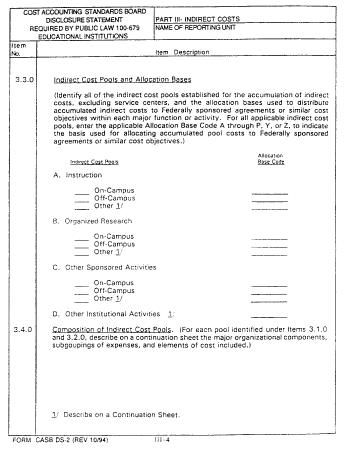

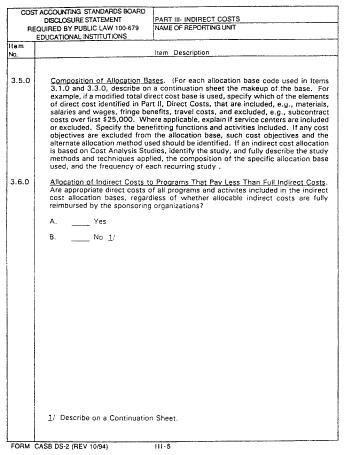

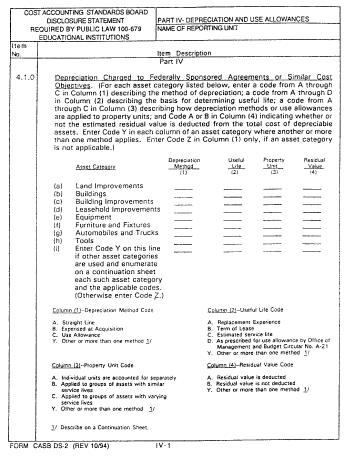

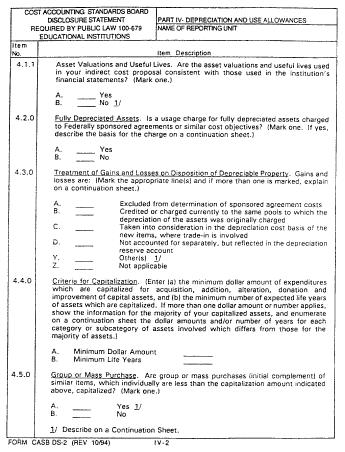

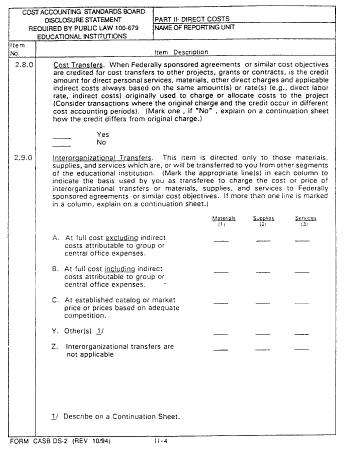

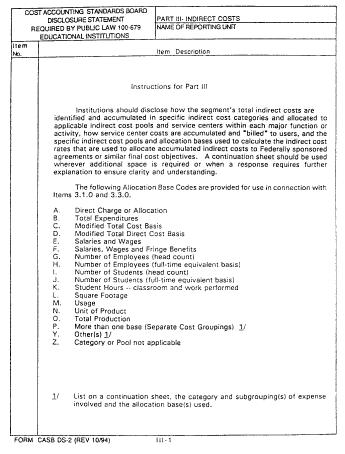

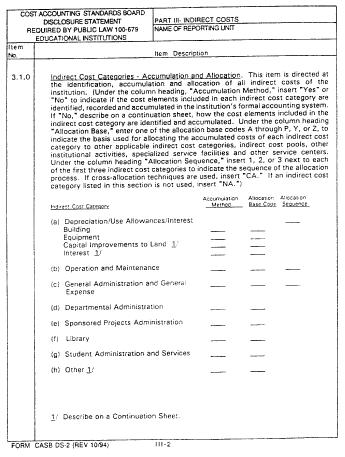

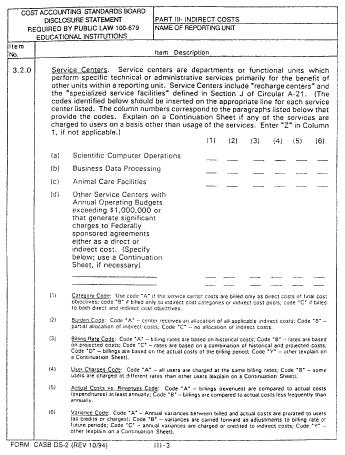

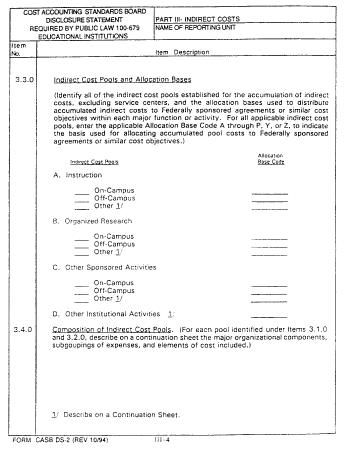

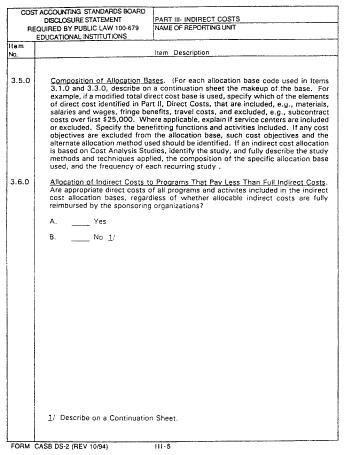

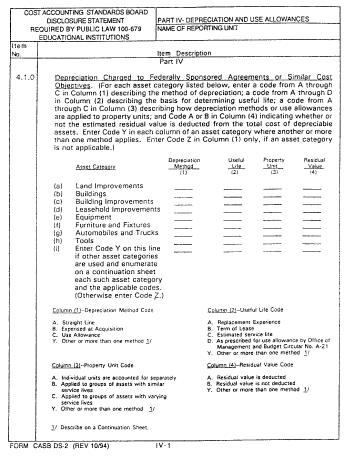

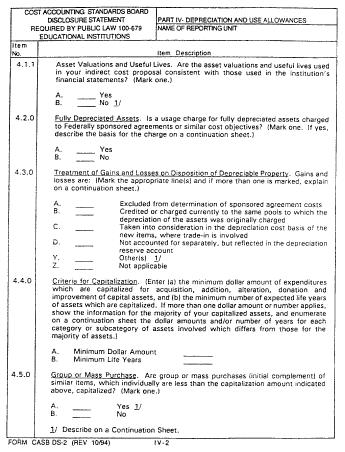

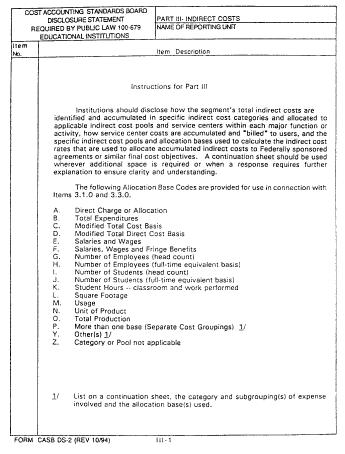

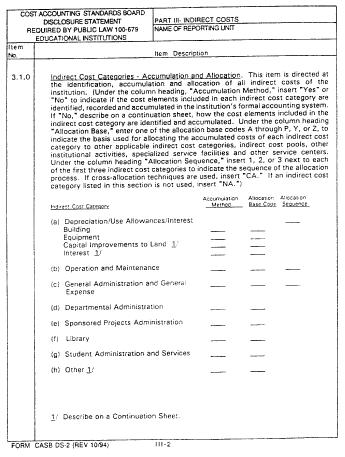

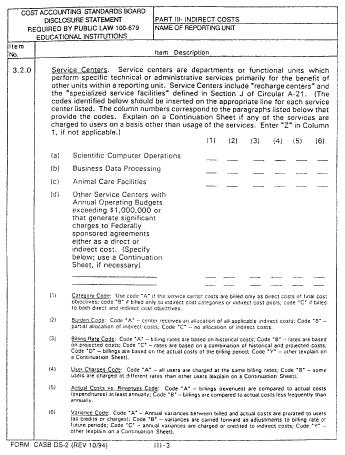

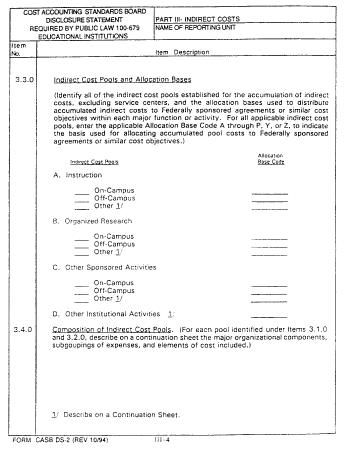

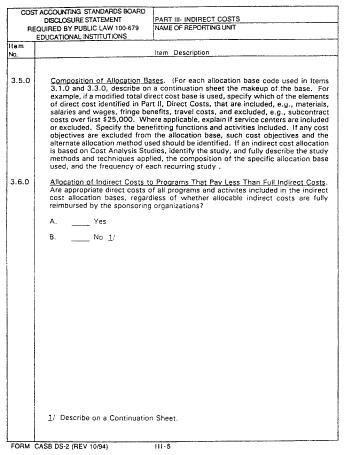

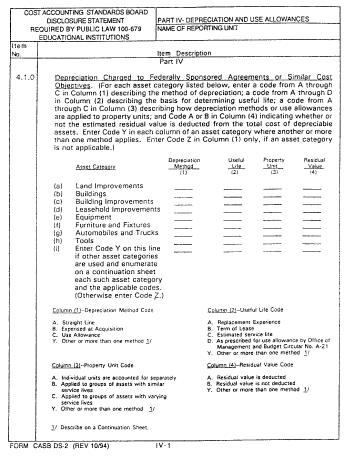

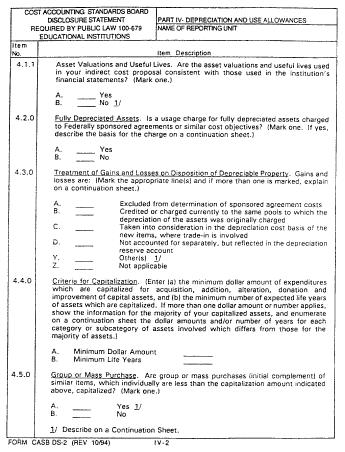

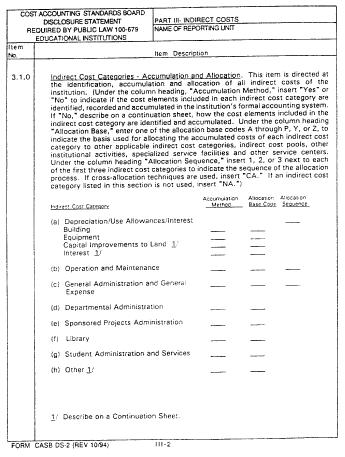

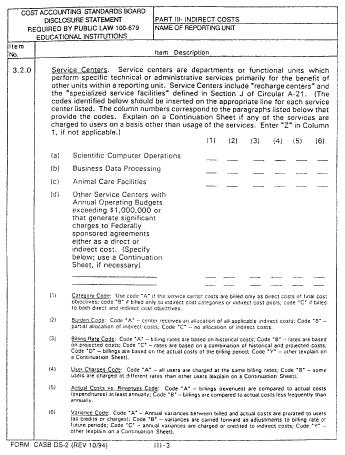

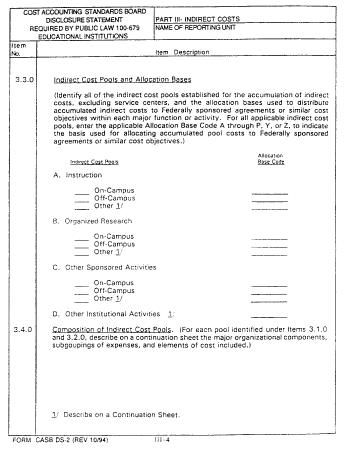

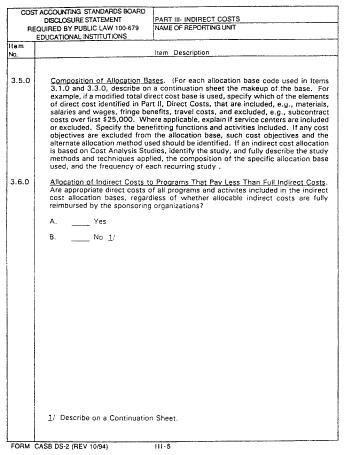

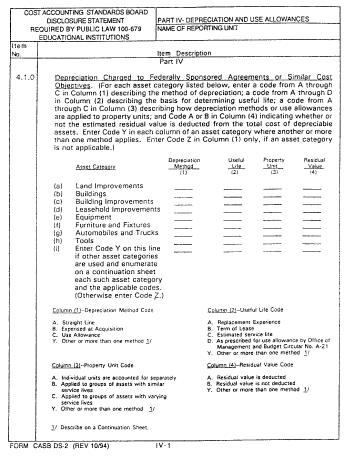

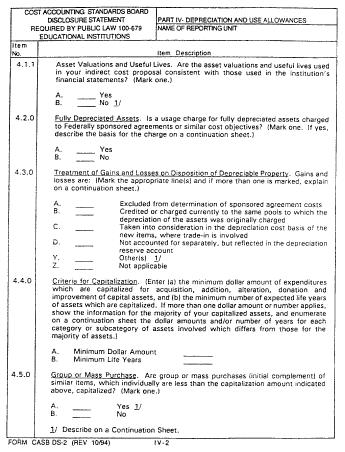

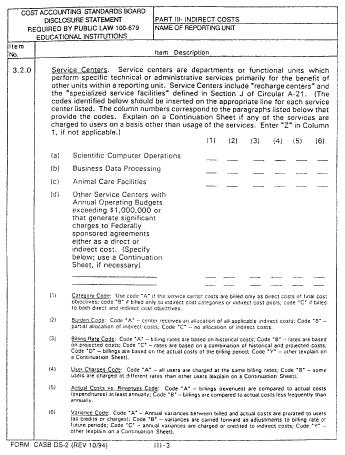

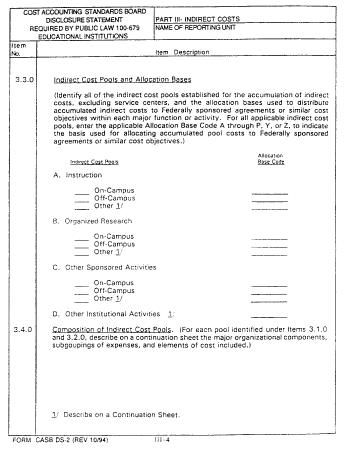

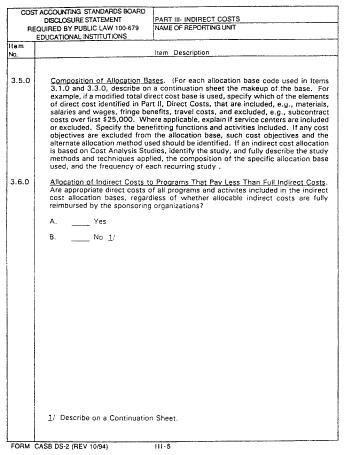

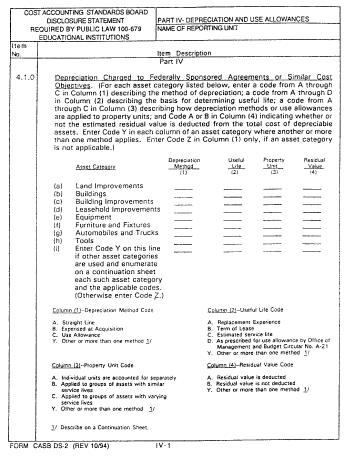

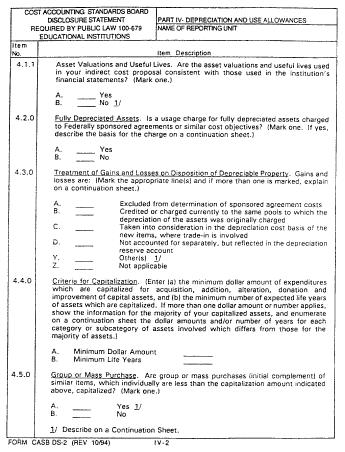

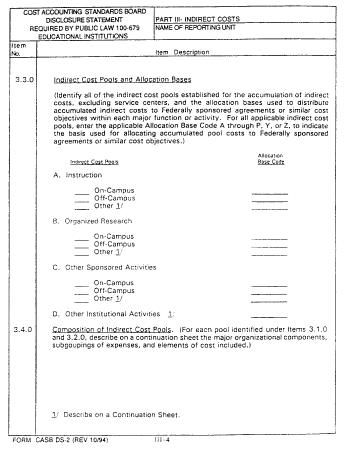

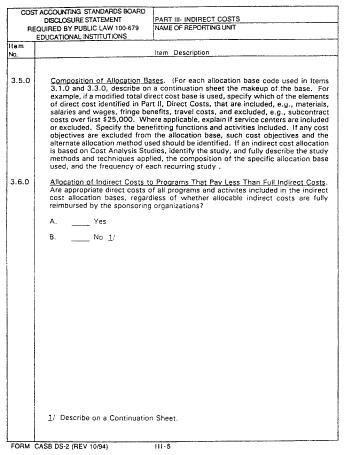

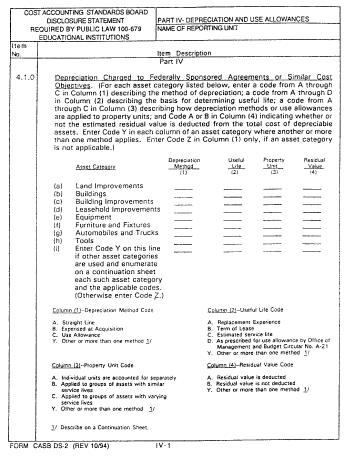

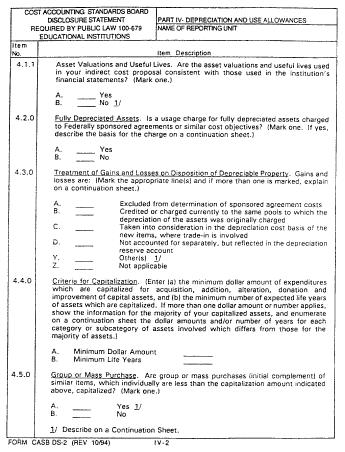

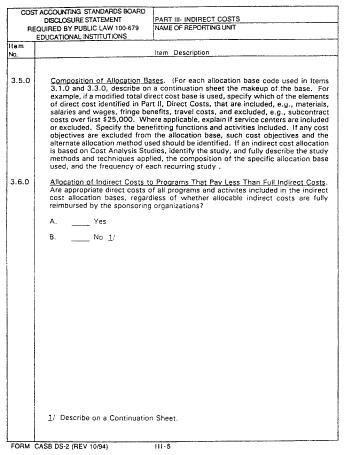

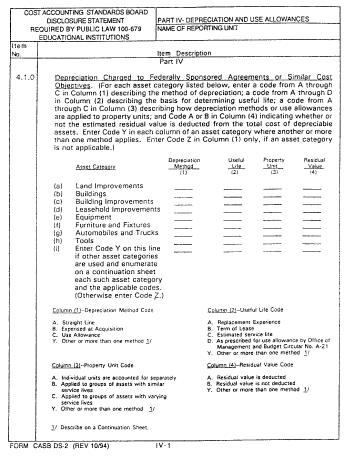

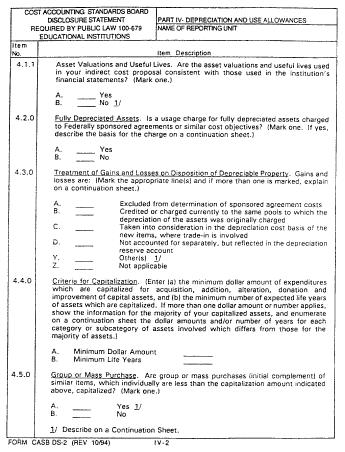

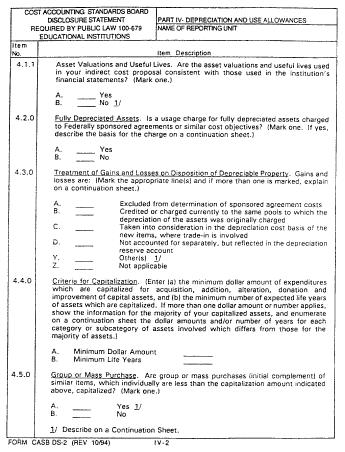

9903.202-10 Illustration of Disclosure Statement Form, CASB DS-2.

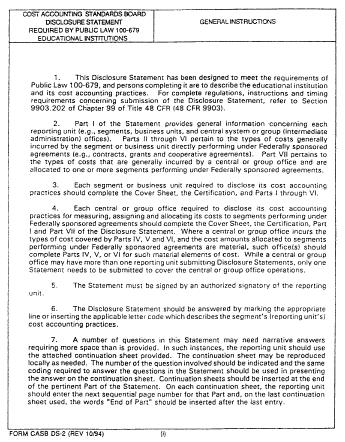

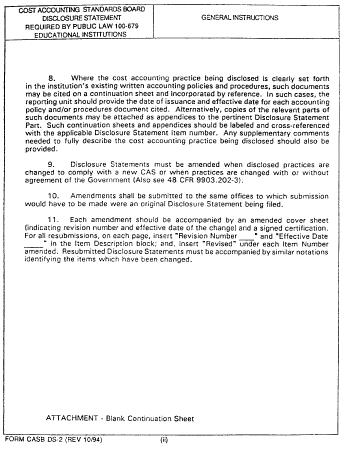

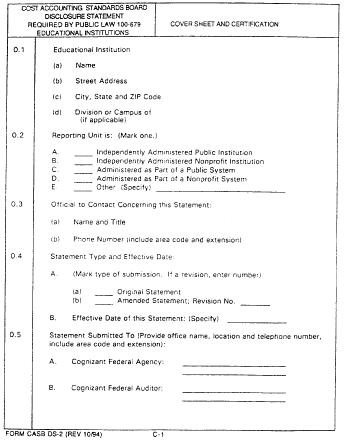

The data which are required to be disclosed by educational institutions are set forth in detail in the Disclosure Statement Form, CASB DS-2, which is illustrated below:

Subpart 9903.3 - CAS Rules and Regulations

9903.301 Definitions.

(a) The definitions set forth below apply to this chapter 99.

Accrued benefit cost method. See 9904.412-30.

Accumulating costs. See 9904.401-30.

Actual cash value. See 9904.416-30.

Actual cost. See 9904.401-30 for the broader definition and 9904.407-30 for a more restricted definition applicable only to the standard on the use of standard costs for direct material and direct labor.

Actuarial assumption. See 9904.412-30 or 9904.413-30.

Actuarial cost method. See 9904.412-30 or 9904.413-30.

Actuarial gain and loss. See 9904.412-30 or 9904.413-30.

Actuarial liability. See 9904.412-30 or 9904.413-30.

Actuarial valuation. See 9904.412-30 or 9904.413-30.

Allocate. See 9904.402-30, 9904.403-30, 9904.406-30, 9904.410-30, 9904.411-30, 9904.418-30 or 9904.420-30.

Asset accountability unit. See 9904.404-30.

Assignment of cost to cost accounting periods. See 9903.302-1(b).

Bid and proposal (B&P) cost. See 9904.420-30.

Business unit. See 9904.410-30, 9904.411-30 or 9904.414-30.

CAS-covered contract, as used in this part, means any negotiated contract or subcontract in which a CAS clause is required to be included.

Category of material. See 9904.411-30.

Change to a cost accounting practice. See 9903.302-2.

Compensated personal absence. See 9904.408-30.

Cost accounting practice. See 9903.302-1.

Cost input. See 9904.410-30.

Cost objective. See 9904.402-30, 9904.406-30, 9904.410-30 or 9904.411-30.

Cost of capital committed to facilities. See 9904.414-30.

Currently performing, as used in this part, means that a contractor has been awarded a contract, but has not yet received notification of final acceptance of all supplies, services, and data deliverable under the contract (including options).

Deferred compensation. See 9904.415-30.

Defined-benefit pension plan. See 9904.412-30.

Defined-contribution pension plan. See 9904.412-30.

Direct cost. See 9904.402-30 or 9904.418-30.

Directly associated cost. See 9904.405-30.

Disclosure statement, as used in this part, means the Disclosure Statement required by 9903.202-1.

Entitlement. See 9904.408-30.

Estimating costs. See 9904.401-30.

Expressly unallowable cost. See 9904.405-30.

Facilities capital. See 9904.414-30.

Final cost objective. See 9904.402-30 or 9904.410-30.

Fiscal year. See 9904.406-30.

Funded pension cost. See 9904.412-30.

Funding agency. See 9904.412-30.

General and administrative (G&A) expense. See 9904.410-30 or 9904.420-30.

Home office. See 9904.403-30 or 9904.420-30.

Immediate-gain actuarial cost method. See 9904.413-30.

Independent research and development (IR&D) cost. See 9904.420-30.

Indirect cost. See 9904.402-30, 9904.405-30, 9904.418-30 or 9904.420-30.

Indirect cost pool. See 9904.401-30, 9904.402-30, 9904.406-30 or 9904.418-30.

Insurance administration expenses. See 9904.416-30.

Intangible capital asset. See 9904.414-30 or 9904.417-30.

Labor cost at standard. See 9904.407-30.

Labor-rate standard. See 9904.407-30.

Labor-time standard. See 9904.407-30.

Material cost at standard. See 9904.407-30.

Material inventory record. See 9904.411-30.

Material-price standard. See 9904.407-30.

Material-quantity standard. See 9904.407-30.

Measurement of cost. See 9904.302-1(c).

Moving average cost. See 9904.411-30.

Multiemployer pension plan. See 9904.412-30.

Negotiated subcontract, as used in this part, means any subcontract except a firm fixed-price subcontract made by a contractor or subcontractor after receiving offers from at least two persons not associated with each other or with such contractor or subcontractor, providing

(1) The solicitation to all competitors is identical,

(2) Price is the only consideration in selecting the subcontractor from among the competitors solicited, and

(3) The lowest offer received in compliance with the solicitation from among those solicited is accepted.

Net awards, as used in this chapter, means the total value of negotiated CAS-covered prime contract and subcontract awards, including the potential value of contract options, received during the reporting period minus cancellations, terminations, and other related credit transactions.

Normal cost. See 9904.412-30 or 9904.413-30.

Operating revenue. See 9904.403-30.

Original complement of low cost equipment. See 9904.404-30.

Pay-as-you-go cost method. See 9904.412-30.

Pension plan. See 9904.412-30 or 9904.413-30.

Pension plan participant. See 9904.413-30.

Pricing. See 9904.401-30.

Production unit. See 9904.407-30.

Projected average loss. See 9904.416-30.

Projected benefit cost method. See 9904.412-30 or 9904.413-30.

Proposal. See 9904.401-30.

Repairs and maintenance. See 9904.404-30.

Reporting costs. See 9904.401-30.

Residual value. See 9904.409-30.

Segment. See 9904.403-30, 9904.410-30, 9904.413-30 or 9904.420-30.

Self-insurance. See 9904.416-30.

Self-insurance charge. See 9904.416-30.

Service life. See 9904.409-30.

Small business, as used in this part, means any concern, firm, person, corporation, partnership, cooperative, or other business enterprise which, under 15 U.S.C. 637(b)(6) and the rules and regulations of the Small Business Administration in part 121 of title 13 of the Code of Federal Regulations, is determined to be a small business concern for the purpose of Government contracting.

Spread-gain actuarial cost method. See 9904.413-30.

Standard cost. See 9904.407-30.

Tangible capital asset. See 9904.403-30, 9904.404-30, 9904.409-30, 9904.414-30 or 9904.417-30.

Termination gain or loss. See 9904.413-30.

Unallowable cost. See 9904.405-30.

Variance. See 9904.407-30.

Weighted average cost. See 9904.411-30.

(b) The definitions set forth below are applicable exclusively to educational institutions and apply to this chapter 99.

Business unit. See 9903.201-2(c)(2)(ii).

Educational institution. See 9903.201-2(c)(2)(i).

Intermediate cost objective. See 9905.502-30(a)(7).

Segment. See 9903.201-2(c)(2)(ii).

9903.302 Definitions, explanations, and illustrations of the terms, “cost accounting practice” and “change to a cost accounting practice.”

9903.302-1 Cost accounting practice.

Cost accounting practice, as used in this part, means any disclosed or established accounting method or technique which is used for allocation of cost to cost objectives, assignment of cost to cost accounting periods, or measurement of cost.

(a) Measurement of cost, as used in this part, encompasses accounting methods and techniques used in defining the components of cost, determining the basis for cost measurement, and establishing criteria for use of alternative cost measurement techniques. The determination of the amount paid or a change in the amount paid for a unit of goods and services is not a cost accounting practice. Examples of cost accounting practices which involve measurement of costs are -

(1) The use of either historical cost, market value, or present value;

(2) The use of standard cost or actual cost; or

(3) The designation of those items of cost which must be included or excluded from tangible capital assets or pension cost.

(b) Assignment of cost to cost accounting periods, as used in this part, refers to a method or technique used in determining the amount of cost to be assigned to individual cost accounting periods. Examples of cost accounting practices which involve the assignment of cost to cost accounting periods are requirements for the use of specified accrual basis accounting or cash basis accounting for a cost element.

(c) Allocation of cost to cost objectives, as used in this part, includes both direct and indirect allocation of cost. Examples of cost accounting practices involving allocation of cost to cost objectives are the accounting methods or techniques used to accumulate cost, to determine whether a cost is to be directly or indirectly allocated to determine the composition of cost pools, and to determine the selection and composition of the appropriate allocation base.

9903.302-2 Change to a cost accounting practice.

Change to a cost accounting practice, as used in this part, means any alteration in a cost accounting practice, as defined in 9903.302-1, whether or not such practices are covered by a Disclosure Statement, except for the following:

(a) The initial adoption of a cost accounting practice for the first time a cost is incurred, or a function is created, is not a change in cost accounting practice. The partial or total elimination of a cost or the cost of a function is not a change in cost accounting practice. As used here, function is an activity or group of activities that is identifiable in scope and has a purpose or end to be accomplished.

(b) The revision of a cost accounting practice for a cost which previously had been immaterial is not a change in cost accounting practice.

9903.302-3 Illustrations of changes which meet the definition of “change to a cost accounting practice.”

(a) The method or technique used for measuring costs has been changed.

| Description | Accounting treatment |

|---|---|

| (1) Contractor changes its actuarial cost method for computing pension costs. | (1)(i) Before change: The contractor computed pension costs using the aggregate cost method. (ii) After change: The contractor computes pension cost using the unit credit method. |

| (2) Contractor uses standard costs to account for its direct labor. Labor cost at standard was computed by multiplying labor-time standard by actual labor rates. The contractor changes the computation by multiplying labor-time standard by labor-rate standard | (2)(i) Before change: Contractor's direct labor cost was measured with only one component set at standard. (ii) After change: Contractor's direct labor cost is measured with both the time and rate components set at standard. |

(b) The method or technique used for assignment of cost to cost accounting periods has been changed.

| Description | Accounting treatment |

|---|---|

| (1) Contractor changes his established criteria for capitalizing certain classes of tangible capital assets whose acquisition costs totaled $1 million per cost accounting period | (1)(i) Before change: Items having acquisition costs of between $200 and $400 per unit were capitalized and depreciated over a number of cost accounting periods. (ii) After change: The contractor charges the value of assets costing between $200 and $400 per unit to an indirect expense pool which is allocated to the cost objectives of the cost accounting period in which the cost was incurred. |

| (2) Contractor changes his methods for computing depreciation for a class of assets | (2)(i) Before change: The contractor assigned depreciation costs to cost accounting periods using an accelerated method. (ii) After change: The contractor assigns depreciation costs to cost accounting periods using the straight line method. |

| (3) Contractor changes his general method of determining asset lives for classes of assets acquired prior to the effective date of CAS 409 | (3)(i) Before change: The contractor identified the cost accounting periods to which the cost of tangible capital assets would be assigned using guideline class lives provided in IRS Rev. Pro. 72-10. (ii) After change: The contractor changes the method by which he identifies the cost accounting periods to which the costs of tangible capital assets will be assigned. He now uses the expected actual lives based on past usage. |

(c) The method or technique used for allocating costs has been changed.

| Description | Accounting treatment |

|---|---|

| (1) Contractor changes his method of allocating G&A expenses under the requirements of Cost Accounting Standard 410 | (1)(i) Before change: The contractor operating under Cost Accounting Standard 410 has been allocating his general and administrative expense pool to final cost objectives on a total cost input base in compliance with the Standard. The contractor's business changes substantially such that there are significant new projects which have only insignificant quantities of material. (ii) After change: After the addition of the new work, an evaluation of the changed circumstances reveals that the continued use of a total cost input base would result in a significant distortion in the allocation of the G&A expense pool in relation to the benefits received. To remain in compliance with Standard 410, the contractor alters his G&A allocation base from a total cost input base to a value added base. |

| (2) The contractor changes the accounting for hardware common to all projects | (2)(i) Before change: The contractor allocated the cost of purchased or requisitioned hardware directly to projects. (ii) After change: The contractor charges the cost of purchased or requisitioned hardware to an indirect expense pool which is allocated to projects using an appropriate allocation base. |